Not all crypto-assets are created equal. A framework for evaluating a crypto-asset helps you understand what you’re buying, as tokenomics significantly affect its value. Part 2 of this two-part series on tokenomics dives into the core questions (demand, supply and value capture) to ask when analysing a crypto-asset.

Key Takeaways

- Part 1 explained how tokenomics is the economic design of a crypto-asset. Tokenomics matters because it helps us understand the dynamics that influence why its price may increase or decrease.

- Going beyond market cap helps to understand the ‘whole picture’.

- A core framework forevaluating tokenomics consists of 3 core areas:

- Demand drivers—why token? What’s the use case for the crypto-asset, and are there reasons to hold it?

- Is it needed for the network to run?

- Required to generate staking rewards?

- Are earnings/fees generated from the protocol distributed back to token holders?

- Is there voting power by holding the token?

- Supply drivers—ask questions related to supply dynamics:

- How many tokens exist or will exist, and how many are currently in the market?

- What’s the issuance rate?

- How are the tokens allocated?

- What’s the unlock schedule of the remaining supply?

- Who are the largest holders?

- Value capture—bring together demand and capture to understand how value can flow into the crypto-asset.

- Demand drivers—why token? What’s the use case for the crypto-asset, and are there reasons to hold it?

Contents

- Refresher: Part 1

- Evaluating Tokenomics: What Questions To Ask

- Demand Drivers

- Supply Drivers

- Value Accrual

- Going Deeper

Refresher: Part 1

In Part 1, we learned that tokenomics is a cryptocurrency’s design. It heavily relates to economics, which is the study of how humans make choices under conditions of scarcity. Economic concepts relevant to tokenomics are supply and demand, utility and scarcity.

Tokenomics significantly affect a crypto-asset’s chances of success. Understanding the basics of a crypto-asset and what drives its value, properties and use case is essential.

Understanding tokenomics helps you understand a crypto-asset’s supply and demand dynamics—or, in economic terms, the willing buyers and sellers in the market for the crypto-asset.

Framework For Evaluating Tokenomics

We can think of core principles behind a crypto-asset’s token design in a few broad areas: utility (demand drivers), supply factors and value capture. Use these core questions to develop a framework for analysing a cryptocurrency’s tokenomics.

Going beyond market cap

In Part 1 we learnt the basics of market cap.

- Market cap = total market value of the current supply in circulation.

- Current price * circulating supply

- Fully diluted market cap = the total market value of the total supply.

- Current price * max supply

Crypto personality Cobie famously wrote about why market caps are a “meme”—as it’s easy to forget how market caps can be manipulated and how investors can get into crypto-assets early.

He thinks of market cap as not only the size of the current market but the total dollar public demand for the crypto-asset, which adjusts with price. FDV is more comparable to supply.

If a project has a higher “fully diluted” valuation than some of the world’s bigger tech companies, just a year or two since being founded, it’s probably worth wondering: who is holding this massive new wealth, what price did they get it for, and who are they going to sell it to?

Cobie (On The Meme Of Market Caps and Unlocks)

We must go beyond market cap to understand a token’s functionality, purpose and supply dynamics.

Utility & Demand Drivers

Why is the token needed and what’s the use case? Use cases could include:

- As an incentive or reward to run the network

- Distribution of revenue to token holders

- Payments

- Governance

- Payout ecosystem grants

- Distributed to the community via yield-farming activities

- Staking

- Fee discounts

- Memes (price speculation or historical relevance)

If it’s only used for price speculation, this may be a red flag or sign the token may struggle to survive long term. Some use cases from popular cryptocurrencies:

- ETH: used to pay transaction fees and is the economic incentive helping the Ethereum network run.

- AR: rewarded to miners who store long-lasting data.

- SUSHI: governance, with holders who stake getting a share of total revenues from its exchange.

- CRV: governance to direct future emissions, rewards and generate boosted APY.

Understanding demand drivers

Understanding the core utility of a token is essential to understanding a token’s demand dynamics. That is, what causes an increase in token demand other than speculation? Is there a compelling reason to buy and hold? Are people incentivised to buy, hold, lock or stake the token?

