Crypto gaming has been positioned as a new frontier to onboard the next wave of users. Part 1 of this two-part series explored how crypto is making inroads into this narrative and why it matters. Part 2 covers how it impacts you and the ways to gain exposure to the gaming sector.

Key Takeaways

- Before jumping in, remember:

- 64% of games are yet to be released—stay calm and understand the next big crypto game to “make it” is probably not even built yet.

- 99.9% of people will not become inherently wealthy by playing a crypto game

- It’s also hard to know who will “win” or how value is captured—important to discuss alternative ways to gain exposure.

- 8 ways to gain exposure:

- Blockchains themselves offer indirect exposure if games are significant users of block space.

- Indexes can save time.

- Gaming guild tokens—but beware, many guilds, notably Yield Guild Games, look in trouble. The ability to generate revenue remains uncertain.

- Native gaming tokens, especially those that share in-game revenues directly with holders.

- The possible emergence of more decentralised gaming studios.

- Land may not be the way, especially if it has no inherent in-game utility.

- Gaming platforms

- NFTs themselves could prove to generate more value than tokens without meaningful utility.

Contents

A Focus On Exposure

Part 1 looked into the state of gaming today and provides an overview of what the gaming sector is and why it matters. It provides a much-needed background and context.

Part 2 jumps into how this impacts you by providing more tangible insights into how to get exposure to the sector.

Before I jump in, I encourage all members to let me know in the comments any I missed and/or which method you believe is the best bet.

2 Things To Understand Before Jumping In

Most Games Are Yet To Be Released

It takes a long time to deliver a game, especially a AAA game. The lifecycle can range from 3-5 years for smaller to medium-sized games, beyond 5+ for any AAA title. According to playtoearn.net. 64% of crypto games have yet to be publicly released.

🔶Key Takeaway 🔶

Considering most crypto games only got funded throughout 2021, there could still be a while to go before we see crypto games with the sophistication to match web2. The best games are yet to appear, and web2 gaming studios continue to test the blockchain waters.

Setting Expectations: Hard To Know Which Games Will Win

It’s challenging to know which games will be the break stars of the crypto world. The winners must have a game that’s just as good as any traditional web2 game; without that, the game will struggle for long-term survival.

🔶Key Takeaway 🔶

It’s essential to set your expectations. 99.9% of participants won’t become inherently wealthy by playing a crypto game. It’s hard to know who will “win” or where value accrues, a key reason I explore several alternative ways to gain exposure.

8 Ways To Gain Exposure

I’ve outlined 8 possible methods to gain exposure to the “crypto gaming” narrative.

I’ve graded these in terms of (i) how much time they take to manage & (ii) the Level of knowledge to be effective

#1 Blockchains Themselves

Time to manage: Easy | Level of knowledge Medium

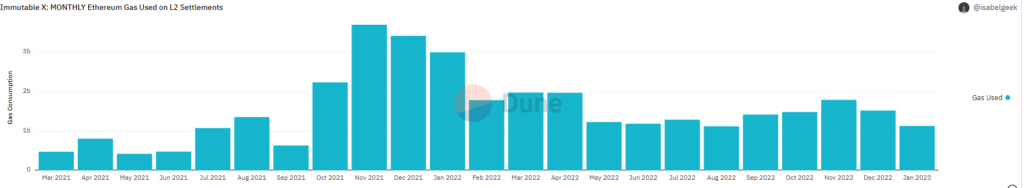

Blockchains like Ethereum, Solana or Polygon are attracting game developers, and the rise of on-chain or off-chain games could provide significant demand for underlying blockspace. Blockspace is simply the demand to secure data on a blockchain.

It could be if gaming takes off, it’s a signal of underlying demand for these blockchains.

Given it’s difficult to “pick” which games will win, a viable option could be betting on the blockchain attracting games, value and users.

Popular ecosystems include Polygon, BNB Chain, Ethereum, Immutable X, Solana, Wax and Ronin Chain.

