Are you holding onto cryptocurrencies, hoping they will reclaim all-time highs in the next bull market? Chances are they might be ‘dead’. This resource gives you the tools to reassess cryptocurrencies you’ve held for a long time and provides a clear framework so you don’t get stuck holding onto “dead” coins.

Key Takeaways

- By looking at previous market cycles, most cryptocurrencies will either fail, never reach another all-time high or slowly bleed out.

- External tools can help you judge whether your cryptocurrency is dead.

- Our fundamental analysis framework helps you make more informed decisions when reassessing the ‘liveliness’ of your cryptocurrencies.

- All holders should consider other important questions when deciding to sell, hold or buy, such as emotional attachment, tax and the sunk-cost fallacy.

Look At History

When assessing the potential of any cryptocurrency, it’s crucial to look at the history of similar technologies and emerging markets.

Like any new technology or business venture, the vast majority of cryptocurrencies—around 99%—will either fail, never reach their previous all-time highs, or gradually fade into irrelevance. This stark reality reflects the inherent volatility and unpredictability of the crypto space. Many projects start with great promise, fueled by hype and speculation, but only a small fraction manage to deliver on their initial vision and achieve long-term success.

Failing to understand and acknowledge this historical pattern is one of the biggest mistakes you can make. It’s easy to get caught up in the excitement of a bull market, but history has shown that many of these projects will not survive in the long run.

By recognising these patterns and maintaining a realistic perspective, you can avoid the pitfalls that have trapped countless investors before you. Being aware of this can help you make more informed decisions, focusing on the projects with the most potential for longevity rather than getting swept away by short-term gains and market euphoria.

We quickly underestimate how much the top cryptocurrencies change from cycle to cycle. Would it be possible to easily look at previous crypto cycles?

Lucky for you, we can! CoinMarketCap’s historical price data displays the total crypto market cap charts for every week since 2013.

A few of my favourites from the crypto graveyard 👇

- Namecoin (NMC): #3 June 2013

- Nxt (NXT): #3 August 2014

- Dash (DASH): #5 March 2015

- MaidSafecoin (MAID): #5 March 2016

- Neo (NEO): #7 Janurary 2018

- EOS (EOS): #4 Feburary 2019

- Terra (LUNA): #7 March 2022

And these are just a few you might’ve heard about. There are thousands beyond the top 10 that are quietly relegated into obscurity, such as the likes of Dentacoin, Emercoin or HyperCash.

What are the chances your altcoins will stay relevant by the time the next bull run kicks into overdrive?

Is Your Cryptocurrency Dead?

Now that you know many cryptocurrencies rise and fall, how does your cryptocurrency stack up? How do you tell whether your cryptocurrency might make it or whether it is already quietly slipping into irrelevance?

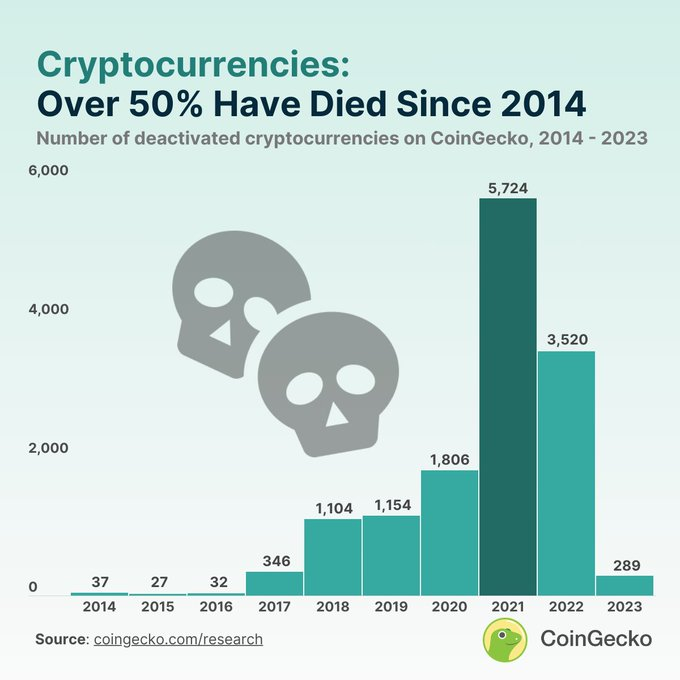

You’ll be surprised just how many cryptocurrencies have officially “died”. In 2023 CoinGecko research found over 50% of all cryptocurrencies have died since 2014.

