These monthly reports—available to Pro members only—cover notable altcoins from the month prior. In these reports, we share our opinion on these altcoins’ progress and outlook. (For the purpose of this report, altcoins are defined as cryptocurrencies that are not BTC or ETH.)

Key Takeaways

- Chainlink integrates with more apps and protocols weekly, entrenching its status as the dominant oracle network. LINK’s average tokenomics should improve as Chainlink staking progresses.

- Arbitrum has achieved what few have, bucking the post-airdrop dump that has plagued countless projects. Multiple potential catalysts before year-end.

- Aave has suffered a harsh 18-month DeFi bear market. And yet, the protocol continues improving and becoming more accessible.

- dYdX is nearing its long-awaited V4 mainnet launch, which will take the form of a Cosmos appchain that, among other things, should enhance DYDX’s tokenomics.

- Ethereum Name Service (ENS) remains the go-to blockchain naming protocol, is earning relatively healthy revenue, and is demolishing its competitors. Worth tracking.

Contents

Chainlink (LINK)

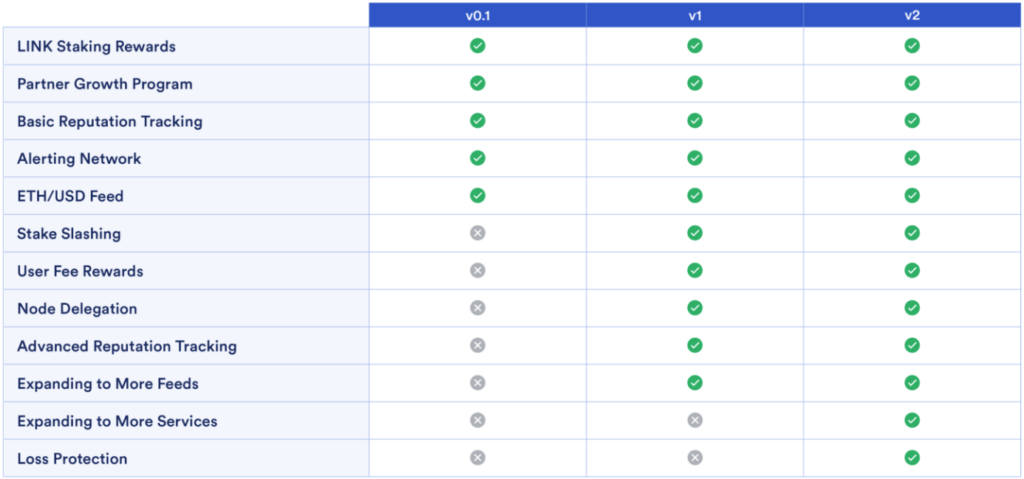

Analyst take: Chainlink remains the dominant decentralised oracle provider. The team is developing a fully featured LINK staking mechanism, having released a beta in late 2022. As has been the case for years, LINK’s tokenomics are hazy but look set to improve as Chainlink’s staking roadmap progresses.

In May alone, there were roughly 37 integrations of Chainlink services across the following 7 blockchains: Ethereum, BNB Chain, Avalanche, Arbitrum, Optimism, Polygon and Moonbeam. The network is nearing 1,000 integrations comprising more than 8.6 billion on-chain data points, up 680% from 1.1 billion in January 2022.

May also saw the beta release of Chainlink Functions, a developer platform for connecting smart contracts to any Web2 API and running custom computations using Chainlink’s network. The platform was deployed on Ethereum’s ‘Sepolia’ and Polygon’s ‘Mumbai’ testnets. (More product updates from Chainlink.)

Will Staking Ease LINK Sell Pressure?

The activation of staking withdrawals is a short-term area of focus for Chainlink. Staking v0.2 is expected to go live in Q4.

Like most cryptocurrencies, LINK has always battled a murky value proposition. Our review of Chainlink in Jul. 2022 questioned whether Chainlink 2.0 staking would enhance value accrual by reducing sell-side pressure. To this end, there was some early promise last year, with the capped launch of staking hitting the community-instilled limit of 24.27 million LINK (≈$170M) within 2 days.

However, short-term sell pressure may rise when participants in the capped launch unlock their staked LINK and rewards withdrawals are enabled. The total amount staked and earning rewards is currently capped due to the community limit being hit, with annual staking rewards locked at roughly 5%. Monitoring the extent to which node operators and community stakers withdraw LINK will be important.

Chainlink Still Dominates, But Challengers Exist

While Chainlink is the dominant oracle network, it faces competition from relatively new oracle services such as Pyth Network that focus on “first-party” data sources which reward exchanges or market makers for sharing price data. Pyth already has more than 80 first-party data providers.

Another potential threat to Chainlink is DeFi platforms not using external price oracles, such as Blur’s Blend. While few examples of oracle-free protocols are live on mainnet, they may threaten Chainlink if they gain traction at scale. (An incredibly small chance of happening, but at least worth monitoring.)