🔶Key Takeaway 🔶

If you believe crypto gaming will be a big driver of adoption, holding the underlying network token used to transact or store these NFTs, assets or game logic might be a viable way to gain indirect exposure.

Source: Immutable X: MONTHLY Ethereum Gas Used on L2 Settlements

Source: Immutable X: MONTHLY Ethereum Gas Used on L2 Settlements

#2 Indexes To Save Time

Time to manage: Easy | Level of knowledge Low

There aren’t many gaming indexs’ out there, but the most common is the Metaverse Index: Which includes gaming tokens such as Illuvium, Axie Infinity, Yield Guild Games and Enjin while providing other game-like tokens for popular “metaverse” platforms.

There’s also the MetaPortal Gaming Index (GAME), which includes a handful of gaming tokens. However, it is unclear whether MetaPortal is still active, and these carry risks, such as the ability to trade into any token. It’s important to trust the manager of the set when using Token Sets.

🔶Key Takeaway 🔶

Crypto Indexes can easily gain exposure to a particular trend, with some gaming or metaverse indexes available. A low-effort way to gain exposure.

#3 Crypto Gaming Guilds

Time to manage: Medium | Level of knowledge: High

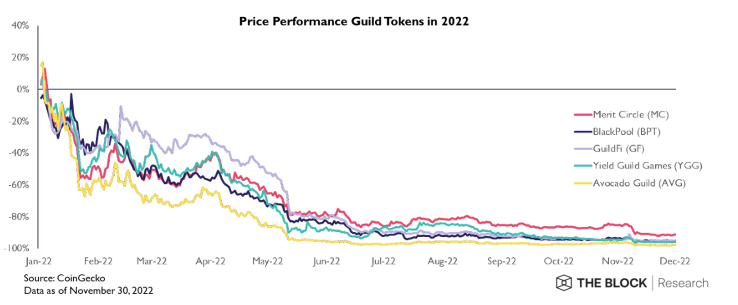

I previously created a post on the long-term potential for gaming guilds to gain exposure to the crypto-gaming sector. Due to the downturn, a few have pivoted their revenue models, and all have plummeted 85-95%. With token valuation down, it could be an opportunity to revisit some leading guilds.

Source: The Block Digital Asset 2023 Outlook

Source: The Block Digital Asset 2023 Outlook

🔶Key Takeaway 🔶

It’s unclear whether gaming guilds are viable exposure or how they intend to distribute value back to token holders. Many guilds will fail, and some have lost significant treasury funds through bad capital management.

If I’m choosing one, it’s likely Merit Circle due to its diverse range of operations, game studio, assets and venture fund. They’ve shown an ability to keep most of its funding, while others like Yield Guild Games lost 2/3rds.

Expect a big announcement from GuidFi regarding “Project Z“; if it’s well-received, this could be a catalyst in the short term.

Gaming Guilds Lose Treasury Assets

These guilds raised significant capital in the bull market of 2021, but unfortunately, not all kept it. Yield Guild Games lost 66% of its treasury, while Merit Circle only lost 15%.

A deeper look into gaming guilds

- Merit Circle

- Market cap (FDV): $130M ($240M).

- Unique differentiator: A versatile gaming DAO with 4 different verticals: Investments, Studios, Gaming and Marketplace (Sphere)

- My Take: Versatile, revenue-generating and maintained most of its treasury compared to others. Proven they can create profit and seem the most likely to succeed from the pack.

- Down From ATH: -98%

- More Info: Merit Circle Gitbook discusses its “2.0” pivot.

- Yield Guild Games (YGG)

- Market cap (FDV): $60M ($330M).

- Unique differentiator: Still focusing on the scholarship model via purchasing and renting NFTs. YGG buys NFTs, allows their guild to use them and profits shares. Earns revenue via in-game rewards, profit-sharing and appreciation of NFTs.

