Setting Your Investment Goals

Key Takeaways

- Setting investment goals is highly personal and subjective.

- Your goal is intrinsic and derived from your unique life situation so Collective Shift goals may not align with your individual objectives.

- Consider whether you’re accumulating specific currencies (BTC) or aiming for ‘financial freedom’.

- Define your goals: Are they specific numbers or based on achieving a certain feeling?

- Complete the Crypto Strategy Document: Crypto Strategy Document

- Refer to Planning Your Crypto Goals for further guidance: Planning Your Crypto Goals

How to Set Effective Goals

Consider applying some of these golden rules of goal-setting:

- Setting realistic goals

- Being consistent

- Avoiding ‘guaranteed money’

- Diversifying

- Understanding the risks

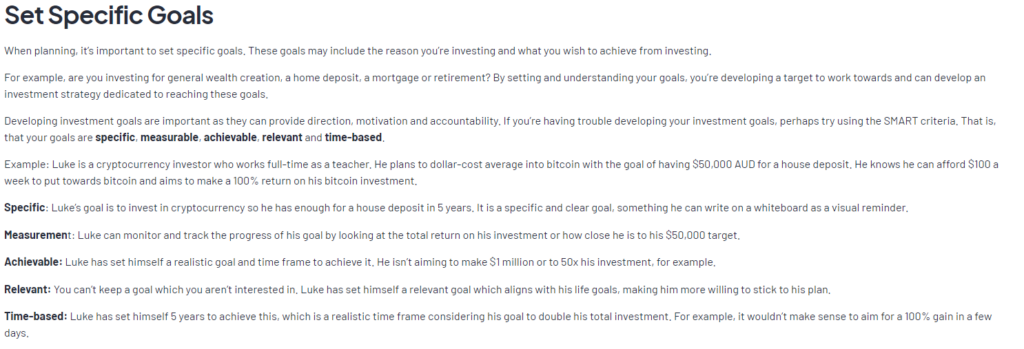

Applying the SMART goal-setting framework can also help.

Understanding the Risks

It’s critical to understand the risks in crypto when you’re setting goals. Understanding the risks better can help influence your goals and provide more clarity so you can avoid common mistakes.

Two great resources to help you understand the risks:

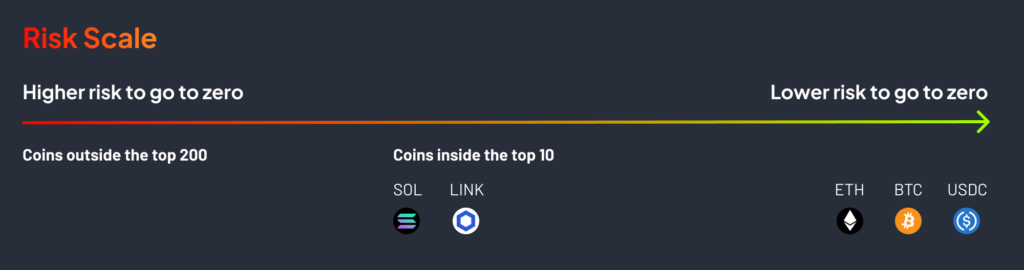

Anything outside Bitcoin is considerably riskier

It’s essential to be prepared to lose some or all of your initial investment if you allocate outside Bitcoin. This is because the further you go out of the top 10, 25, and 100+, the higher the risk your crypto could go to zero.

Even Bitcoin is not guaranteed to survive—at the end of the day, crypto and web3 are still in the early stages of their development—newer inventions or systems could outpace them.

Ultimately, It’s On You

This resource aims to help get the conversation started about your goals and targets. We are not financial advisors nor financial planners, so we cannot give you the ‘answers’.

Only you have this responsibility, but we can help you think about the right questions to ask, consider your timeframes and give you the information to make the most informed decisions possible!