Understanding Basic Risks of Crypto

You’re almost there!

By now, you should have a sound understanding of what cryptocurrency and Bitcoin are;

A new TYPE of currency that doesn’t require a government to function.

Before you buy your first cryptocurrency, it’s important to learn about the risks and considerations before jumping in.

We will buy your crypto, and here’s how to stay safe.

Click here to access the Collective Shift Security Center to learn more!

Importance of staying in BTC

Before we understand more specific risks, there are some broader risks to appreciate.

Before buying, it’s important to appreciate the risk of volatility and the long-term sustainability of your crypto assets.

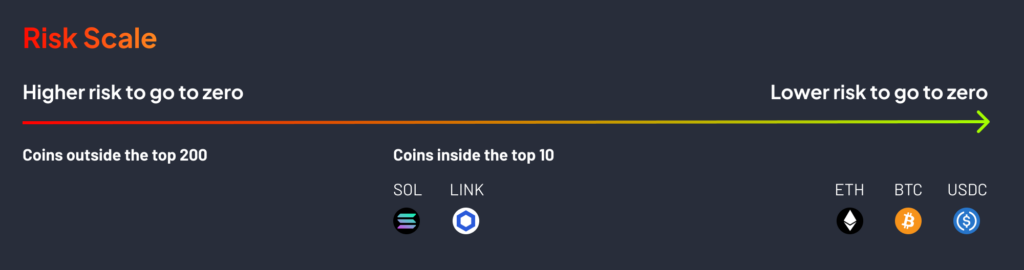

If you want to minimise significant losses, giant swings and the potential for your crypto-asset to go to 0, then staying solely in BTC is very common.

For example, in 2022, Terra (LUNA), a top-10 crypto-asset, went to nearly 0 in 48 hours.

While in the 2022 crypto flash crash, 12,763 crypto-assets have fallen by at least 95+% from their all-time high. Many won’t be back and will fade away. BTC has fallen by 77%, and its place in the ecosystem remains highly likely long-term.

Simply put, the risk increases as soon as you start to dip into other cryptocurrencies, especially outside the top 10, top 50 and top 100+.

Crypto for First-Time Investors

We highly recommend any person entering crypto and Bitcoin for the first time to consume our “Crypto Assets for First Timers’

See the Full Resource Below

If you’re a first-time buyer and want to get into the crypto space, we believe you should have all the information before you start and understand what you’re getting into. After all, there is significant volatility and risk to be aware of!

Here are our 7 tips for getting started if this is your first experience looking into crypto-assets.

We also have the 7 crypto commandments we champion to help along your crypto journey.

| #1 Understand Crypto is still highly risky Crypto is a highly risky asset; even top cryptocurrencies like Bitcoin and Ethereum can fall significantly in value. However, they have stood the test of time compared to many other failed cryptocurrencies. The crypto industry is moving towards more fundamental value and use cases but remains highly speculative. | |

| #2 No such thing as guaranteed returns; be vary of high yield In the crypto world, you may come across high annual percentage yields (APY) ranging from 10% to even 500%+ that can be generated from staking, lending, or depositing your crypto assets. However, anything promising a certain profit with no risk should be a red flag and warning sign. High APYs above 10% are considered exceptionally risky and often not sustainable. If you do not understand how “yield farming” works or where the yield comes from, it’s best to avoid it, especially as a beginner. | |

| #3 Be prepared for high volatility and understand the risk profile – assets can go to zero Crypto assets are still the highest volatile assets and can see wild swings. If this keeps you up at night and is something you struggle with, crypto assets may not be for you. Even the biggest cryptocurrencies, such as BTC or ETH, can see substantial 70% swings from all-time highs, and it’s critical to understand any alternative cryptocurrency (commonly known as an ‘altcoin’) outside of Bitcoin could fail and lose 90–99.99% of its value. If you’re older or seeking retirement, it’s critical to understand these risks and only allocate a smaller % into crypto or steer clear of the riskiest crypto assets altogether. Please consider your time horizon and risk appetite. | |

| #4 All crypto assets are different: Bitcoin is the first crypto asset to be adopted and used as a digital store of value. It’s been available for over a decade, has a limited, fixed supply, and there is no issuer or controller sitting behind Bitcoin. All crypto assets won’t perform like Bitcoin—just because Bitcoin is doing well; it’s not to say another crypto will perform the same. All cryptocurrencies differ in their design, use case, scarcity (number of tokens) and how they accrue value. For more on the types of cryptocurrencies, go to How To Categorise Crypto Assets. | |

| #5 Limited protection There is often limited protection for the user. If you lose your cryptocurrency due to an error or transfer to the wrong address, you may be unable to recover the funds. Or if you fall victim to an online crypto scam, you may find it difficult to hold the party to justice. Important to consider if you are willing to lose some or all of your investment as there can be little consumer protection, and you are in control of your crypto-assets. For many users worried about this, users may use established exchanges like Coinbase to hold their cryptocurrencies for them or make trading easier. To understand how to secure your crypto, see our Ultimate Guide to Storing Your Cryptocurrency | |

| #6 Understand security When swapping and engaging in crypto online, taking security seriously is essential. Never underestimate security and be across the top tips to protect crypto-assets and personal information. Activating 2FA is essential when buying your first cryptocurrency. We have a Security Centre with our best tips, resources and community news. | |

| #7 DCA can help smooth out volatility Dollar-cost averaging (DCA) is a way to buy bits of bitcoin each week rather than spending a large sum at once. This can be especially helpful with Bitcoin or cryptocurrency, which are very volatile. By DCAing, you can smooth out the volatility. |

More Information

We highly recommend checking out ASIC’s info on Crypto-assets and their podcast episode with the Communications Adviser and Crypto-Asset Coordinator at ASIC.

If you want more information on staying safe and the risks in crypto.

Please navigate to our Collective Shift resources.