Just as blockchain technology has a wide range of uses, so too do crypto-assets. That’s why, as you’ll learn, crypto-assets are designed in all sorts of ways. For investors, it’s crucial to understand these design decisions because they greatly affect a crypto-asset’s value.

So important is this topic that we’re breaking it up into a two-part series. Below is part 1, which covers the basics of tokenomics and why you should care about it.

Key Takeaways

- Tokenomics is the economic design of a crypto-asset. It’s an expansive topic that covers utility (i.e. how the token is used), supply, demand and incentives (how it functions).

- By understanding tokenomics, you can better appreciate the dynamics that influence movements in a crypto-asset’s price.

- Get the basics right by understanding the core tenant of tokenomics, such as why it exists, price, market cap, and broad supply.

- Part 2 will be on how to evaluate a crypto-asset’s tokenomics. We’ll cover how to critically assess factors such as utility, value flows and supply.

Contents

- Tokenomics Series Overview

- What Is Tokenomics?

- Why Tokenomics Matter

- The Basics Of Tokenomics

- Previewing Part 2

Tokenomics Series Overview

Tokenomics is a rabbit hole. Before you learn the more complicated aspects of tokenomics, knowing the basics is a must. Our two-part series will be structured as follows:

- What Is Tokenomics? What is it, why does it matter and the basics with tangible examples.

- How to Evaluate Tokenomics: Looking in-depth into critical questions and valuable tools to analyse tokenomics.

- Deep Dive Into Various Tokenomic Models: A number of tokenomic models are evolving in parallel. More advanced topics include the design of token-based incentives (i.e. choosing what behaviour to reward and how to reward it).

What Is Tokenomics?

Tokenomics is the design of a crypto-asset. It relates to economics, the study of how humans make choices under conditions of scarcity. Economic concepts particularly relevant to tokenomics are supply and demand, utility and scarcity.

Thus, a make-shift term of ‘tokenomics’ is given to studying the economic design of crypto-assets. It’s all about answering questions such as those listed below.

- Why does the token exist? The purpose of the crypto-asset should be clear.

- What are the supply dynamics? Several supply-side variables can affect token prices. (More on this in part 2.)

- How does it function? Scrutinising how the token incentivises certain behaviours is critical.

- Does it capture value? This is a stumbling block for many tokens, even if they are tied to a widely used app.

Why Tokenomics Matter

Tokenomics greatly affect a crypto-asset’s chances of success. Understanding the basics of a crypto-asset and what drives its value, properties and use case is essential. Good tokenomics can make a lazy project viable, while poor tokenomics can kill even the most exciting of projects.

Understanding tokenomics is essential for grasping the supply and demand dynamics of a crypto-asset, which refers to the buyers and sellers willing to participate in the market for the crypto-asset.

Common traps newcomers make

Not understanding a crypto-asset’s tokenomics can lead to heavy investment losses.

Unit bias

This refers to the trap of not understanding market cap and supply by conflating low prices with higher potential for gains, without considering the market’s substantial token supply.

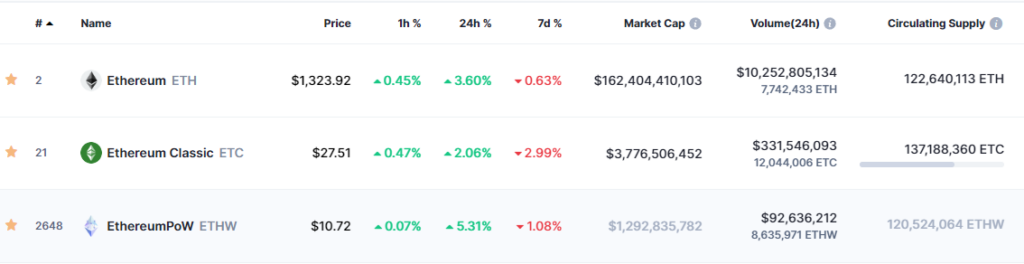

An example could be confusing different versions of “forked” crypto-assets as cheaper versions of the same thing—such as confusing ETH with other vastly different versions of Ethereum.