- My Take: Lost 66% of treasury value due to poor management. Focusing on the play-to-earn model appears limiting as this circulator economy faltered. Still too reliant on Axie Infinity, although E-sports presents an opportunity. 🟥Red flag they have stopped providing quarterly financials on assets held.

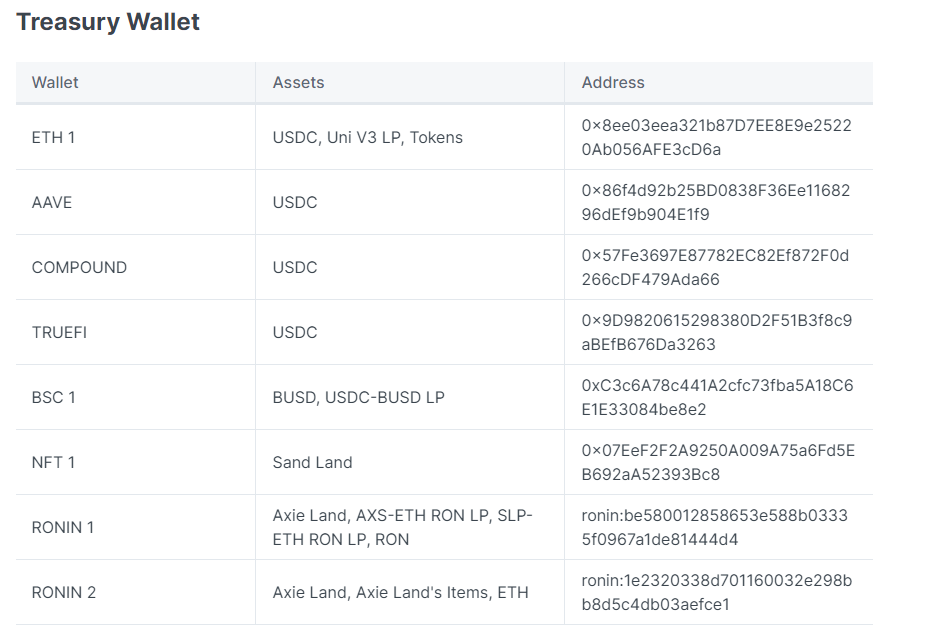

- GuildFi (GF)

- Market cap (FDV) = $19M ($101M).

- Unique differentiator = Ecosystem of interconnected Web3 games, NFTs, and guilds. A focus on gamification and social aspects.

- My Take = Not sold on the GuildFi model of its interconnected ecosystem as it’s very unclear how they generate revenue besides NFT appreciation. In positive news, they remain with a $100M treasury, are heavily invested in The Sandbox Land and Axie Infinity, plus promise a new content hub called “Project Z” to be unveiled in 2023. Risk/reward opportunity is decent for a treasury holding $100M.

Source: GuildFi Treasury Wallets

Source: GuildFi Treasury Wallets

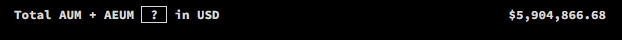

- Blackpool (BPT)

- Market cap (FDV): $3M ($35M).

- Unique differentiator: A community-owned investment and management protocol for digital assets and eSports. Staking and locking BPT for xBPT allows holders to participate in the shared ownership of NFTs and capture the value attributed back to Blackpool.

- My Take: Small Treasury of only $200K (with only ~12 ETH, with 50% in native token) and low assets under management (AUM) ~$6M. 🟥 Red flag: stopped reporting written financials; doubtful this continues.

Source: Blackpool Treasury Metrics

Source: Blackpool Treasury Metrics

- AvocadoDAO (AVG)

- Market cap (FDV): $1M ($43M).

- Unique differentiator: Similar model to GuildFi, operating a quest portal to gamify crypto games, unifies gamers and earns revenue from scholars or in-game NFTs. Unlike GuildFi, they heavily pursue Web3 investments.