Arbitrum (ARB)

Analyst take: Since launching ARB, activity on Arbitrum has remained robust, a pleasant change from the ‘post-airdrop’ challenges that have typically plagued new protocols. The second half of 2023 will be particularly eventful for Arbitrum, with the highlights being the Stylus and EIP-4844 upgrades and an Odyssey 2.0 campaign.

Strong Fundamentals

Since the ARB token launched in late March, Arbitrum has not suffered from the post-airdrop dump that has plagued so many protocols and apps in the past. This alone is reason enough to monitor Arbitrum during the bear market.

The relative strength of Arbitrum in recent months is reflected in the below metrics sourced from DefiLlama and Dune.

- TVL on Arbitrum surpassed an all-time high of $2.5B in early May.

- Arbitrum is responsible for 67.5% of TVL on all L2s combined.

- In the past 7 and 30 days, Arbitrum Bridge has been the third- and second-most used bridge, respectively.

- Year to date, Arbitrum has generated more profit than any other L2. However, in May, it generated the second-most (i.e. 505.1 ETH vs Optimism’s 532.7 ETH).

Also, in terms of stablecoin supply, Arbitrum has the most of any L2 with 1.83 billion, enough to top some of the leading alternative layer-one blockchains such as Solana (1.54 billion) and Avalanche (1.42 billion), according to Artemis.

This lead looks set to deepen after the recent announcement that USD Coin (USDC) will launch natively on Arbitrum on June 8. Post-launch, USDC will be able to move natively to and from Ethereum—and other supported chains—in minutes and, withdrawals will no longer be delayed.

Eventful Second Half of 2023 Awaits

Looking ahead, Offchain Labs plans to release Stylus by year-end. Stylus is an upgrade to Arbitrum’s current tech stack, Nitro, and can be described as a new programming environment that will allow users to deploy contracts written in popular programming languages such as Rust, C and C++. (More on Stylus.)

A community-driven Odyssey 2.0 campaign is being planned. Importantly, unlike last year’s Odyssey campaign, this is organised by Arbitrum community members and isn’t affiliated with the Arbitrum Foundation. Provided Odyssey 2.0 can generate substantial interest—which should be achievable in this quiet market—it may drive more activity on Arbitrum.

Arbitrum will also benefit considerably from the release of EIP-4844, an Ethereum upgrade expected by year-end that will slash the cost of posting data for L2s by more than 99%.

Aave (AAVE)

Analyst take: During the bear market, Aave DAO has kept developing the protocol, listing more assets, and deploying the Aave protocol on other blockchains. Being a foundational part of DeFi—arguably the worst-performing sector in the past 18 months—has resulted in Aave’s key metrics and AAVE’s price plummeting. Still worth monitoring.

As a liquidity protocol at the core of DeFi, it’s unsurprising to learn that Aave has been struggling. Key metrics such as TVL, protocol reveue and amount borrowed have plummeted, as has AAVE’s price, which is 90% below its all-time high of $662 from May 2021.

During this quieter period, Aave DAO has kept developing the protocol, listing more assets, and expanding to other blockchains. Today, Aave is on 6 chains—Ethereum, Avalanche, Arbitrum One, Optimism, Polygon and Metis—and has 11 markets, in which $8.2 billion worth of tokens are locked.

Most of these markets are on Aave V3, an upgraded version of the protocol deployed in Mar. 2022 on Avalanche, Arbitrum One, Optimism and Polygon. It eventually launched on Ethereum in late January.

More Chains, More Integrations, More Assets

For Aave DAO, making the protocol as accessible as possible–while not jeopardising security—has been a focus so far this year. In recent weeks, Aave V3 went live on Avalanche’s Spruce subnet (Apr. 14), Scroll’s alpha testnet (May 4) and Metis (May 9).

Of Aave’s recent app and protocol integrations, the most notable was Balancer’s launching of Boosted Aave Pools that are built on Aave V3. These pools—which Balancer has made available on Ethereum, Polygon and Arbitrum—accumulate swap fees and, uniquely, generate yield for LPs by lending excess liquidity to other yield-generating DeFi protocols.

Liquity USD (LUSD) and Rocket Pool ETH (rETH) are among the assets recently approved by Aave DAO as collateral types and listed on Aave markets.

Preparing to Launch the GHO Stablecoin

Aside from V3, Aave’s largest project in the past year has been the GHO stablecoin, which is hoped to become an integral part of Aave’s liquidity markets. First proposed by Aave Companies last June, GHO is another attempt at a decentralised and collateral-backed stablecoin pegged to the U.S. dollar. It launched on testnet in early February and should arrive on mainnet by year-end.

dYdX (DYDX)

Analyst take: The established decentralised derivatives exchange is getting closer to launching V4 as an application-specific blockchain (i.e. appchain) on Cosmos. The milestone should bolster the utility of the DYDX token.

