This monthly report covers the state of Bitcoin and Ethereum and market-sensitive news before previewing the month ahead. We also share our short-term market outlook. (For coverage of altcoins, see our Monthly Altcoin Reports.)

Key Takeaways

- BTC hit a 12-month high of $31,470 in June and continued to gain market dominance, as it has done throughout 2023.

- Total ETH staked continued to increase throughout June, an encouraging sign for various reasons. Competition between layer 2s (L2s) intensified after multiple similar feature launches.

- The market was affected by high-profile lawsuits against Binance and Coinbase, and BlackRock’s landmark ETF filing.

- These prices still present as an opportune time to accumulate BTC and ETH.

Content

Market Overview

Analyst take: The market continues to climb steadily in 2023. Ongoing underperformance by the altcoin market has been one of the stories of 2023 so far year. For now, as we’ve been saying since late last year, now is still an opportune time for long-term investors to accumulate BTC and ETH.

The combined market cap of all cryptocurrencies increased by 5% in June to $1.24T. For the month, BTC was +12.0% and ETH was +3.2%. Concerningly, the total market cap of stablecoins fell for the 14th month in a row. (Generally speaking, the more stablecoins in circulation, the better.)

For most altcoins, it was another rough month with no categories or sectors notably outperforming the market. Among June’s top performers were FLEX (+273%), BCH (+170%) and KAS (+66%).

Bitcoin (BTC)

Analyst take: Those who have accumulated BTC over the past year would be chuffed with how the year has unfolded. The continued outperformance of BTC is largely a reflection of its regulatory certainty relative to other cryptocurrencies. The ETF applications surprised everyone and have thrust BTC back into the mainstream headlines.

Bitcoin Dominance Hits Two-Year Highs

BTC dominance—that is, BTC’s market cap as a percentage of all cryptocurrencies combined—increased yet again in June to as high as 52.0%, a level not seen since April 2021. Having started the year at 42.0%, BTC dominance’s strong increase has been among the most significant market stories of the year.

The latest jump was due to widespread sell-offs in the altcoin market—particularly among those altcoins that the SEC alleged as securities in its lawsuits against Binance and Coinbase (covered later). For example, ADA, SOL and MATIC—3 of the several altcoins alleged as securities by the SEC—fell by 23.6%, 10.0% and 25.6%, respectively, in June.

This trend is common in a bear market. Crypto investors are clearly seeking the relative safety of BTC. At the same time, their appetite for investing in altcoins has diminished. This will change eventually, but likely not anytime soon.

