This monthly report covers the state of Bitcoin and Ethereum and market-sensitive news before previewing the month ahead. We also share our short-term market outlook. (For coverage of altcoins, see our Monthly Altcoin Report.)

Key Takeaways

- The combined market cap of all cryptocurrencies decreased in May, the first monthly decline this year.

- Certain Bitcoin on-chain metrics are at levels unseen in years due to the continued strong demand for ordinals.

- Ethereum suffered finality issues and recovered relatively quickly. The total supply of ETH continues to decrease due to high gas fees.

- May’s only notable news was Hong Kong opening licensing for exchanges.

- The U.S. central bank’s rate decision (Jun. 14) is the known event most likely to affect markets in June.

Content

Market Overview

Analyst take: The market finally retraced after 4 straight months of growth, something we had been anticipating for a while. Price action is relatively muted across the board, typical of a bear market where most speculators have moved on and the amount of new money entering the asset class is minimal.

The combined market cap of all cryptocurrencies fell to $1.20T in May, the first monthly decline of 2023. For the month, BTC fell by 6.9% while ETH increased by 2.3%, its fifth straight monthly gain. Market volatility has eased significantly. As Checkmate covered in May, the longer this lasts, the more likely BTC will move swiftly up or down.

No categories or sectors notably outperformed the market in May. Among the month’s best-performing altcoins were AKT (+142%), LINA (+107%) and TOMO (+57%).

Bitcoin (BTC)

Analyst take: Bitcoin saw a considerable rise in several key metrics, all of which were caused by the continued strong demand for Ordinals inscriptions. Elsewhere, Tether Holdings announced it would continue buying BTC with as much as 15% of its excess reserves.

Price action was subdued for much of May. Near the end of the month, BTC’s 7-day price range actually fell to 3.4%, one of its tightest ranges in 3 years, according to Glassnode. The net BTC accumulation rate is the fastest since Oct. 2021, signalling growing net demand from long-term holders. (For the latest Bitcoin on-chain analysis, watch Checkmate’s video from May 28.)

Tether Becomes New Buyer, Will Keep Accumulating

Earlier in May, an attestation report for stablecoin issuer Tether Holdings revealed that, as of Mar. 31, it held $1.5 billion worth of BTC (≈52,673 BTC), equivalent to 1.8% of its total reserves.

One week later, the company announced it’d start “regularly” buying BTC with up to 15% of its net realised operating profits.

Two reasons why Tether Holdings will likely keep buying a relatively large amount of BTC for the foreseeable future:

- By issuing the largest stablecoin in circulation, Tether (USDT), it can deploy tens of billions into extremely liquid assets (e.g. U.S. Treasury Bills).

- Interest rates have soared in the past year, helping the company generate significant revenue and net profit. Rates are unlikely to plummet any time soon.

Record Monthly Transactions, Miner Revenue Surges

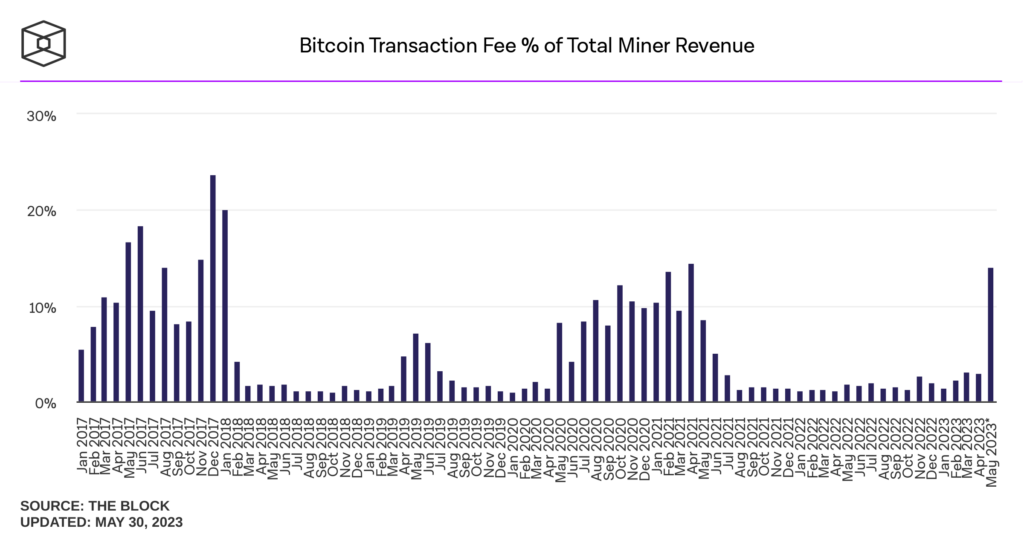

Demand to inscribe data into the Bitcoin blockchain remained extremely strong in May. Miners have benefitted considerably from this trend.

