This guide on decentralised autonomous organisation (DAOs) is written to help you understand the various aspects of DAOs as of April 2021.

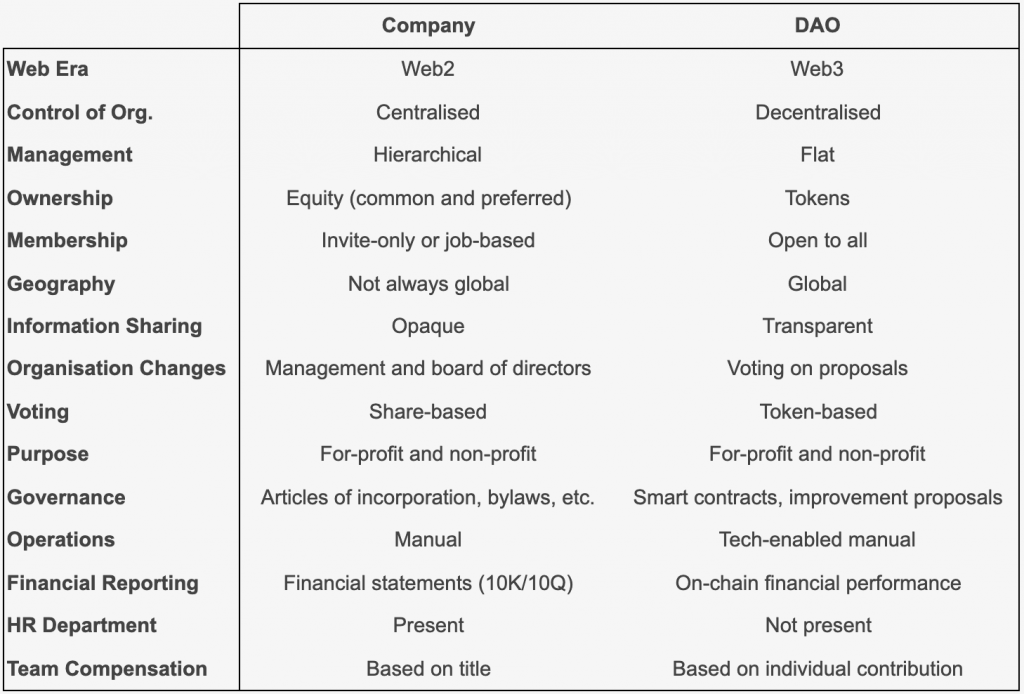

The transition from Web2 to Web3 has thrown all commonly held business practices into question, with decentralised systems and cryptocurrencies enabling novel business systems.

Web2 companies such as Facebook and Airbnb utilise various organisational structures to organise their ownerships and operations. Technological advances have helped these sorts of companies operate with a flatter organisational structure, radically changing the way people work and workplace culture. Today, technological advances are starting to disrupt the traditional company ownership structure: from ownership via various categories of shares to ownership via governance tokens.

Governing a geographically dispersed group of people is hard. To do so efficiently and effectively, several challenges need to be overcome, particularly those relating to logistics, finance and management.

The first DAO, conceived in 2016, was a mechanism through which to aggregate capital and deploy it in a venture-capital-like manner.[1] Those who held DAO tokens were able to vote on whether the DAO should invest in proposed projects.

As of April 2021, many of the core teams behind the most widely used blockchain-based protocols, platforms and apps, have either (i) already relinquished administrative control and transferred it to a DAO or (ii) made public their intention to do so.

A DAO is a type of organisation that is controlled by its stakeholders and has no central governing body.

In the world of crypto, the term governance is typically used to describe the mechanisms through which decisions are made on key risk parameters, proposed improvements and other matters. In the same way that true ‘decentralists’ believe that all of society will be tokenised, the idea extends to all organisations eventually becoming decentralised and autonomous.