Volumes Surge Amid Bitcoin ETF Mania

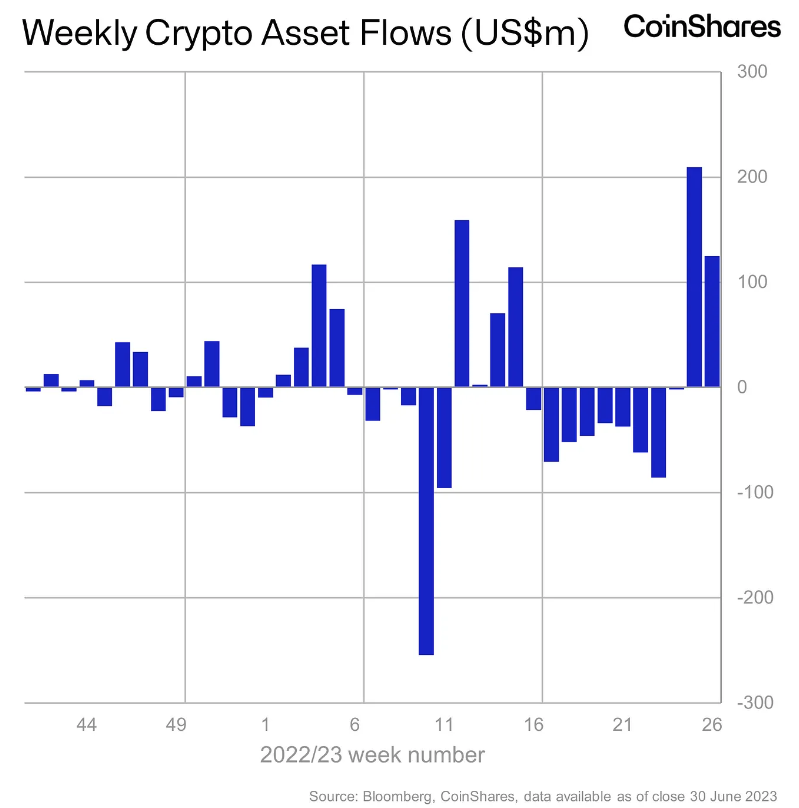

The flurry of bitcoin ETF applications (covered later) unsurprisingly led to higher volumes and buy-side demand for BTC in June. Two areas that reflected this were volumes on spot exchanges and publicly listed crypto investment products.

The 7-day moving average of BTC spot volumes increased to its highest level ($8.26B) since late March and nearly doubled from the volumes being posted in mid-June, prior to BlackRock’s ETF filing, according to data from The Block.

As for crypto investment products, they have seen two consecutive weeks of inflows totalling $334M, according to CoinShares’ latest weekly flows report. Of this, a whopping 98% was related to BTC investment products.

Ethereum (ETH)

Analyst take: Record growth in staked ETH validates our prediction that the enabling of ETH withdrawals was a derisking event that would benefit Ethereum. The adoption of layers 2s continues to be a core theme of 2023. Fierce competition between L2s was on display in June, with multiple L2s announcing similar features.

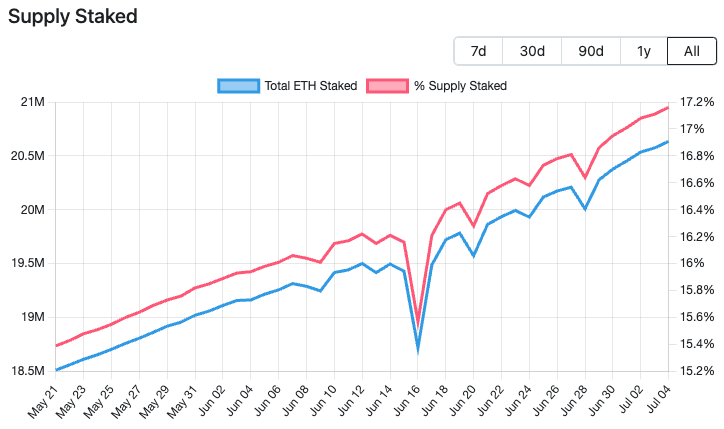

20M ETH Staked As Validator Growth Persists

In June, the total number of staked ETH hit 20 million—that is, 17% of ETH’s circulating supply—for the first time. It also surpassed the combined balance of ETH held on centralised exchanges. Indeed, the demand to stake ETH remains incredibly robust, validating our prediction that April’s enabling of withdrawals was ultimately a derisking event that would encourage more ETH staking and bolster Ethereum’s security.

Short term, the number of staked ETH will increase further, given the sheer number of pending validators currently awaiting activation to help secure the Ethereum blockchain. At the same time, as has been the case for a while, no validators are exiting. The number of pending validators is currently 89,338, which is ever so slightly below the 90,000–95,000 range that lasted for all of June. (For security reasons, Ethereum limits the rate validators can join and exit.)