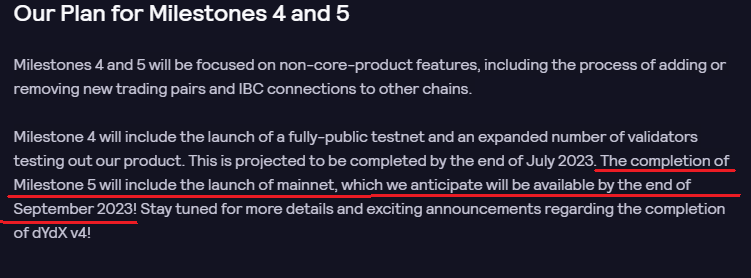

Not Long Until dYdX Chain Launches

After rigorous testing, the V4 release of dYdX is now just a few months away. The product is entering the fourth and fifth of stages of the 5-stage rollout. A public testnet is expected by July, before the mainnet launch “by the end of September,” according to a recent blog post.

The launch of dYdX V4 promises to bolster the DYDX token’s utility. After having limited utility for several years, the token will soon be used to incentivise volume and help secure the dYdX chain. Running on its own appchain should improve, among other things, the customisability of dYdX, making it easier to improve user experience.

Derivatives to Follow the Decentralisation Trend In Spot Markets?

dYdX may also benefit if DEX-to-CEX spot volumes continue increasing from their current all-time highs of more than 20%. While dYdX does not offer spot markets, the ongoing adoption of relatively decentralised markets is encouraging.

Hopefully, this ratio can start improving for derivatives markets. According to The Block, decentralised futures accounted for just 1.3% of futures volume in May. It may be some time before that improvement comes, though, with Coinbase set to launch its derivatives exchange on June 5.

Ethereum Name Service (ENS)

Analyst take: ENS is the go-to decentralised naming protocol, benefitting from a sizeable treasury and competitive moat. The protocol’s treasury generates a healthy amount of revenue, compared to other crypto protocols. High gas costs on Ethereum resulted in May being quieter for ENS.

May Highlights: Major App Upgrade, More Integrations

Early in May, the ENS Foundation launched V3 of the ENS app, significantly improving its performance and usability. The app is the most common way people manage their ENS names and interact with the ENS protocol. (Similar to how Uniswap Labs developed its widely used app (app.uniswap.org) to interface with the Uniswap protocol.)

Also in May, the protocol—now 6 years old—integrated with more projects, such as those listed below. (More integrations increase awareness of ENS and can drive more registrations and, therefore, protocol revenue.)

- Worldcoin’s World App and Uniswap Wallet launched with support for ENS names.

- Uniswap DAO voted to create a subdomain to track official v3 deployments.

- PancakeSwap integrated ENS to improve user experience.

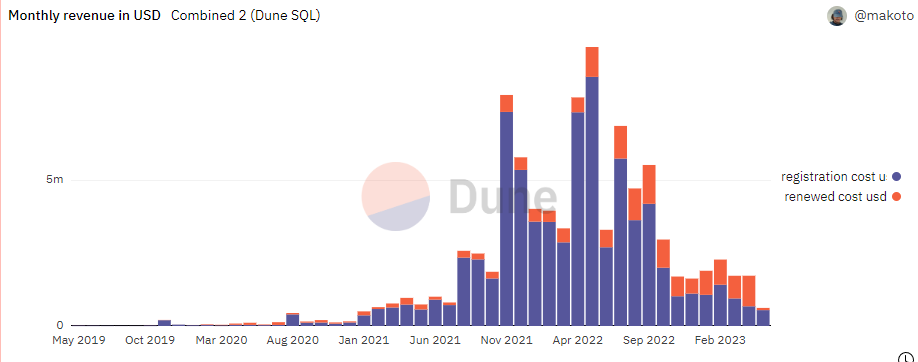

Revenue Slows as Ethereum Gas Soars

In May, ENS generated its lowest revenue since mid-2021, likely due to gas costs on Ethereum being at or around 12-month highs for most of the month. (Higher gas means people are less likely to mint or renew ENS names.)

Despite the quiet month, ENS remains one of the most consistent revenue-generating DAOs and is miles ahead of competitors. Its closest rival, Unstoppable Domains, has a similar number of domain registrations as ENS. However, it earns no revenue from registration and renewals.

Encouragingly, from a user accessibility standpoint, solutions are being developed on layer-2 networks to slash the cost of managing ENS names. For example, OptiNames will soon enable setting up ENS records on Optimism.

The Coinbase Conundrum

Coinbase is arguably ENS’ most fruitful integration. As of early April, Coinbase Wallet users had created over 2 million ENS subdomains since the feature launched in September. However, it’s unknown how this integration will be affected once Coinbase launches its layer-2 solution, Base, which will have its own gas-free naming service.

Upcoming Milestones & Conferences

| Project | Event | Expected Date |

|---|---|---|

| Optimism (OP) | ‘Bedrock’ release | Jun. 6 |

| Ethereum (ETH) | EthCC 6 | Jul. 17–20 |

| Litecoin (LTC) | Halving | Aug. 2 |

| Chainlink (LINK) | SmartCon 2023 | Oct. 2–3 |

| Solana (SOL) | Breakpoint | Oct. 30–Nov. 3 |

Want more altcoin content? See April’s report covering SOL, UNI, RPL, MKR and MPL.