This resource dives into how to categorise different types of crypto-assets, from tier 1 (BTC), tier 2 (ETH) and tier 3 (altcoins)—with how to classify the wide range of tier-3 crypto-assets. We look into how stablecoins and NFTs fit in as crypto-assets, so you can understand their role in the crypto ecosystem.

What Are Crypto-Assets?

A crypto-asset is a blanket term not just limited to cryptocurrencies. It refers to tokenised assets issued on a public ledger like Bitcoin, Ethereum or Solana. They are digital assets that depend on cryptography.

Crypto-assets can also be known more broadly as cryptocurrencies (this term can include NFTs).

Categorisation of Crypto-Assets

It’s essential to understand the type of crypto-assets out there. There are many different types, all serving different purposes and risk profiles.

With new crypto assets entering the market daily, we have categorised these crypto-assets into 3 tiers; bitcoin (BTC), ether (ETH) and ‘altcoins’ (alternative cryptocurrencies), while covering stablecoins and NFTs under the crypto-asset banner.

There is no united framework for categorising crypto assets; other organisations will categorise them differently—this is Collective Shift’s framework.

The goal? To help you navigate the crypto-asset space and understand why they’re used and how they differ from each other.

Our framework for categorisation:

- Stablecoins: Designed to be pegged to a specific value or asset. Most commonly to the U.S. dollar. There are many types of stablecoins, some riskier than others and backed by different types of crypto or real-world assets.

- Bitcoin: Bitcoin is considered in its own class of cryptocurrencies. We refer to Bitcoin as a ‘Tier 1’ crypto asset. BTC aims to create a new form of money and an alternative digital currency outside the regular banking or financial system (i.e. central banks and government issue them).

- Ethereum: Ethereum is the most dominant smart contract platform (as all these crypto-native experiences need to happen on blockchains). Many may consider ETH an ‘altcoin’, although at Collective Shift, we consider ETH a tier 2 cryptocurrency due to its history, development, level of adoption and our outlook on the role of smart contract platforms.

- ‘Altcoins’: For many new entrants into the cryptocurrency space, it’s essential to understand that ‘altcoins’ (alternative cryptocurrencies other than BTC) have a much higher risk factor. Consider this before allocating a significant portion of your funds.

‘Altcoins’ can fit into a range of different categorisations:- Financial or DeFiInfrastructure or Layer 1s PaymentsExchange tokens

- Service

- Privacy

- Media, gaming & entertainment

Stablecoins

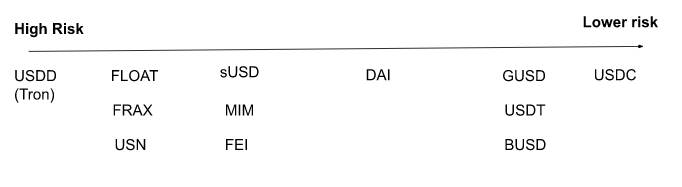

Each stablecoin has a different risk profile. Some are riskier than others—not all stablecoins are created equal.

Stablecoins act as an on/off-ramp between fiat currency and the crypto ecosystem or as a shelter for volatility.

The level of trust in the stablecoin depends on who issued it and how the stablecoin is backed (or collateralised).

Think of stablecoins in these 5 different ways:

- Fiat pegged or backed: Pegged to a fiat currency and backed by fiat currency.

- Crypto-backed/collateralised: Backed by a mix of crypto-assets, fiat currency or other commodities.

- Asset or commodity-backed: Backed by commodities such as gold.

- Algorithmic structure: Backed by a cryptocurrencies token design. The stablecoin may not be physically backed 100% by tangible collateral and can be prone to depegging.

- Hybrid: A mix of crypto-backed and algorithmic designs.

See the below example from our resource ‘Managing Risk In Cypto’ for different risk profiles for stablecoins.

When using stablecoins, the biggest question is ‘is this stablecoin backed by 100% 1:1 audited reserves?”. If the answer is no, then there may be added risk.

Bitcoin: Tier-One Cryptocurrency

Bitcoin (BTC) can be seen as an entirely different tier. It stands alone as arguably the number one crypto asset within its own asset class. It’s not uncommon for some holders to be 90 or 100% in BTC.

It’s the most dominant cryptocurrency, longest-running and secure.

What is Bitcoin used for? Bitcoin separates itself from the other crypto assets mentioned as it attempts to be more of a ‘digital gold’ and a new form of ‘money’ that’s entirely digital. It’s an alternative digital currency outside the regular financial or banking system (i.e. central banks and government issue them).

The native token bitcoin (BTC) is used as the economic incentive to run the network. Think of Bitcoin as:

- Payments (transfer of value).

- Store of Value.

- Open financial infrasturcture.

Its place in the crypto-economy is considered the most secure compared to other crypto assets. BTC’s suffered notable 90% falls in the past but has bounced back to remain the only constant asset throughout crypto’s short history.

Ethereum: Tier-Two Cryptocurrency

Ethereum (ETH) is the second-largest cryptocurrency and the most widely used, adopted and battled test smart-contract platform (smart-contract platforms are networks that can house sophisticated crypto apps).

Although Ethereum is facing radical competition from emerging blockchains ecosystems, such as Solana, Cosmos and Avalanche, it remains a tier 2 asset (for now) due to its significant value locked, strong reputation, development and history.

What’s ETH used for? Ethereum is designed to support smart contracts. You’ll often see Ethereum called a ‘smart-contract platform’—meaning anyone can create apps on it—like you’ll go to Apple’s App Store to access an app.