| Activation | Exiting | |

|---|---|---|

| Number of queued validators | 89,338 | 0 |

| Approximate time to process current queue | 39.5 days | 0 days |

| Total ETH in queue | 2,858,816 ETH | 0 ETH |

Sustained Growth of Ethereum L2s

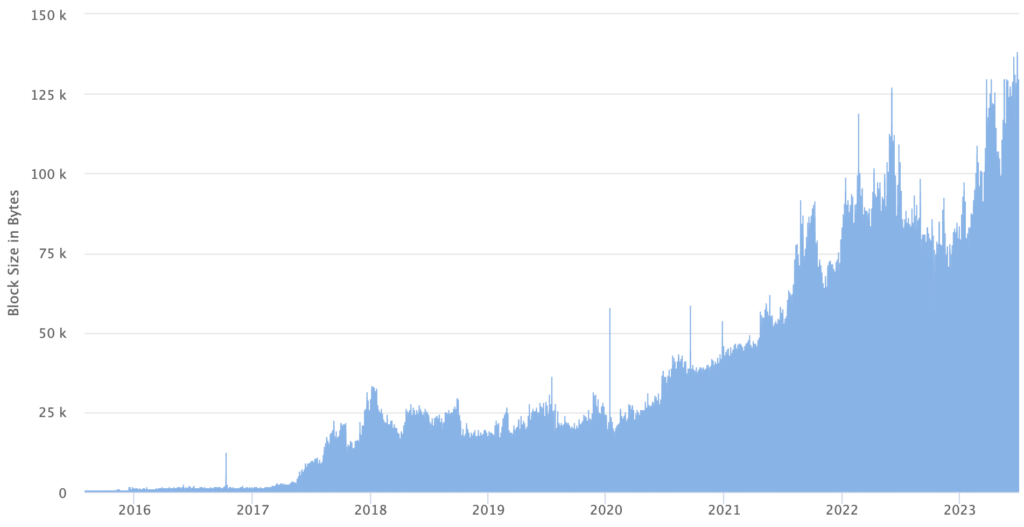

It’s promising to see activity on layer 2s (L2s)—which are critical to helping Ethereum scale—continuing to grow. One clear sign of this growth is the average block size on Ethereum mainnet, which hit all-time highs in June, according to Etherscan. (As a reminder, L2s periodically post data back to Ethereum.)

Finally, a notable trend for L2s in June was the fiercely contested race to make it as easy as possible for developers to build their own custom chains on top of L2 networks. Examples include Arbitrum’s Orbit, Optimism’s OP Stack and zkSync’s ZK Stack. Such strong competition should accelerate L2 adoption, further easing pressure on the Ethereum blockchain.

June’s Market-Sensitive News

Analyst take: The month started with the biggest crackdown yet by the SEC—which sued the two largest crypto exchanges on consecutive days—and ended with the incredibly bullish news that the world’s largest asset manager had applied for a spot bitcoin ETF. Of note, it may take many months for any market-sensitive updates to come from these developments.

SEC Sues Binance, Then Coinbase

The most significant regulatory news so far this year happened earlier in June, with the SEC suing the two largest crypto exchanges on consecutive days.

SEC vs Binance (Jun. 5): The SEC charged Binance, Binance.US and its CEO with violating several U.S. securities laws, including concerning accusations of fraud, commingling user funds and wash trading. This is significant because Binance is the world’s largest crypto exchange—if these allegations prove true, it’d further tarnish the crypto industry and trigger enormous downside price pressure.

SEC vs Coinbase (Jun. 6): The SEC charged U.S.-headquartered Coinbase with operating an unregistered securities exchange and violating other securities laws. As opposed to the Binance lawsuit, this case doesn’t involve fraud or manipulation but reinforces just how hostile areas of the U.S. government have become against crypto. (The court hearing starts on July 13.)

This news was price-sensitive for all cryptocurrencies, but particularly for the various altcoins that the SEC alleged as securities in its lawsuits. As explained earlier, altcoins such as ADA, SOL and MATIC have severely underperformed since the filings. Contributing to this was the decision by certain brokers (e.g. Robinhood, eToro, SoFi) to delist the altcoins alleged as securities.

