ETH holders can earn rewards by staking their ETH. One of several ways to stake ETH is with liquid-staking protocols. This guide explains liquid staking on Ethereum and covers the 3 most popular liquid-staking protocols that ETH holders use.

Key Takeaways

- Thanks to liquid-staking protocols (LSPs), you don’t need to own 32 ETH to stake and earn rewards.

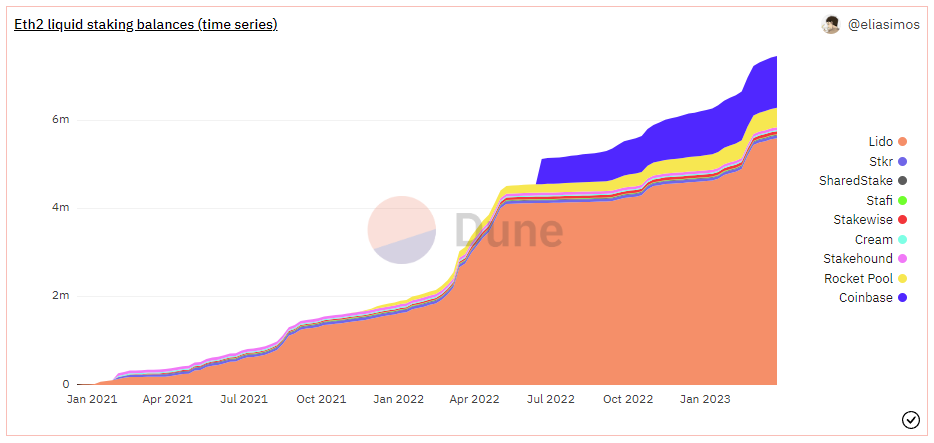

- Lido is by far the most popular LSP, and the next are Coinbase and Rocket Pool.

- Relative to holding ETH, liquid staking is riskier but generates a higher return.

Contents

- What Is Liquid Staking?

- Purpose of ETH Liquid Staking

- ETH Liquid-Staking Protocols: Lido, Coinbase & Rocket Pool

- Comparing Lido, Coinbase & Rocket Pool

- Risks of Liquid Staking

- Recap

What Is Liquid Staking?

Liquid staking refers to the act of depositing cryptocurrencies (e.g. ETH) into a protocol and receiving a tokenised claim, or derivative, on the deposit (e.g. stETH, cbETH, rETH). At any time, these tokens can be traded back to the protocol for the deposit plus staking rewards earned and, usually, minus a fee.

Before proceeding, let’s define some terms below in the context of ETH liquid staking.

- Ethereum staking: Staking your ETH to help secure the Ethereum blockchain.

- Liquid staking protocol (LSP): The smart contracts that ETH is deposited to (e.g. Lido, Coinbase, Rocket Pool).

- Liquid staking derivative (LSD): The token received after depositing ETH into an LSP (e.g. stETH, cbETH, rETH). (Some entities call these liquid staking tokens (LSTs).)

Purpose of ETH Liquid Staking

Liquid staking is becoming an increasingly popular option for ETH holders due to the below reasons.

You don’t need 32 ETH to participate. Most LSPs accept deposits of as little as 0.01 ETH, making them accessible to a much larger pool of ETH holders than the 32 ETH required to run a validator as a solo staker.

Ability to earn additional rewards. The staking deposit tokens that LSPs send to depositors are ERC-20 tokens (i.e. the most common Ethereum token standard), allowing holders to use them in all sorts of ways. One common use of LSDs is in DeFi, where holders deposit them into liquidity pools and earn rewards paid out in other tokens while taking on additional risk.

More user-friendly and passive. Compared to other methods of ETH staking, liquid staking is among the most user-friendly. Also, LSD holders aren’t required to spend additional time and money associated with operating a validator.

ETH Liquid-Staking Protocols: Lido, Coinbase & Rocket Pool

Several LSPs are available for ETH holders wanting to stake their ETH. Below are the 3 most widely used ones to date; Lido, Coinbase and Rocket Pool. They account for the vast majority of Ethereum’s LSD market. Each has unique trade-offs to consider before staking.

Lido: The Largest Liquid-Staking Protocol

Lido provides a relatively decentralised platform for staking ETH and helping secure Ethereum. The protocol is managed by Lido DAO, the members of which are holders of the LDO governance token. These holders can vote on various parameters, such as fees and node operators.

The ticker of the LSD you get after sending ETH to Lido is stETH. Underscoring Lido’s dominance, at the time of writing, only 7 cryptocurrencies have a larger market cap than stETH.

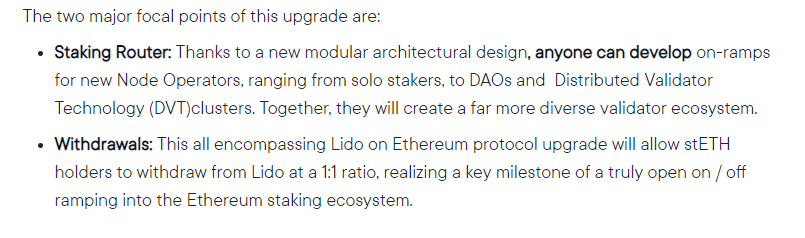

Lido V2 should launch around the middle of 2023. See below for significant protocol changes that will come with V2.

Lido’s dominance is largely attributable to the fact it was the first LSP on the market. With a headstart over competitors, Lido is deeply integrated with many DeFi protocols and layer-2 solutions (e.g. Arbitrum, Optimism). Its relatively long existence also likely helps it in terms of trust and reputation. (More on liquid staking with Lido.)