Demand drivers include:

- Needed for the network to run?

- Required to generate staking rewards

- Are earnings/fees generated from the protocol distributed back to token holders?

- Is there voting power by holding the token?

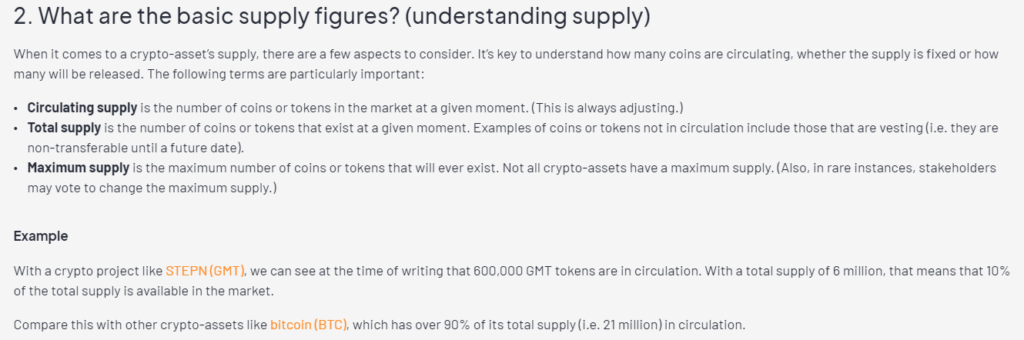

All About Supply

Supply is an essential part of tokenomics. Key questions to ask include:

- How many tokens exist or will exist, and how many are currently in the market?

- How many tokens currently exist?

- How many will ever exist? (e.g. is there a supply cap, known as the ‘maximum supply’)

- How many are in the market right now? (circulating supply)

