The Pro Investor Newsletter is your go-to resource for staying updated with the crypto market and price-sensitive news. Emailed monthly. Below is a copy of the newsletter. If you are a Pro member and not receiving the Pro Investor Newsletter, please contact us through our member chat at the bottom right corner of your screen.

Foreword: Eight Weekly Gains, But Nowhere Near Euphoria

Bitcoin (BTC) is currently on an eight-week streak of gains—its longest since mid-2017—and is +152% year to date.

And yet, as strange as it may sound, it doesn’t feel like the market is getting ahead of itself.

I’m seeing no signs of ‘froth’ or irrational exuberance. Only now are the historically reliable metrics for gauging retail participation starting to move a little.

All that’s to say, I firmly believe that this bull market has a very long way to go throughout next year and potentially into 2025 depending on how next year unfolds.

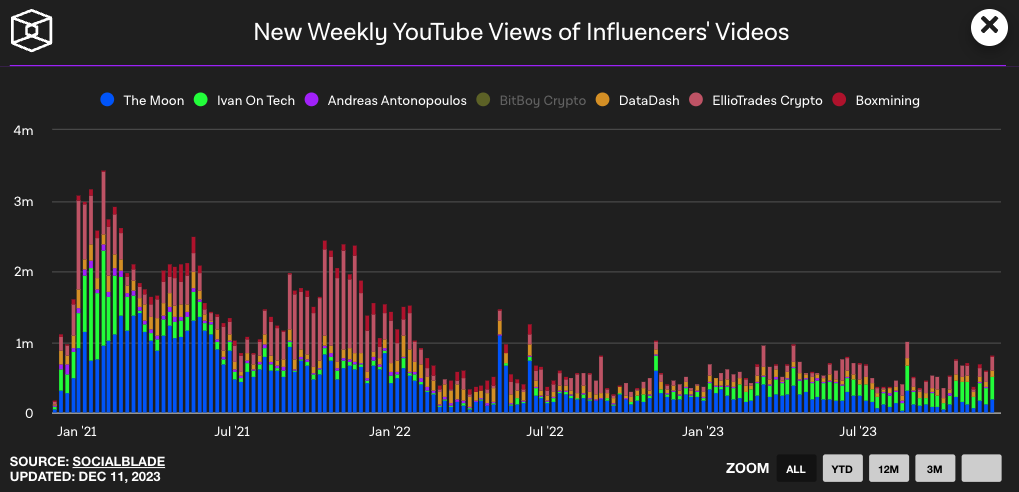

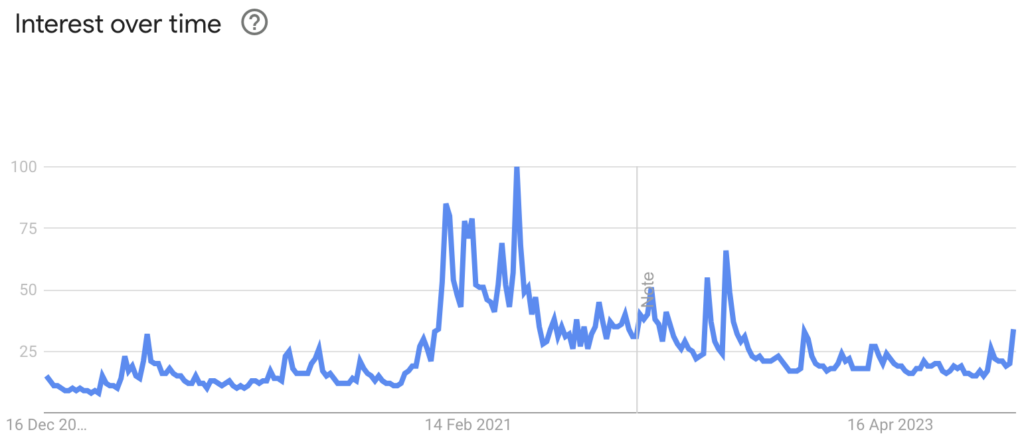

The charts below illustrate just how slight the uptick has been among new retail participants. Historically, bull markets hit their stride when new retail investors arrive en masse. (These simple metrics are surprisingly effective at indicating new retail investment activity. I think their simplicity causes a lot of more experienced crypto investors to ignore them. But believe me when I say these metrics are very useful!)