As per the below chart from The Block, in May, the share of miner revenue from transaction fees was 14%. This was nearly 400% higher than April (2.93%) and the highest percentage since April 2021. The 7-day moving average of transaction fees on Bitcoin also hit a 2-year high of $16.08 in May.

The insatiable demand for ordinals has also led to a surge in the number of transactions. In May, the Bitcoin network processed a monthly record of nearly 16 million transactions.

Ethereum (ETH)

Analyst take: Ethereum saw its highest-ever monthly supply reduction. Despite these positives, Ethereum experienced finality issues for the first time in a long while.

Finality Issues

The Ethereum network suffered issues in May due to a failure to finalise blocks with multiple clients, including Ethereum’s largest client Prysm. (For more details, read Offchain Labs’ post-mortem.)

A silver lining is the issue was fixed quickly, with no impact on the user, pointing to the strength of the network due to the diversity in infrastructure. It could pose potential issues if the cause repeats and becomes a more serious protocol-level issue.

ETH Burn Continues

The effects from the Merge show no signs of cooling. Post-Merge, ETH’s supply has fallen by 260K ETH. Roughly 55% of that (i.e. 146K ETH) was burnt in May alone due to increased on-chain activity and gas consumption, making May the largest net reduction month ever in the supply of ETH.

Staking Reward Increases

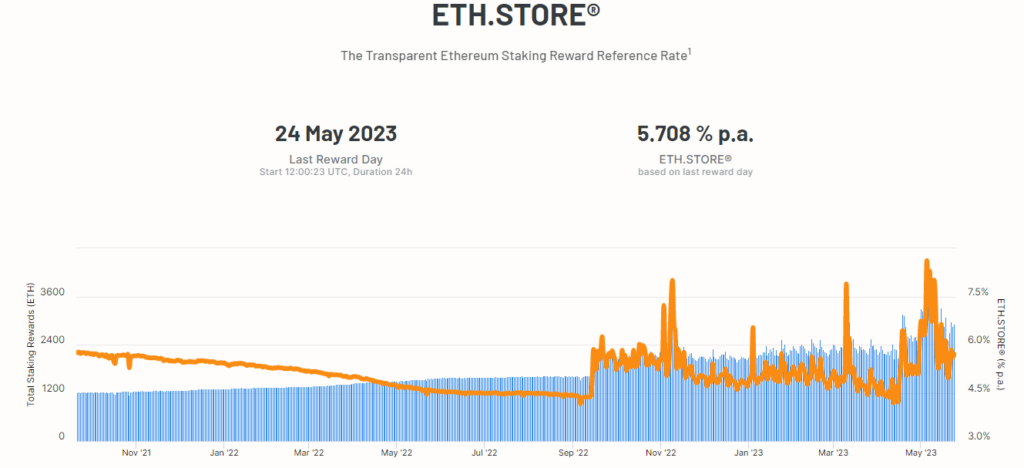

May was particularly pleasant for validators, who received more ETH rewards than in previous months. The effective ETH staking reference rate hit an ATH.

The annual staking reward hit 8.7% in May, the highest since April 2021. This has since retraced to ~6% but marks the potential for ETH to be an interest-bearing cryptocurrency. Causing these recent increases was elevated network activity, increasing MEV and value captured by validators.