Retaining value

The vast majority of crypto-assets fail because they didn’t satisfy tokenomics 101: “why does the token exist?” and “how does it incentivise or reward a particular outcome or essential for a system to function?”

Not understanding supply

Not knowing a crypto-asset’s tokenomics can leave you unaware of the vast amount of tokens hitting the market.

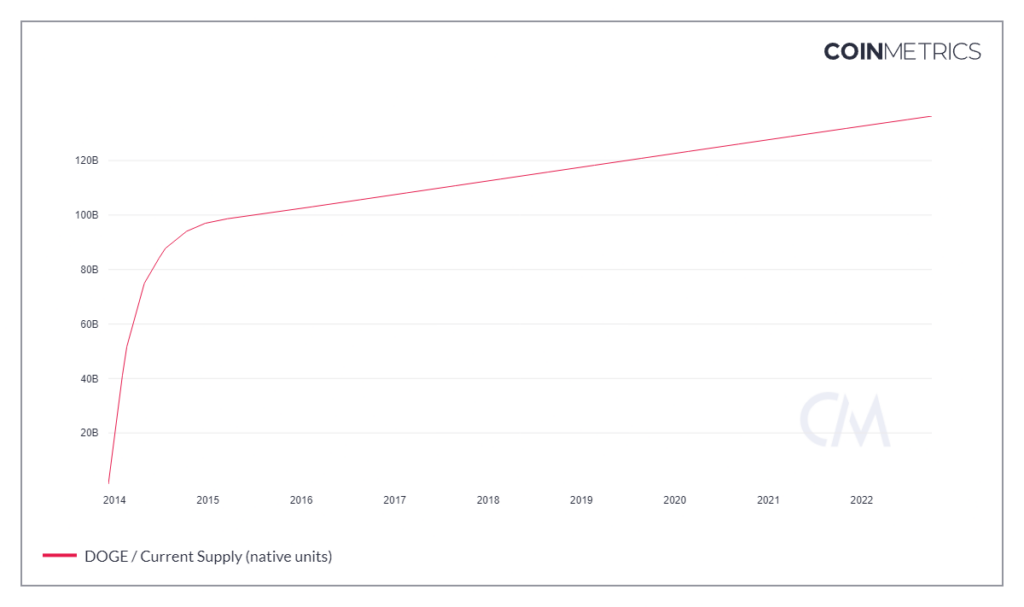

It can take time to appreciate the extent to which supply dynamics differ between crypto-assets. For example, Dogecoin (DOGE), one of the most widely held crypto-assets, has an unlimited supply. Every day, 14 million DOGE comes into circulation the supply—that’s 5.1 billion per year! (More on inflation in part 2.)

The Basics of Tokenomics

We can break up the basics of tokenomics into three key areas: (i) use case, (ii) supply and (iii) valuation.

1. Why does it exist? (understanding use case)

When assessing a crypto-asset’s tokenomics, always start with the following question: “what’s its use case?” Ask yourself a few key questions:

- What problem is this solving?

- Why does it need to be on a blockchain?

- What use does the token have in this ecosystem or app?

Example

Ether (ETH) is the Ethereum network’s native token. Its incentive mechanism is such that validators earn ETH in exchange for the service they provide of verifying transactions and securing the network. Also, to perform a transaction, a small fee must be paid in ETH. Without ETH, Ethereum simply could not function without ETH.

Arweave (AR) is used to pay a one-time, up-front fee to store their data permanently. AR is also paid to miners as incentives on the Arweave platform to ensure all the data is there.

2. What are the basic supply figures? (understanding supply)

When it comes to a crypto-asset’s supply, there are a few aspects to consider. It’s key to understand how many coins are circulating, whether the supply is fixed or how many will be released. The following terms are particularly important:

- Circulating supply is the number of coins or tokens in the market at a given moment. (This is always adjusting.)

- Total supply is the number of coins or tokens that exist at a given moment. Examples of coins or tokens not in circulation include those that are vesting (i.e. they are non-transferable until a future date).

- Maximum supply is the maximum number of coins or tokens that will ever exist. Not all crypto-assets have a maximum supply. (Also, in rare instances, stakeholders may vote to change the maximum supply.)

