As you likely already know, every cryptocurrency is native to a specific blockchain. For example, bitcoin (BTC) and ether (ETH) are native to the Bitcoin and Ethereum blockchains, respectively. BTC can only be sent between Bitcoin addresses. Similarly, ETH can only be sent between Ethereum addresses.

In a roundabout way, it’s possible to use a particular cryptocurrency on a non-native blockchain. This is where tokenisation comes in. Via the process of tokenisation, cryptocurrencies can effectively become usable on non-native blockchains.

One well-known example is tokenised BTC on Ethereum. These are Ethereum-compatible tokens designed to be pegged 1:1 to the price of BTC. These tokens are created—or ‘minted’—in a number of different ways. Ultimately, they all involve BTC being sent to an address.

Demand for tokenising BTC on Ethereum grew significantly in 2020. This was driven primarily by BTC holders who wanted to participate in the Ethereum-based DeFi ecosystem. For example, BTC holders may have tokenised their BTC and deposited it into a DeFi lending protocol to generate yield.

Ways to Tokenise BTC on Ethereum

There are various solutions that BTC holders use to tokenise and un-tokenise their BTC on Ethereum. The extent to which these solutions are decentralised is arguably their biggest differentiating factor.

With the more centralised solutions, an entity or small group of entities custody all deposited BTC and mint Ethereum-based tokenised BTC on a 1:1 basis. As for the more decentralised solutions, smart contracts are written in such a way that the tokenisation process can be achieved without the involvement of a central party.

Tokenising your BTC involves taking on additional risk. Learn more about understanding and managing risk in crypto.

Wrapped Bitcoin (WBTC)

WBTC is an ERC-20 token backed 1:1 by BTC. It was the first tokenised BTC solution to gain significant traction. It was created as a collaborative project between BitGo, Ren, Dharma, Kyber, Compound, MakerDAO and Set Protocol. These days, it is governed by a DAO.

Anyone who wishes to mint WBTC must pass strict KYC checks. Multi-sig cold storage wallets are used to secure the BTC that is backing WBTC.

Huobi BTC (HBTC)

HBTC is an ERC-20 token backed 1:1 by BTC. The sole issuer of HBTC is crypto exchange operator Huobi Global Limited. It can be redeemed for BTC 1:1 at any time.

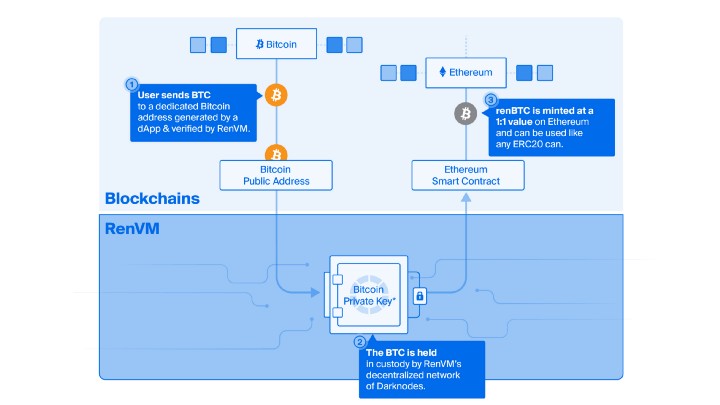

renBTC

renBTC is an ERC-20 token backed 1:1 by BTC locked in the RenVM decentralised custodian. It can be minted with BTC via the RenBridge and is redeemable at any time for BTC on a 1:1 basis.

tBTC

tBTC is a trustlessly BTC-backed ERC-20 token. Each tBTC is matched by at least 1 BTC held in reserve. Deposited BTC is safeguarded by groups of so-called ‘signers’ selected by a random beacon to minimise counterparty risk. Signers are economically incentivised to perform functions that facilitate the depositing and redeeming of BTC.