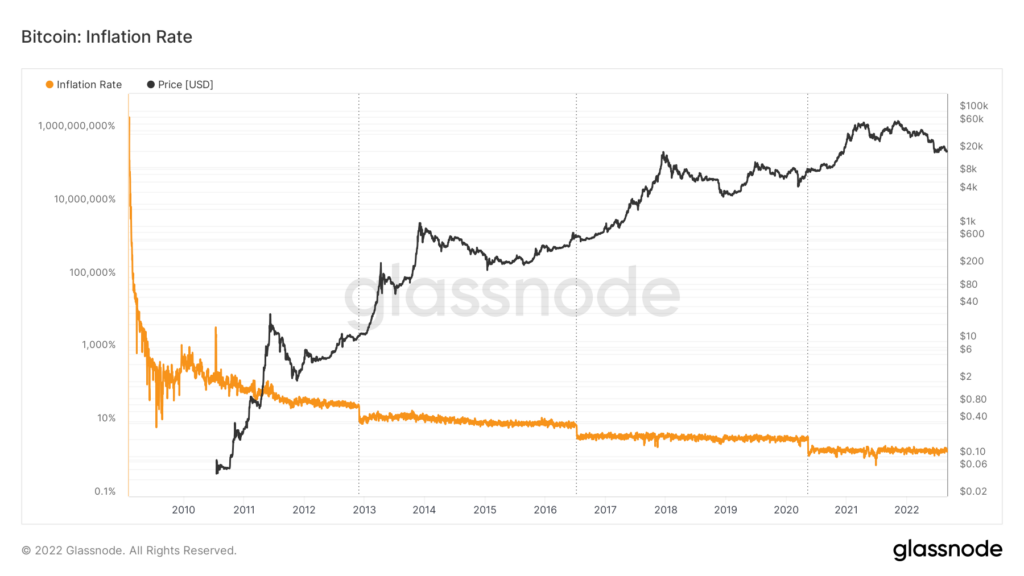

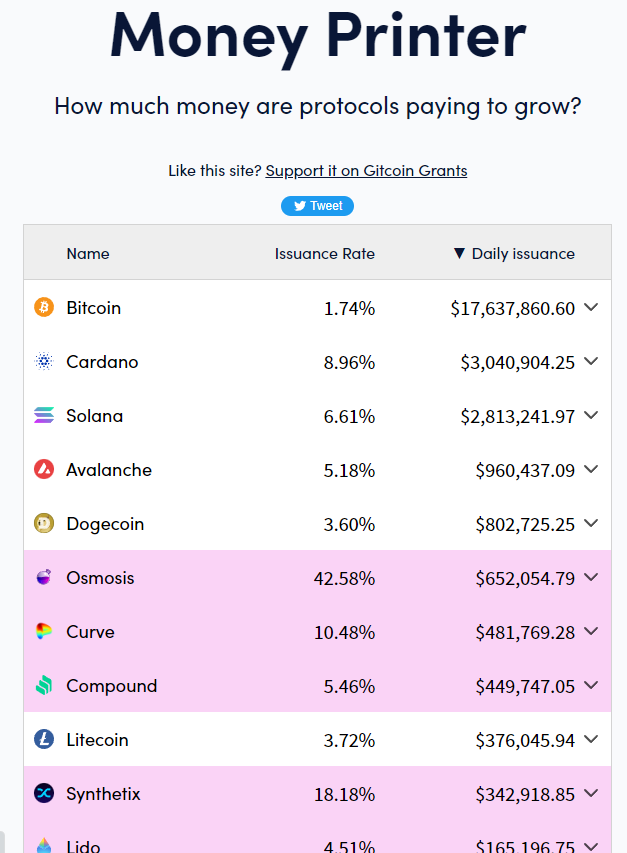

Myth: Unlimited supply isn’t necessarily bad. Issuance is more important.

What’s the token issuance rate? i.e. how much inflation/deflation annually?

Just like fiat currencies, most crypto-assets are subject to supply inflation. In some cases, annual inflation (new tokens created) can be above 10%. Below are the inflation levels of some cryptocurrencies.

- Bitcoin (BTC): ~1.77%. Decreases every 4 years due to the halving.

- Ether (ETH): ~0.5%.

- Polkadot (DOT): 10%.

- Solana (SOL): 8%. Decreases by 15% each year.

- Dogecoin (DOGE): ~3.6% with an unlimited supply.

Read: Understanding & Combating Crypto Inflation

Fixed vs variable issuance:

- Is the issuance rate fixed or variable?

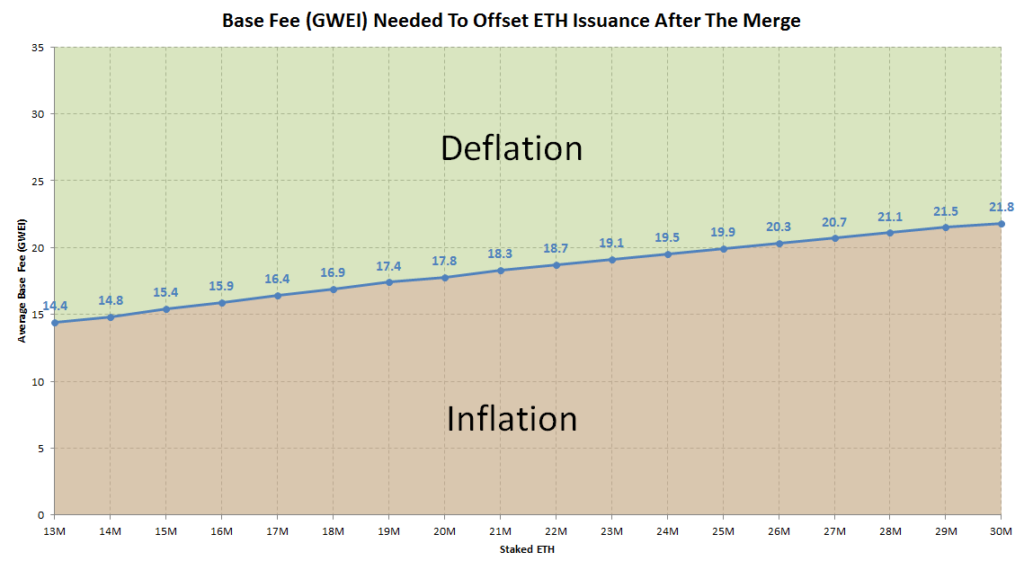

- Bitcoin has a fixed issuance rate, whereas Ethereum’s issuance is variable.