Withdrawal Concerns Fade

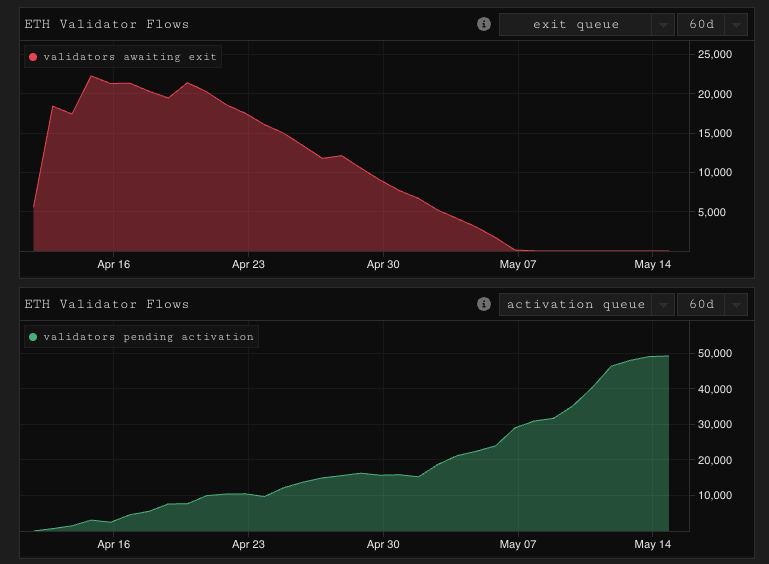

This high rate is unlikely to last because, all else being equal, the staking rate falls as the total amount of ETH staked increases.

Concerns about large withdrawals have been alleviated, as the queues for validators to exit trend to 0, while validators waiting to activate continue to soar—78,742 validators are currently waiting to be activated—a wait of more than a month. This is all encouraging and indicative of growing demand to help secure the Ethereum network.

May’s Market-Sensitive News

Analyst take: In a quiet news month, the main development was Hong Kong’s crypto-friendly move. While regulations again dominated the crypto news, nothing extremely significant happened.

Last month, Hong Kong’s Securities and Futures Commission (SFC) announced that, starting Jun. 1, it’d start accepting applications from exchanges wanting to offer certain cryptocurrencies to retail customers. Exchanges have a year-long grace period to secure the necessary license.

Hong Kong citizens will only be able to trade cryptocurrencies that are included in at least two “acceptable indices” issued by at least two “independent index providers,” according to the SFC. Aside from BTC and ETH, eligible cryptocurrencies include LTC, DOT, BCH, SOL, ADA, AVAX, MATIC and LINK.

Retail trading of cryptocurrencies has always been legal in Hong Kong. This development introduces a licensing regime that crypto exchanges must adhere to.

As for mainland China, it continues to ban its citizens from trading cryptocurrencies. However, it will likely monitor the effect of these latest developments in Hong Kong. Indeed, China—which banned crypto (again) in 2021—has been posturing as somewhat more crypto-friendly in recent times. (The below video interview by CoinDesk with InvestHK’s King Leung further details this development.)

June Preview: Central Bank Decision Hotly Anticipated

Below are potential market-sensitive events to be aware of in June.

U.S. central bank’s rate decision on Jun. 14. The market’s expectation of whether the Fed will adjust interest rates in June has fluctuated considerably in recent days, according to the widely followed CME FedWatch Tool. Earlier this week, a 25-basis-rate hike was 66.5% likely. Now, as of Jun. 2, no rate change is the most likely outcome (71.5%), according to the tool.

Confirmation of an adjustment to the U.S. debt ceiling. It’s not yet certain that the U.S. government will strike a deal about the U.S. debt ceiling. In the very unlikely scenario that a deal falls through, risk-on assets would undoubtedly slide in the short term.

Potential closure on important legal battles. The years-long Ripple Labs vs SEC case is inching closer to a judgement, the nature of which may influence the outcomes of future cases related to crypto. It’s also worth monitoring the status of DCG—which 12 months ago was among the world’s largest crypto companies—after it failed to pay Gemini $630M by the due date in late May.

Uncertainty over Binance remains. Binance avoided the regulatory headlines in April and May. Still, we want to reemphasise that the prospect of more civil or criminal allegations against Binance may be weighing on crypto prices. If the CFTC’s recent allegations are true, criminal charges could be brought against Binance by agencies such as the Department of Justice. (This also bears repeating: We strongly advise against keeping your cryptocurrencies on exchanges. These cryptocurrencies aren’t truly yours until you send them to an address you control.)