BlackRock Triggers Wave of Bitcoin ETF Applications

BlackRock—the world’s largest ETF issuer and asset manager, with $10T under management—surprised many in June by filing a spot bitcoin ETF application. Its proposed ETF triggered the reactivation of other previously rejected ETF filings by entities such as Investco, WisdomTree, Fidelity and Valkyrie.

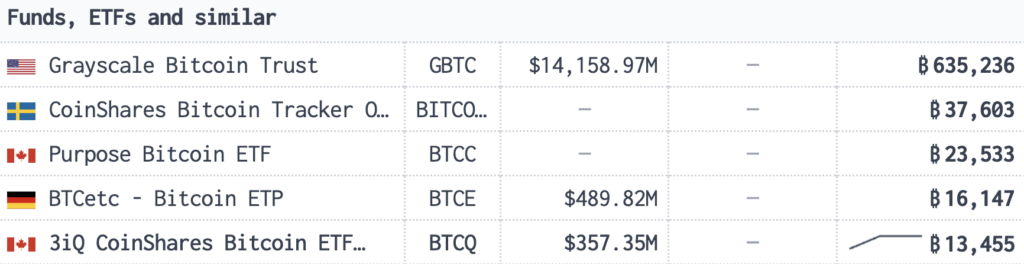

The SEC has yet to approve a spot bitcoin ETF. An approval would be seriously validating for BTC and would cause its price to rally by double-digit percentages within hours. Unlike futures ETFs, issuers of spot ETFs must buy and hold the underlying asset. In other words, they become a new source of demand for the underlying. For BTC, all else being equal, additional demand increases BTC’s price. (For more, see Matt’s recent post on why BlackRock’s proposed ETF is so significant and what happens next.)

Issuers of structured BTC products (e.g. Grayscale, CoinShares, Bitwise) already hold more than 800,000 BTC (≈3.8% of total supply), according to Bitcoin Treasuries. This figure would almost certainly grow considerably if the SEC approved a spot ETF.

July Preview: Binance Unknowns & ETF Watch

Below are potential market-sensitive events to be aware of in July.

Potential for Binance to be charged by other U.S. federal agencies. The exchange continues to deal with regulators globally. Among other developments in June, Binance was ordered to cease operations in Belgium and started being investigated for money laundering in France. The prospect of more civil or criminal allegations against Binance may be weighing on crypto prices. The main source of investor uncertainty is whether the U.S. Department of Justice will bring criminal charges against Binance.

(We’d like to take this opportunity to reiterate the following: We strongly advise against keeping your cryptocurrencies on exchanges. These cryptocurrencies aren’t truly yours until you send them to an address you control. Go to our Security Centre for more.)

Possible (though highly unlikely) decision on proposed bitcoin ETFs. While we wanted to include this here because of the sheer price sensitivity surrounding a would-be decision by the SEC, we stress that it’s extremely unlikely the SEC will announce a decision in July. It still hasn’t published the applications to the Federal Register. Doing so would commence the SEC’s first of what could be 4 decision windows. (Matt broke down the decision process last month. We welcome your questions in the comments.)

Potential closure on important legal battles. The years-long Ripple Labs vs SEC case is inching closer to a judgement, the nature of which may influence the outcomes of future cases related to crypto. It’s also worth monitoring the status of DCG—which 12 months ago was among the world’s largest crypto companies—after it failed to pay Gemini $630M by the due date in late May. (As of this writing, Gemini’s co-founder and president just published a second open letter to DCG’s founder and CEO with a final offer that expires on July 6.)

U.S. central bank’s rate decision on Jul. 26. The market’s expectation on the Fed’s next interest-rate decision has changed significantly in recent weeks following multiple data releases that indicated the U.S. economy was performing better than expected. According to the widely followed CME FedWatch Tool, a 25-basis-point rate hike is 87.4% likely. Crypto prices will almost certainly move strongly if the Fed announces anything other than a 25-basis-point rate hike, which is very unlikely.