Example

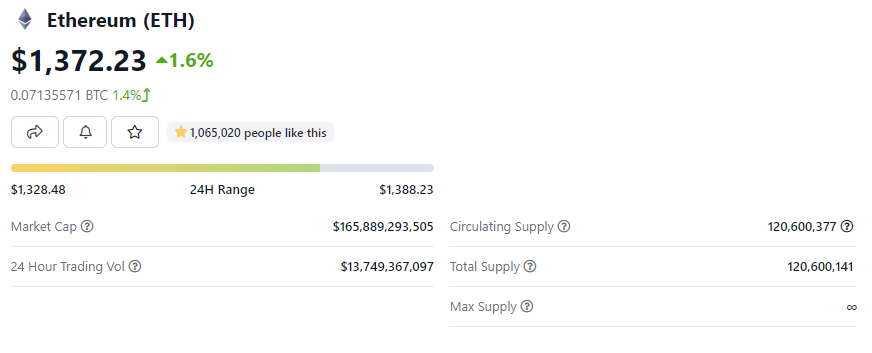

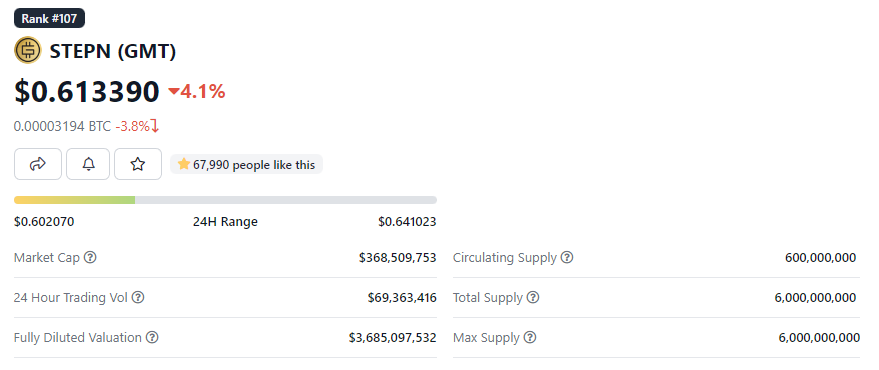

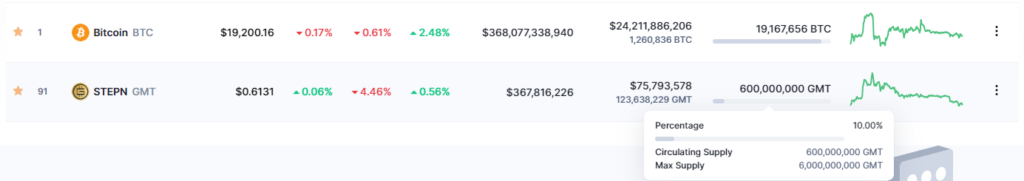

With a crypto project like STEPN (GMT), we can see at the time of writing that 600,000 GMT tokens are in circulation. With a total supply of 6 million, that means that 10% of the total supply is available in the market.

Compare this with other crypto-assets like bitcoin (BTC), which has over 90% of its total supply (i.e. 21 million) in circulation.

Tip: CoinMarketCap shows you the portion of a crypto-asset’s supply that’s in circulation. (See below.)

3. What’s the total value? (understanding market cap)

Market capitalisation (market cap) is the total dollar value of a crypto-asset, determined by the last transaction price. It’s determined by multiplying the circulating supply by the current price.

You may see the term fully diluted valuation (FDV). This is another measure of a crypto-asset’s value. FDV is determined by multiplying the maximum supply by the current price.

Example

Continuing with STEPN (GMT), with only 10% of the total supply in circulation, its market cap is $368 million yet its FDV is a whopping $3.6 billion.

Compared this with a crypto-asset like Uniswap (UNI), which has a market cap of $4.9 billion and an FDV that isn’t too much greater (i.e. $6.5 billion).

Previewing Part 2

Part 2 will cover how to evaluate a crypto-asset’s tokenomics and the tools that can help you do this. Areas we’ll focus on include:

- going beyond market cap;

- diving deeper into token utility;

- token supply and distribution;

- demand levers; and

- value capture.