What Is Uniswap?

Uniswap is one of the most popular ways that people swap cryptocurrencies on the Ethereum blockchain. Every month, tens of billions of U.S. dollars worth of cryptocurrencies are traded on Uniswap.

People use the Uniswap protocol because it lets them:

- Buy tokens that may not be listed on more popular exchanges.

- Earn income by sending their tokens to a liquidity pool.

- Exchange tokens without needing to do KYC.

How Uniswap Works

Whereas most exchanges maintain an order book and facilitate matches between buyers and sellers, Uniswap smart contracts hold liquidity reserves of various tokens. Trades are executed directly against these reserves.

Prices are set automatically using a simple math equation. The fees for swapping tokens are very small, ranging between 0.05% and 1.00%.

Swapping Tokens on Uniswap

For most people, swapping tokens is the only thing they’ll ever use Uniswap for. This can be done from Uniswap’s open-source interface.

To do a swap, you need one of the following wallets: MetaMask, WalletConnect, Coinbase Wallet, Fortmatic or Portis. Assuming you have one of these, click ‘Connect to a wallet’.

Related: How to Use MetaMask Wallet

Next, choose the 2 tokens you want to swap. You will need to select a token list such as Uniswap Default List. You can find a token by searching for its name or symbol or by pasting its address in the search bar.

Adding Liquidity to a Uniswap Pool

Behind swapping, providing liquidity is the most popular thing people use Uniswap for. They do this to earn income, which comes from the 0.05–1.00% fee that is automatically charged on each trade.

Fees are shared pro-rata between all liquidity providers to a given liquidity pool. (A liquidity pool is simply a smart contract and is itself an ERC-20 token.) Anyone can become a liquidity provider for a pool by depositing an equivalent value of each underlying token in return for pool tokens.

Risks With Uniswap

Fake tokens

Because Uniswap is permissionless, anyone can list fake tokens in the hope that people will mistakenly send tokens to the fake token’s address. The core Uniswap team combatted this in Aug. 2020 by introducing Token Lists. As per the below excerpt from Uniswap’s blog post:

As the rate of token issuance accelerates, it has become increasingly difficult for users to filter out high quality, legitimate tokens from scams, fakes, and duplicates. Across the space, projects are managing and maintaining rapidly growing token lists. The end result is a lot of wasted time, slow listing processes and scammed users.

Phishing attacks

While this risk isn’t inherent to Uniswap, it is definitely something to note. Scammers continue to create phishing copies of Uniswap’s interface.

Sometimes these scam websites appear on the top of the Google search results as an ad when you search for ‘uniswap’.

Always ensure you are on https://app.uniswap.org/#/ swap before making a swap. If you use MetaMask, you can always verify you are using the real Uniswap interface by clicking the 3 dots and then clicking ‘connected sites’.

To lower the risk you land on a phishing copy of the Uniswap interface, consider bookmarking the real interface and clicking that bookmark whenever you want to use Uniswap.

Related: Tips on Avoiding Crypto & NFT Scams

Smart contract risk

While Uniswap’s smart contract code is relatively lean and simple, it is always possible that a bug in one of Uniswap’s smart contracts is identified and exploited.

Divergence loss

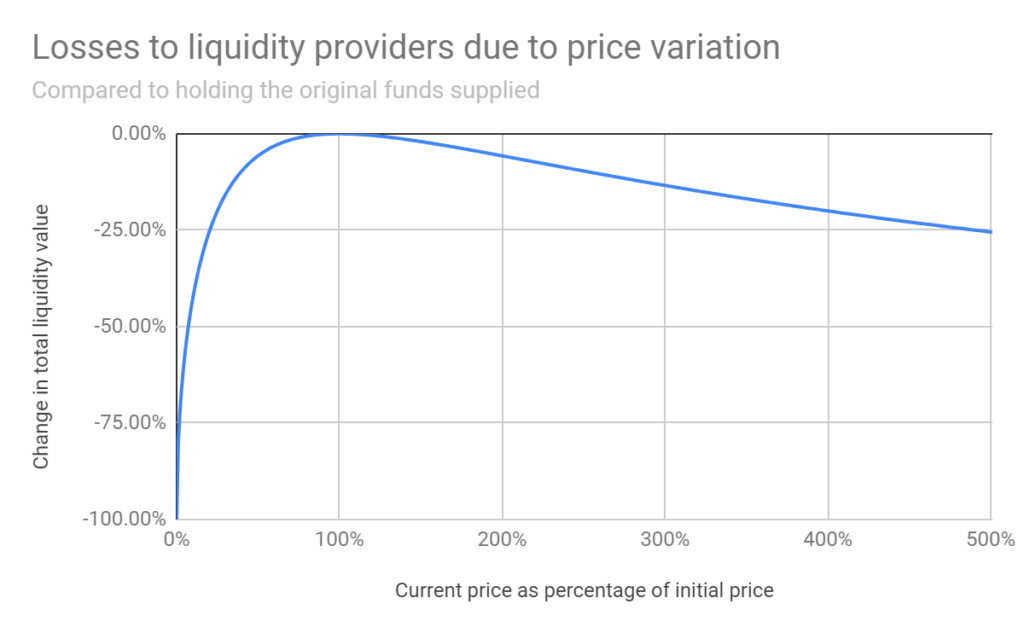

Liquidity providers can lose money—compared to if they simply held their tokens and never provided liquidity—when the underlying token’s price significantly increases or decreases. This loss is only realised when the liquidity provider withdraws their liquidity.

The more volatile the price action of the underlying token, the more the liquidity provider loses relative to if they simply never provided liquidity. (More about divergence losses in Uniswap.)

FAQs

My transaction is pending for X hours/days but it doesn’t show up on Etherscan. Your transaction was likely dropped from the mempool, meaning it will likely never succeed. To remove this pending transaction, you must reset your wallet and Uniswap. If you’re using MetaMask, you can reset your account to clear pending transactions. Then, to clear pending transactions from the Uniswap interface, click your account and select ‘clear all’ above your list of transactions.

My transaction failed. Can I get my fees back? No. When your transaction fails for any reason, you permanently forfeit the gas fees used to pay miners. However, the fee you paid for a failed transaction is usually less than you would pay for a successful one.

What is UNI? UNI is an ERC-20 token that enables shared community ownership and a governance system, which is limited to contributing to both development and usage as well as development of the broader Uniswap ecosystem. The total supply of UNI is 1,000,000,000.

Want to know more about SushiSwap, an exchange that is similar to Uniswap? Watch the below video from the Collective Shift YouTube channel.

Uniswap and SushiSwap are examples of decentralised exchanges (DEXes). Learn more about them in What Is A Decentralised Exchange (DEX)?.