Top 3 Risks To Pay Attention To

You are now well aware of the risky nature of cryptocurrencies and that most of them will fail over the long term. This is just reality.

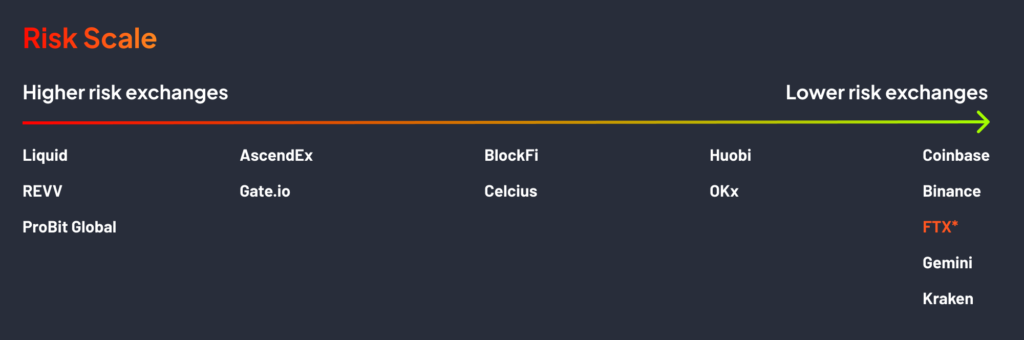

Exchange risk

There’s an inherent risk when using exchanges or lending platforms. The level of risk depends entirely on the exchange or platform you’re using.

If these exchanges go insolvent, your crypto assets are at risk as these platforms will often not insure your funds. This is why self-custody can be so important—i.e. the act of holding your cryptocurrency in your own possession and not with an exchange.

Often, when holding your crypto with an exchange, you are given an IOU, and you don’t really own that crypto but rather an IOU. This voucher or IOU inherently has risk, it is a claim on an item, others may have the same claim on the the same item.

Storage risk

Storing your crypto outside of an exchange and in your own custody is not something to take lightly.

Many people have lost serious amounts of cryptocurrency because they either:

- forgot their password;

- lost their seed phrase;

- wrote down the wrong words; or

- had poor security.

Strongly consider using a hardware wallet to store what you consider to be a significant amount of cryptocurrency.

Rugpull or scammer risk

Scam risk is one of the most common risks in crypto. Lax security practices and crypto scams pose a significant risk that isn’t to be understated.

Unfortunately, if people know you hold crypto, you may become a target.

Remember the basics:

- If it’s too good to be true, it probably is (e.g. “if you send me 1 BTC, I’ll send you back 2 BTC”).

- Verify you are talking to the correct customer service and not imposters.

- Ensure the URL is correct by bookmarking the exchanges you use.

- Never share your seed phrase or passwords with anyone, even the exchange themselves.

- Use 2FA on your exchange amount.

- Keep your recovery phrase offline.

This risk increases when doing more complicated things in crypto (e.g. using a web wallet and interacting with crypto apps). We’ll cover this more later.

Rugpulls are situations where you buy a cryptocurrency or NFT, and then the team abandons it without notice—often after they have promised to deliver on a roadmap.

Further risks from our Beginner Course

Risk Tolerance

Your personal risk appetite will dictate what percentage of your portfolio is allocated to cryptocurrencies in comparison to other asset classes, as well as what percentage of your cryptocurrency portfolio you allocate to specific cryptocurrencies.

It’s important to perform a comprehensive risk assessment of any cryptocurrency before you consider investing. Not doing so can significantly impact the risk-reward ratio of your portfolio.

Failure

Most cryptocurrency projects will fail over the long term for various reasons (e.g. low user adoption, mismanagement, poor execution, outright scam).

This high failure rate is why many are hesitant to invest in crypto and why those who do tend to be conservative with their approach and allocations.

Use Cases

We’ve covered the risks involved with investing in one industry or sector, and this same theory can be applied to the way you structure your cryptocurrency portfolio. If you own several cryptocurrencies that are all based within the same industry or designed to solve the same problem, you may be exposing yourself to unnecessary risk.

For example, if the industry or sector you base all of your cryptocurrency investments no longer has a demand or need for a blockchain-based solution, the combined value of your cryptocurrencies could plummet.