Global searches on Google for ‘bitcoin’ are only now starting to climb (Source: Google)

(There are various other metrics I use for tracking retail interest. I chose not to share all the charts above as they are all reflecting the same thing. For what it’s worth, I also like monitoring Coinbase’s web traffic via Similarweb and app usage via Sensor Tower. I could track more major exchanges, but I’m comfortable using Coinbase as a proxy.)

Two more things from me.

Firstly, this will be the last issue of the Pro Investor Newsletter before the crucial ETF dates of January 8–10 (see below for more). Given the 10 years of failed spot bitcoin ETF applications, I’m trying not to get too excited, but I also acknowledge the long list of reasons why an ETF approval is highly probable in early January.

While I’m expecting approval, I’m also preparing for the highly unlikely scenario that the SEC rejects the applications in early January. If this happens, I expect a bloodbath in the crypto market and will be taking the opportunity to buy more BTC, ETH and SOL.

Secondly, if you want to receive more airdrops from quality projects, stay tuned for my post tomorrow on an opportunity to qualify for EigenLayer’s airdrop.

Matt Willemsen

Head of Research & Content

November Recap: Removal of Largest Source of Market Risk

Binance’s settlement with the U.S. Department of Justice (DoJ) and various other U.S. regulators was easily the most price-sensitive news from November. All other news paled in comparison.

Essentially, Binance admitted to running its exchange with insufficient internal controls and without the necessary licences to operate compliantly in the U.S. (For more details on the settlement, see this section of our latest Market Report.)

For all of 2023, the DoJ’s years-long investigation into Binance had been the largest source of market uncertainty. There was simply no telling what the DoJ would discover about the world’s largest crypto exchange. Indeed, after what happened to FTX, you could forgive investors for fearing the worst.

Now, with this uncertainty all but gone, the market has one less tailwind—a particularly strong tailwind, at that—to contend with, giving it more reason to continue climbing higher.

December Preview: Make or Break For ETF Approval

Unsurprisingly, December tends to be quiet from a news standpoint. Therefore, expect the market to continue being fixated on whether the SEC will finally approve a spot bitcoin ETF. At this stage, the consensus prediction is for the SEC to approve all outstanding spot ETF applications between January 8 and 10.

(As a reminder, the ARK 21Shares Bitcoin ETF application has its final deadline on January 10, meaning the SEC must approve or deny it. Therefore, if the SEC plans on approving all spot ETF applications simultaneously—an approach that is widely expected—in the near future, it will need to do so on or before January 10.)

Of course, it’s possible, albeit highly unlikely, that the SEC:

i. denies the ARK 21Shares Bitcoin ETF application before approving other applications later in 2024; or

ii. denies all outstanding applications on or before January 10.

Prices would almost certainly crash if either scenario happens in early January. (For long-term investors still accumulating, it could be worthwhile having some capital ready to deploy should either of these unlikely scenarios play out.)

If the SEC does as expected and approves the ETF applications in early January, BTC would likely lead the market in another rally higher. There would perhaps be some periods of selling around the time that the ETFs actually go live in the weeks after the SEC’s approval, but these would merely be retracements in an extended bull market.

For more on the state of the crypto market, altcoins and the global economy, click the relevant links below to go to our new monthly member-only reports.

- Crypto Market (Dec. 4): Updates on the market, Bitcoin, Ethereum and must-know industry news.

- Altcoins (Dec. 6): Coverage of altcoins that have caught our analysts’ attention. In this report: SOL, AVAX, ARB, DYDX and AR.

- Macro (Dec. 2): Explanations of the 5 most important trends to monitor.

Kind regards,

Collective Shift