Luckily, many free tools are out there to help you reassess whether or not your cryptocurrency is dead.

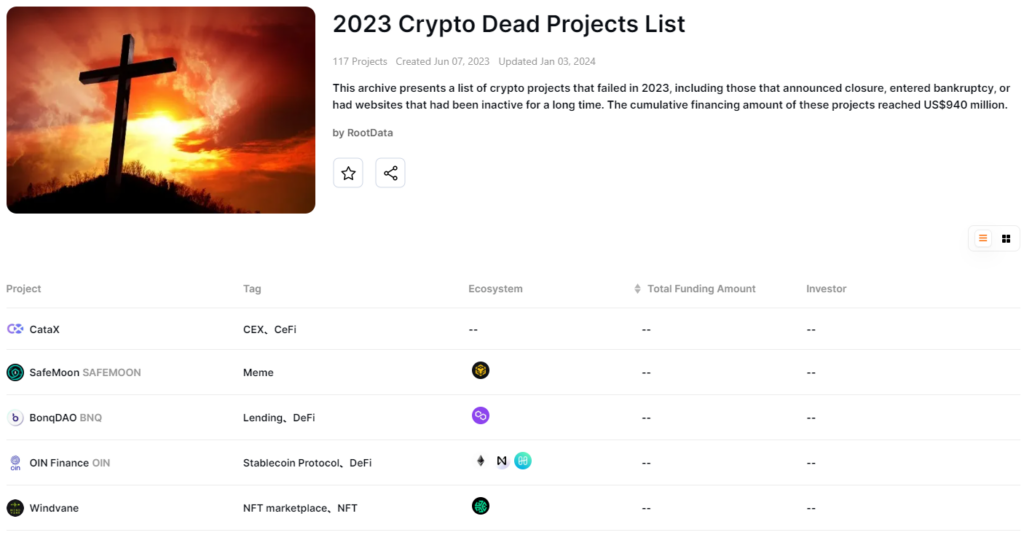

A free tool via RootData archived a list of crypto projects that failed in 2023, either by announcing a closure, entering bankruptcy or having inactive websites.

Key Questions When Reassessing Your Cryptocurrencies

Not all cryptocurrencies will be on the above lists—consider 50% to be the bare minimum. There are thousands, if not millions, of cryptocurrencies still operating that could be next.

You don’t have to sit back and wait. There are a few things you can do to reassess your cryptocurrencies. Our framework consists of a way to make more informed decisions and help you reassess your cryptocurrencies.

Look At Fundamentals

The first thing to do will is to look at the underlying fundamentals of the cryptocurrency. Treat this as if you were going to buy the cryptocurrency again and conduct a review of what it does, how the tokenomics are structured and whether it is capturing a narrative in the market.

Fundamentals such as how active the team is and how active their social media presence is will help give you a signal of whether the cryptocurrency has legs.

As an exercise, take a cryptocurrency you’re unsure about and want to reassess. Ask the following list of fundamental questions and answer with a ❌ (no), ✔️ (yes) or ➖ (uncertain).

| Fundamental | ❌(no) ✔️ (yes) ➖ (uncertain) |

|---|---|

| Timing—do they solve a growing need? | |

| Are they still building & releasing updates or new products? | |

| Do they still have a community of developers and an active or growing ecosystem? | |

| Are they active across their socials? | |

| Have they gained any legitimate adoption? (i.e. onchain metrics) | |

| Are they being surpassed by competitors? | |

| Do they have sufficient runway left? | |

| Are the tokenomics sound or broken? (i.e. how useful is the token?) | |

| Do they have an outdated or redundant narrative? | |

| Are there any upcoming catalysts? |

If you get more crosses than pluses and a low percentage, it could be a sign something needs to change.