- If variable, what factors determine (and can influence) the issuance rate?

- Example: The amount of ETH issued depends on (i) network activity [gas fees] and (ii) the amount of staked ETH.

- Other factors, such as token burns, might impact issuance and tokens in the market.

How are the tokens allocated?

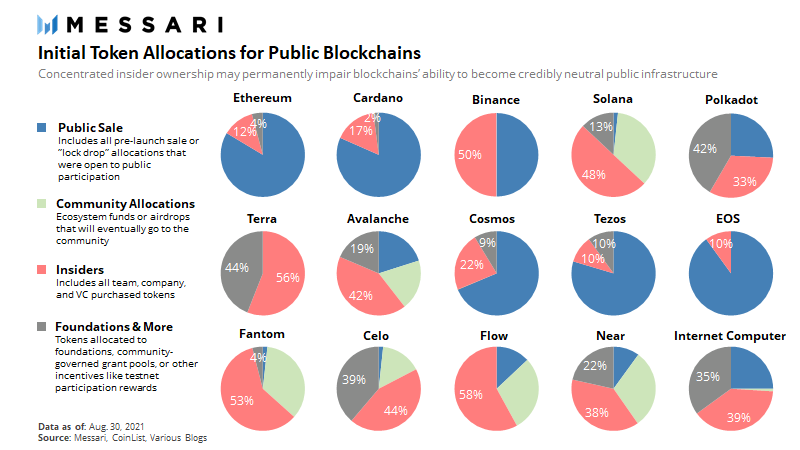

How was supply initially allocated among the core team, community and investors?

Are a significant amount of tokens held by early insiders who were gifted tokens or purchased at much lower prices via presales? Knowing the significant holders can help you identify possible sources of future material selling pressure.

Tip: Free website CoinGecko has a ‘Tokenomics’ tab to view supply schedules or token allocations.

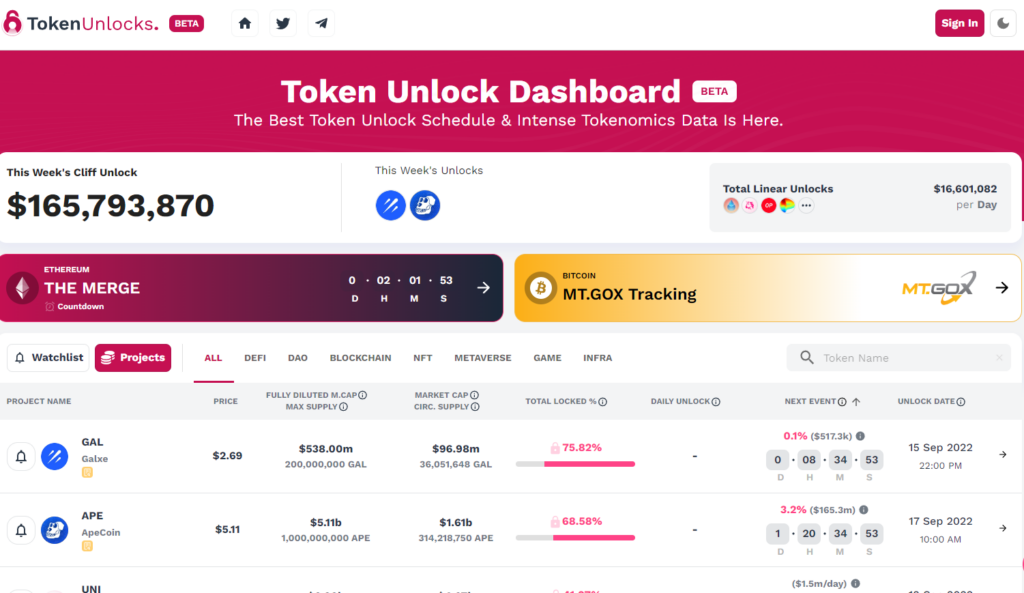

What’s the unlock schedule of the remaining supply?