For these reasons, blockchains like Ethereum have become in demand, as anyone can create art, a financial app or house significant value on the network. ETH is the underlying asset needed to run the network. It is used to pay for transactions. Validators earn ETH as staking rewards.

Catagorgising Other Cryptocurrencies By Use Case

We can start to think about other cryptocurrencies outside of BTC and ETH.

It can be difficult to categorise these as there’s no ‘official’ categorisation, and industry leaders will categorise them differently.

We’ve broken these into primary use cases or applications. Some cryptocurrencies may fall into multiple categories.

- Payments: Primarily used as a means of payment or value transfer.

- Examples: Bitcoin (BTC), Dai (DAI) and Dogecoin (DOGE)

- Financial or DeFi: Crypto-assets that underpin, incentivise or ‘govern’ decentralised finance (DeFi) apps.

- Examples: Aave (AAVE), Maker (MKR) and Uniswap (UNI)

- Platform (smart-contract platforms): These crypto-assets use a native token to run the network or are pivotal to creating an underlying infrastructure. Allowing smart-contract platforms to run, they pay for transactions and incentive the network using the native token.

- Examples: Ethereum (ETH), Solana (SOL) and Sui (SI)

- Exchange tokens: Native to crypto exchange platforms. They may offer discounts on trading fees or exclusive offers via the native exchange. Importantly, these tokens don’t represent an ownership stake in the exchange.

- Example: BNB (BNB)

- Privacy: Privacy-focused crypto-assets.

- Examples: Monero (XMR) and Zcash (ZEC)

- Service (utility): Provide a service, a function or a resource to address a specific need.

- Examples: Chainlink (LINK) and Filecoin (FIL)

- Media, gaming and entertainment: Crypto-assets that reward users for content, games or social media. They relate to video, photography, the metaverse and can reward users for participation or entry into clubs.

- Examples: ApeCoin (APE) and Axie Infinity (AXS).

‘Altcoins’ are highly volatile

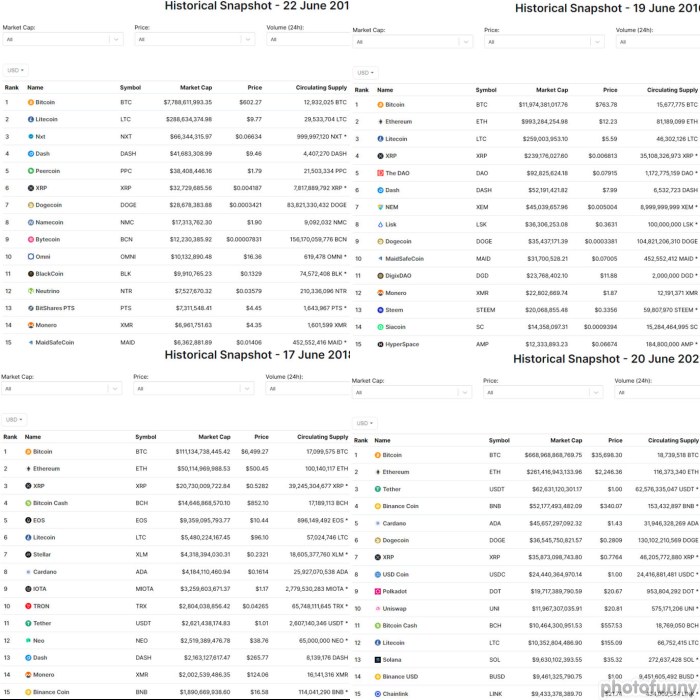

Whatever type of crypto asset you hold, it’s essential to understand many cryptocurrencies can go to 0. There’s a lot of experimentation—for example, compare the top 15 crypto-assets from 2014 to 2022.

The top 15, 50 and 100+ vary widely as new crypto-assets gain traction, while others slowly fade into the background.

Non-fungible tokens (NFTs)

NFTs are different to cryptocurrencies because they are non-fungible. We can think of NFTs as virtual tokens representing digital content items and acting as a digital timestamp to prove their uniqueness.

But what does that even mean? It’s unique and can’t be replaced with something else. For example, if you trade 1 ETH for another, you’ll have the same asset. This isn’t the same with trading an NFT or another, even in the same collection.

Each NFT is different and has different perks or utilities. They can be anything digital such as art or music.

Examples of NFTs include:

- Virtual avatars or profile pictures: Bored Ape Yacht Club (BAYC)

- Art: Art Blocks

- Collectibles: NBA Top Shot

- Domain names: Ethereum Name Service (ENS)

- Plots of virtual land: Otherdeed for Otherside and The Sandbox Land

- Membership or access: The Meta Key and LinksDAO

- Fundraising: Pooled Togethers’ Pooly NFTs were created to fund a legal defence

- Gaming and in-game items: Axie Infinity creatures (i.e. Axies)

Read: What Are NFTs?

Recap

From this resource, you should better understand the different types of crypto-assets and how Collective Shift categorises them.

- Stablecoins: A means to move in and out of crypto assets or bridge from fiat—many different stablecoins exist with varying risk profiles.

- Bitcoin (tier 1): A new form of ‘money’ or monetary system native to the internet, outside central banks.

- Ethereum (tier 2): A network used to house or access the wide range of crypto applications—it’s the infrastructure allowing it all to happen.

- ‘Altcoins’ (tier 3): Crypto assets outside of Bitcoin that provide a service, membership or purpose in the crypto economy. From layer-1 blockchains to financial applications (DeFi) to media or gaming. These are the riskiest crypto assets out there.

- NFTs: A way to digitally prove ownership, promote new ways for artists to monetise their work and membership to clubs, events or tools.