- My Take: Very little sets them apart. A smaller treasury with ~$16M in stablecoins left and spent a significant amount of the treasury on 46 investment deals in Q1 and Q2 2022—meaning they likely bought high valuations. 🟥Red flag unclear exactly how much and what they own, lack of transparent on-chain assets.

- Others

- UniX (UNIX), with only a sub $1M market cap, claims to have <190,000 Discord members.🟥 Very high chance the Discord is botted. I would exercise caution.

- PathDAO (PATH) and Blockchain Space (GUILD) remain other notable guilds.

#4 Native Gaming Tokens

Time to manage: Medium| Level of knowledge: High

One way to gain exposure is through the native governance tokens of the games themselves.

Although this may be potentially lucrative, remember not all gaming tokens are created equal. A few things to consider:

- What is the core utility?

- Is there in-baked revenue distribution for in-game sales or revenue?

- 🟥Mistake: Purchasing highly inflationary or unlimited rewards token vs the limited revenue accruing governance token.

- Some games like Axie Infinity offer a dual token system, a reward token (SLP) and the other a governance token with control over the treasury (AXS).

Source: Axie Infinity Duel Token Charts: SLP vs AXS

Source: Axie Infinity Duel Token Charts: SLP vs AXS

🔶Key Takeaway 🔶

Getting exposure to popular games’ native token is often a viable strategy, especially if it controls a large treasury or share in-game revenues directly with holders.

Some of the biggest games include:

- Axie Infinity (AXS): A game based on the buying, trading and battling of NFT creatures called Axies. It has ~400,000 monthly active users and has started unveiling its in-game land economy and new mobile app.

- Illuvium (ILV): A gaming world where users compete for NFT creatures called Illuvials. Starting with 3 different games, token holders share in-game revenues. In private beta.

- ApeCoin (APE): Governs and currency for the Bored Ape Yauct Club and Yuga Labs suite of gaming experiences.

- Unreleased games to look out for include:

- My Neighbor Alice (ALICE): A multiplier farm and builder game similar to Animal Crossing.

- Shrapnel (Sharp): AAA game built on Avalanche set for release this year.

For more on emerging games, see the winners of the Game3 awards in Part 1

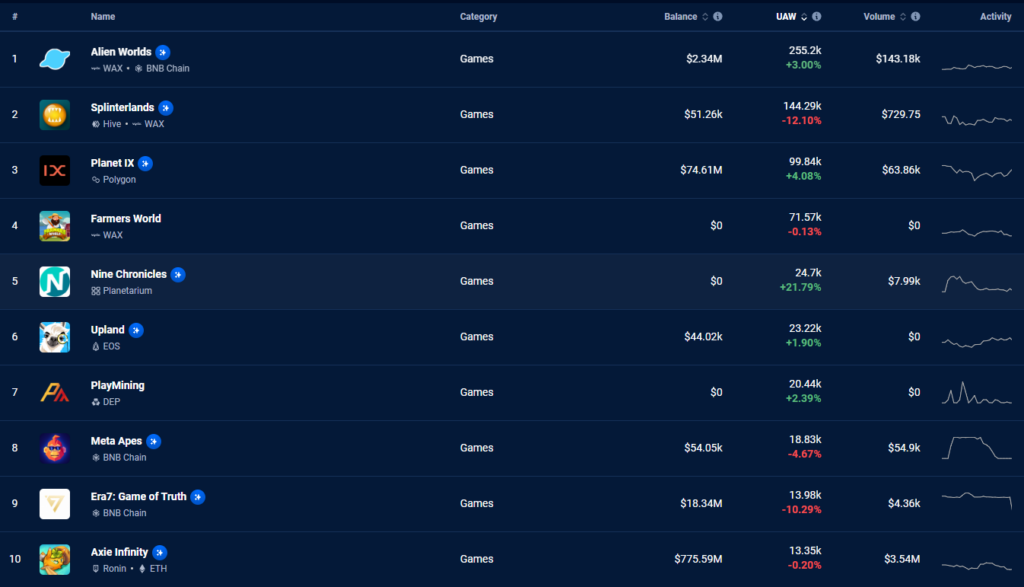

Source: Top 10 most played web3 games

Source: Top 10 most played web3 games

#5 Decentralised Gaming Studios

Time to manage: Median | Level of knowledge: High

Gaming studios or publishers are traditionally the ones who capture most of the value. There is potential for emerging crypto-native gaming studios to launch as DAOs.