When can holders sell?

Often, a portion of tokens is locked (or ‘vested’) before being released to specific stakeholders (e.g. early investors or founders).

Some vesting schedules have a cliff. This is when someone—usually a core team member—must work for the project before tokens start unlocking—for example, a 4-year vesting period with a one-year cliff.

Tip: Use TokenUnlocks for important tokenomic data such as unlock schedules

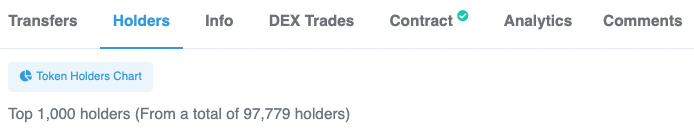

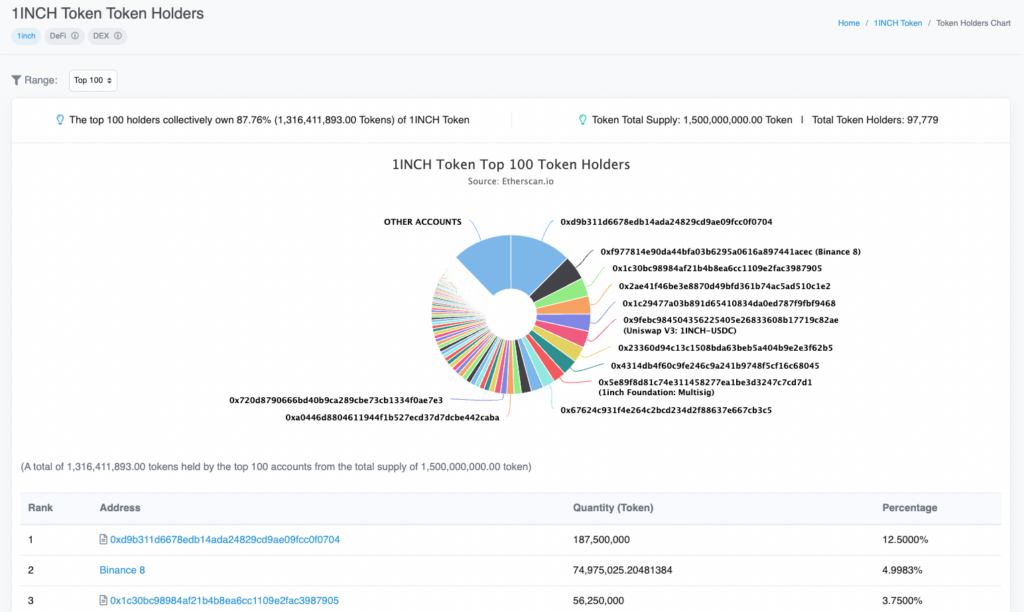

Who owns most of the supply? Use block explorers such as Etherscan to inspect a token’s supply distribution. This will let you investigate holder distribution and potentially identify the largest holders.

Value Capture

Value capture brings it all together.

How does value flow to the token, if at all? Questions to ask here include:

- Generates a share of revenues from the protocol? (Often requiring users to stake the native token).

- A large treasury generating substantial revenues that token holders have influence over (e.g. onchain voting).

- Future airdrops or value for holders.

- Used for network payments.

- Required to hold to secure the network (staking).

- Favourable token buyback-and-burn mechanisms.

If there is a tangible use case and reason to hold, does oversupply and sell pressure negate incoming demand? It’s all about supply and demand.

Sell pressure looks at the inflows of holders selling their tokens. This can significantly impact price.

Key supply questions explored above heavily impact market sell pressure. Question how it affects sell pressure:

- Are there locked tokens that, once unlocked, could put downward pressure on the price?

- What % of the total supply is locked?

- What is the token’s inflation rate?

- How widely distributed is the supply?

- What % of the total supply is circulating?