It can be hard to do it alone—for help, see our monthly live stream on how to choose which altcoins to cull.

Other considerations

While fundamentals are crucial in evaluating any cryptocurrency, they are just one piece of the puzzle. Reassessing a cryptocurrency involves taking a broader perspective. It’s essential to approach this process with a clear mind and consider all the relevant aspects before making any decisions. Here are some additional critical questions you should be asking yourself, preferably in consultation with your tax professional:

Are you too emotionally attached?

Emotional attachment can be one of the biggest obstacles in reassessing your cryptocurrency objectively. It’s easy to become too emotionally invested, especially if you’ve spent significant time and resources on a particular coin. However, this emotional involvement can cloud your judgment, making it harder to make rational decisions.

A practical question to ask yourself is, “If I were to buy this cryptocurrency today at its current price, would I feel confident and happy with the decision?” If your answer is no, this could be a clear sign that you’re too emotionally attached, and it may be time to reconsider your position.

Do you understand how much it needs to return to its previous high?

Understanding the basic math behind how much a coin needs to recover is crucial. Consider how much your cryptocurrency needs to increase to reach its previous all-time highs or simply break even.

For example, if you are currently holding a position that is down by 70%, the cryptocurrency would need to increase by a staggering 233% just to get back to your initial investment level. This kind of insight can help you make a more informed decision about whether it’s worth continuing to hold or if it’s time to cut your losses and move on to a more promising opportunity.

| How negative your altcoin is (%) | Price increase needed to return to break even (%) |

|---|---|

| -10% | +11% |

| -20% | +25% |

| -30% | +43% |

| -40% | +67% |

| -50% | +100% |

| -60% | +150% |

| -70% | +233% |

| -80% | +400% |

| -90% | +900% |

Can you save on tax by selling?

Tax considerations are often overlooked but can play a significant role in your decision-making process. Depending on where you live, there may be opportunities to engage in tax-loss harvesting, where you sell cryptocurrencies at a loss to offset capital gains taxes. This can be a strategic move to not only optimise your portfolio but also reduce your tax burden.

Consulting with a tax professional can help you understand the potential benefits and ensure that you’re making the most informed decisions regarding your investments.

Are you stuck in a sunk-cost fallacy?

The sunk-cost fallacy is a common trap that many investors fall into.

But what exactly is it? The sunk-cost fallacy occurs when you continue to hold onto a cryptocurrency or pursue a specific goal just because you’ve already invested a lot of time, money, or effort into it, rather than because it’s the best decision moving forward.

The market doesn’t care about your past investments or how much time you’ve spent researching a particular cryptocurrency. What matters is the opportunity cost—what you could gain by reallocating your resources to something else more promising. If there is a higher probability of upside in another cryptocurrency, it might be wise to consider moving your capital and attention elsewhere rather than holding onto that cryptocurrency that no longer aligns with your goals.

There could be a greater opportunity cost in not realising any losses and using that new time, attention and capital to look at other cryptocurrencies that tick all the boxes in the above fundamental analysis table.

Summary

Cryptocurrencies come and go—it is rarer to see a cryptocurrency maintain or increase its market cap position over several years than it is to slide out of the top 100.

So, users shouldn’t be surprised to see cryptocurrencies fail and should actively investigate whether they’re holding onto a “dead” coin.

As a result, users should reassess their cryptocurrencies, and there are a range of tools to do so. Looking at fundamentals and asking the hard questions can very quickly help understand whether the team is still active and whether or not they have gained any traction.

But it isn’t just about looking at the fundamentals; it’s about taking a comprehensive approach that includes emotional detachment, understanding potential recovery scenarios, considering tax implications, and avoiding cognitive biases like the sunk-cost fallacy.

By asking yourself these critical questions and consulting with professionals where necessary, you can make more informed decisions that better align with your long-term financial objectives.