Solana’s picked itself off the canvas following the fallout of the FTX collapse. With many considering it “dead” and now its recent resurgence, I share 5 reasons why Solana has staying power.

Key Takeaways

- Solana’s rebounded after a horror 2022, rising +120% since the “bottom.”

- 5 reasons SOL could have staying power include:

- It still represents a hedge against Ethereum or “layered” scaling.

- Strong infrastructure development.

- Network and community hardening.

- Increasing adoption and projects building on Solana.

- New product development.

Why Solana Has Staying Power

Solana remains one of the market’s most divisive cryptocurrencies. Many either love it or hate it.

We saw many calling Solana “dead” due to the fallout of the FTX collapse. It has rebounded from lows of $9 to above $20 (+120%) to re-enter the top 10.

After a massive sell-off and partial recovery, the natural question is, “will this last?”

For me, that’s a firm yes, because of 5 main reasons shared below.

1. Still represents a hedge against Ethereum or “layered” scaling

The current trend is “modular” blockchains that specialise in different areas while outsourcing other parts of the work. Solana is doing the opposite and pursuing a “monolithic” approach to building all in one layer.

- Solana’s approach to scaling can be seen as more straightforward than Ethereum—relying on more traditional advances in hardware to continue increasing capacity and transactions.

- Ethereum relies on more complicated software challenges to scale.

It’s unclear which approach is “best”, so Solana remains attractive due to its different approach focusing on simplicity which could have benefits such as better composability or a better user experience (no need to move around Ethereum chains consistently).

2. Infrastructure development

Development is ramping up with Firedancer, a second validator client for Solana (validator clients simply maintain the integrity and security of a blockchain).

This helps keep the Solana ecosystem resilient.

- It’s a positive signal outside teams are working on core Solana infrastructure, showing a real long-term commitment to the ecosystem.

There’s strong development in the land of NFTs. Solana’s NFT compression platform launched, enabling bulk minting that slashes costs by magnitudes of scale.

- Minting 1,000,000 NFTs through this mechanism would cost roughly $113.

The estimated cost of minting various amounts of NFTs across different blockchains (Source)

The estimated cost of minting various amounts of NFTs across different blockchains (Source)

Core development is also ongoing with the network. Transactions per second (TPS) shows positive medium-term trends ticking up.

- In the first year of the network, TPS stabilised at ~1.5K the network, steadily climbing to hit a record 5.5K.

- With more significant development, we should expect Solana to continue increasing TPS as it scales.

3. Network and community hardening

The FTX collapse and subsequent SOL sell-off was perhaps the darkest day in Solana’s short history. Many compare this to Ethereum’s “The DAO” moment, which almost caused the end of Ethereum as we know it.

- “The DAO” was a smart contract that got exploited, causing Ethereum developers to return the funds via a network upgrade (the old Ethereum was renamed Ethereum Classic).

The way the community banded together is a positive sign and was on full display with the most recent hackathon, which was the largest ever, with 10,000 participants and 813 final projects.

A big focus for the rest of the year is to “harden the network” to ensure no more downtime.

- Solana Labs have shown they can improve the network with recent fixes and a new fee market implemented last year that’s helped tackle network spam and useability.

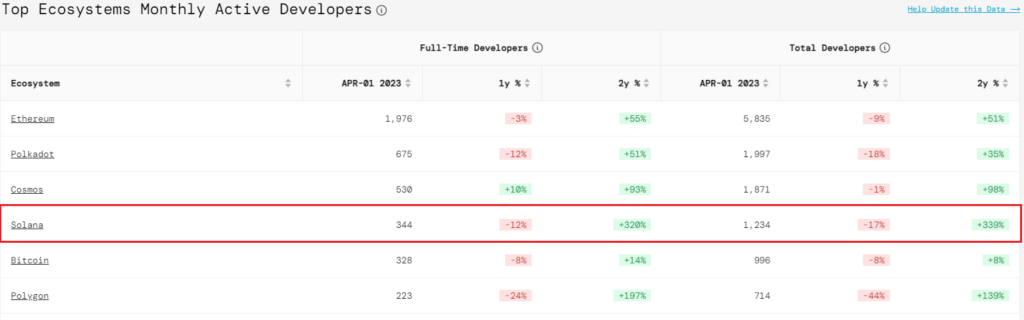

Solana also has a robust developer ecosystem, with the 4th highest total developers.

Monthly Active Developers (Source: Developer Report)

Monthly Active Developers (Source: Developer Report)

4. Increasing adoption and projects building on Solana

I’m reaffirmed Solana can remain in the top 10 because of the increasing amount of projects migrating.

- Helium, a decentralised wireless network, migrated over 350K devices and turned them into NFTs.

- Ethereum app Render will also migrate to Solana, citing its lower fees and NFT compression.

Solana also saw a new NFT community arise, “Mad Lads”, championing a new format xNFTs signalling staying power within the community.

5. New product development

Finally, we’ve seen some innovation in the mobile space with the launch of Solana Labs’ Saga smartphone this week. It could impact how crypto-specific mobile apps are built and used.

What Stops Solana From Remaining Top 10?

Network downtime is the biggest threat.

- If more downtime occurs, it could encourage DeFi applications to move over to newer L1s because downtime has massive implications for DeFi platforms and traders that can cause significant losses.

The rise of new “performant” blockchains is causing a rise in competition from newer networks that are looking to eat Solana’s lunch.

- Let’s not forget the 50+ other L1s in the market.

New blockchains, Aptos (APT) and Sui (SUI), have launched in the last 6 months and positioned themselves similarly to Solana.

- A better user experience.

- Similar fee structure (when fees increase because of one app, other apps are not affected).

- An “all-in-one” approach versus Ethereum’s modular model.

A would-be decrease in core developers would be concerning for Solana, particularly if those developers leave for Aptos and Sui. Track developer metrics and trends in the next 6 months.

In a following post, I’ll explore whether newer blockchains Aptos and Sui are coming to eat Solana’s lunch or whether they can co-exist.

For more on Solana’s bull and bear case, see our SOL Asset Page!