Illuvium is an example of a game but also a gaming studio DAO. There are plans to release many more Illuvium titles if the first games are successful. ILV appears to be the later titles’ governance token and distribution token.

Holders of ILV help decide key aspects of gameplay which the Illuvum Council then vote on and produce via the development team.

🔶Key Takeaway 🔶

Gaming Studios traditionally capture most of the value. Look out for emerging DAO-based gaming studios that release games and co-create with token holders. Not many at the moment.

#6 Is Land The Play?

Time to manage: Hard | Level of knowledge: High

In-game land is the most speculative aspect of crypto and often sold with little plan for utility, big promises, and as a fundraising tool for the creators. I explored some of the challenges in a previous post, ‘A Dive Into Metaverse Land: Should You Be Buying?‘.

- For example, land in these games doesn’t have to be fixed like in the real world, and land can be diluted just like any other cryptocurrency or NFT by offering more.

It’s probably not worth it unless it has straightforward inherent utility in the game and you are highly knowledgeable or understand the risk.

One exception I found is Illuvium. The in-game land is critical to the in-game economy, and functionality acts like resource deposits powering the world. Although I’m cautious Illuvium land could become diluted with future land offerings as developers and the community wrestle with a shrinking runaway.

🔶Key Takeaway 🔶

Be very careful of purchasing in-game play without any real utility.

#7 Gaming Platforms

Time to manage: Easy | Difficulty: Medium

Some crypto-organisations aren’t open to one specific game but are a platform hosting many, often compatible with one another.

These platforms host development infrastructure, help produce games and provide the tools or medium for users to access.

In this regard, some game platforms include:

- Enjin Coin (ENJ): Built on Polkadot, Enjin offers development kits, NFTs and games in its ecosystem.

- Gala (GALA): A platform for web3 games via its own blockchain.

- Decentral Games (DG): A gaming platform offering a seamless poker experience where NFT holders share profits.

- RedFOX (RFOX): A gaming ecosystem with a focus on its “Metaverse”. I’m highly sceptical about RedFOX, I don’t see real organic growth and doubtful of its pivot (and many different products). I see many better opportunities out there.

🔶Key Takeaway 🔶

Gaming ecosystems provide another opportunity for exposure. It depends on how fun these games are to play and whether revenue from the platform flows to their native token.

#8 NFTs Themselves

Time to manage: High | Difficulty: Medium

The final way to gain exposure is to hold popular gaming NFTs directly. It’s one of the most promising ways to gain exposure to the industry, but it requires more effort, knowledge and is highly dependent on a particular game or ecosystem.

Common Examples

- Illuvials: Many have asked which is best to gain exposure with the upcoming Illuvium game. Is it the NFTs, land or token? My hunch is the first generation of Illuvial NFTs could become valuable (I explored this in a previous post), which is my strategy for when the game goes live.

- Axies: Axie Infinity creatures Axies are essential characters that power the game; rarer or more powerful NFTs fetch a premium.

- Free-to-own: If you have time, looking into Free-to-Own mints is definitely worth it. Free-to-Own is likely to continue, with Limit Break set to become a big gaming powerhouse following their $200M raise.

🔶Key Takeaway 🔶

NFTs themselves are a common way to gain exposure to the industry, but they are specific to a game and require more effort.

Thanks for reading; I encourage all members to let me know in the comments any I missed and/or which method you believe is the best bet.