Coinbase: Best Exchange for Liquid Staking

Coinbase is a U.S.-headquartered crypto exchange founded in 2012 and is the most popular centralised venue for liquid staking. Compared to its relatively decentralised counterparts, liquid staking with Coinbase carries different benefits (e.g. customer support) and risks (e.g. regulatory). The ticker of the LSD you get after sending ETH to Coinbase is cbETH.

ETH holders wanting to stake with Coinbase must meet the eligibility requirements listed below.

- Hold ETH in a Coinbase account.

- Live in a jurisdiction eligible for ETH staking.

- Complete identity verification.

- Complete ID document verification.

- Read and understand the terms and conditions associated with ETH staking.

Notably, Australia is exempt from the regions that can participate in liquid staking with Coinbase. It’s also worth noting that business accounts are ineligible.

Coinbase’s cbETH was the best and easiest centralised solution for ETH staking. Coinbase itself is a reputable and compliant U.S. company, which inherently carries an element of risk.

The SEC may pursue Coinbase for offering unregulated securities as holding cbETH potentially gives users the ‘expectation of profit’. This term refers to the SEC’s framework for investment contracts regarding digital assets.

(More on liquid staking with Coinbase.)

Rocket Pool: The Most Decentralised & Grassroots

Rocket Pool is a staking pool for Ethereum that upholds values such as community ownership, decentralisation and trustlessness. Its aim is to reflect the fundamental principles of Ethereum and DeFi, which involve non-custodial self-sovereignty. The ticker of the LSD you get after sending ETH to Rocket Pool is rETH.

With Rocket Pool, you can deposit any amount of ETH or the equivalent of 10.4 ETH to set up a so-called minipool. (More on liquid staking with Rocket Pool.)

Other Liquid-Staking Solutions

The above 3 solutions account for nearly all liquid-staked ETH. We have omitted the other solutions due to their relatively light adoption. Among these other solutions are Frax and StakeWise.

Comparing Lido, Coinbase & Rocket Pool

| Lido | Coinbase | Rocket Pool | |

| LSD (Type) | stETH (rebasing) | cbETH (non-rebasing) | rETH (non-rebasing) |

| Native Token | LDO | – | RPL |

| Annual Return (Apr. 2023) | 4.5% | 3.8% | 7.1% |

| Distribution of Staking Rewards | Daily | Upon redemption | Upon redemption |

| Centralisation & Regulatory Risk | Medium | Highest | Lowest |

| Liquidity & Volume | Medium | Highest | Lowest |

| Fees/Commissions | 10% | 25% | 15% |

| DeFi Opportunities | Highest | Lowest | Medium |

| User-Friendliness | Medium | Highest | Lowest |

| Accessibility | Medium | Lowest | Highest |

Commentary:

Lido demonstrates superiority with a moderate annual return, lower fees and deep DeFi support.

Coinbase provides the least rewards and goes against the ethos of decentralisation. However, it has the deepest liquidity and the offering of customer support can be particularly appealing to some.

Rocket Pool has the highest annual return and is the most decentralised of the major LSPs.

Risks of Liquid Staking

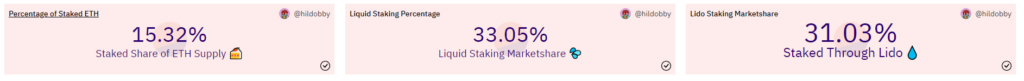

Cartelisation

Context is required to understand this risk. Cartelisation refers to key stakeholders in a given market colluding for their own benefit. If an LSP were to exceed critical consensus thresholds (e.g. 1/3, 1/2, 2/3), the staking derivative can earn excessive profits compared to non-pooled funds due to coordinated maximal extractable value (MEV), block-timing manipulation and/or censorship. Put another way, the cartelisation of block space may occur.

In summary, some people may gang up on others because they control a lot of the market. It being good or bad is subjective and is based on your position in the market. Further, future ETH stakers become disheartened by staking elsewhere due to outsized cartel rewards, this self-reinforcing the cartel’s hold on staking when users return.

For context, the below snapshot in April 2023 shows Lido having a 31% of the liquid-staking market.

Smart-contract risk

LSPs are built by developers who are relatively unknown and unproven, particularly the newer ones with small ETH deposits. Smart-contract code exploits and hacks frequently occur, regardless of how many times the code is audited.

Regulatory risk

The SEC has announced an impending lawsuit against Coinbase for staking. As previously discussed, regulation is a strong headwind cryptocurrency will have to navigate. There are different approaches to regulation, with some countries taking a more hands-off approach (emerging economies) while others are more strict (entrenched economies).

Systemic risks

The more intertwined and complex the ecosystem, the harder the dominoes can fall. Nothing beats holding the original asset. As you use or hold a derivative of a product, it is prone to certain instabilities.

Depegging risk

Your LSD is traded on the open market, and coordinated efforts could depeg the derivative (e.g. stETH) from the underling (e.g. ETH). This is an extremely small risk, but a risk nonetheless.

Liquidity risk

During high price volatility, the liquidity of certain LSDs may suffer, leading to losses when attempting to trade into the underlying. Further, when using the LSD in lending markets, you are taking on some liquidation risk.

Recap

Liquid staking on Ethereum is a common way to stake ETH. Three LSDs have emerged as the majority of participants. One of these, Coinbase, is a centralised and regulated company that’s headquartered in the increasingly anti-crypto U.S. Rocket Pool is an emerging option while Lido is the most common. Lido has cemented a market-leading position with increased rewards and provides a fair user experience. If partaking in LSDs, one must be aware of the risks associated with their implementation. Though with risk also comes reward, one no longer needs to have 32 ETH to help secure Ethereum.

For more related resources, please visit Guide to Staking ETH on Ethereum and Proof of Work vs Proof of Stake.

Please note all statistics and details in this guide are accurate as of Apr. 16, 2023, and are likely to have changed by the time you are reading this.