In contrast to how businesses are incorporated today, creating a DAO is often referred to as ‘summoning’ or an ‘exit to community’.[2] Many protocols start with a team-led, centralised governance structure for efficiency purposes, before gradually decentralising to the point where all proposed changes go through a DAO. The participants of these DAOs are the people and entities who hold the protocol’s native token.

Characteristics

Aspects of a DAO

Blockchain-based DAOs remain a novel concept. For many, participating in a DAO remains intimidating and confusing. Managing all of the steps between ideation and implementation is no easy task, particularly when the protocol is experiencing strong growth.

That said, certain online tools are making community-driven governance more possible. Novel blockchain-enabled organisational concepts have been created due to blockchain technology like on-chain treasury management; on- and off-chain voting; secure smart contracts and open-source API services.

Yearn Finance is one example of a protocol that is at the forefront of decentralised governance. Below is an overview of the various components that are relevant for those governing Yearn.

Information and communication

- Website: Web2 website detailing the project’s value proposition.

- Application: Web3-enabled app.

- Twitter: the primary social media platform of Yearn.

- Medium: in-depth articles on project features and recent developments.

- Discord: the engine room of Yearn’s community and the main channel through which core team members are accessible.

- Telegram: a tool for verified team announcements.

- Community calls: held periodically via video- or audio-streaming software. (Some projects, such as Celo and MakerDAO, subsequently publish recordings on YouTube. Yearn does not.)

Technical information

- Documentation: detailed information on all key aspects of the protocolo.

- GitHub: open-source code repositories.

- Audits: internal and external smart contract audits are publicly available.

- Smart contracts: depending on the degree of decentralisation, documentation for most DAOs should have links to open-source smart contracts.

- Community-built tools: the best DAOs empower and incentivise stakeholders to build developer tooling and lead other initiatives such as weekly newsletters. Examples for Yearn: Feel the Yearn, organisation overview, Yearn Finance Newsletter.

- API: application programming interface to make it easier to retrieve key data specific to Yearn.

Governance

- Forum: centre for organisational action and discussions on yEarn Improvement Proposals (YIPs) as well as other general governance matters.

- Proposals: ideas for improving Yearn, in any way, which are submitted by stakeholders.

- Snapshot: off-chain voting tool.

Financial reporting

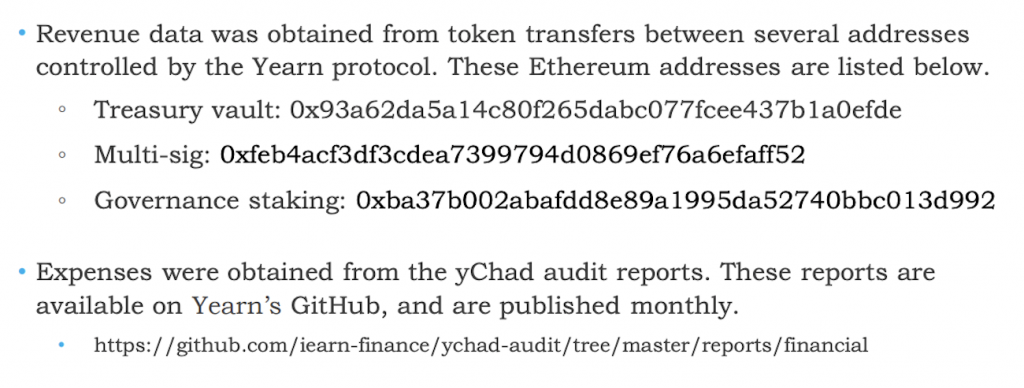

- Financial reporting: financial performance of treasury addresses documenting revenue, expenses and assets.

- Multi-signature addresses: depending on the DAO, multi-signature signers control the spending of treasury funds or the minting/burning of tokens.

- Treasury wallets: DAOs have certain publicly trackable wallets that are used for operations.

Operations

- Team members: whether or not the team is anonymous, good DAOs have known leaders who active members can follow and occasionally interact with.

- Decentralised operations: yearn has built a permissionless platform to coordinate team members’ operational duties and community contributors.

Types of DAOs

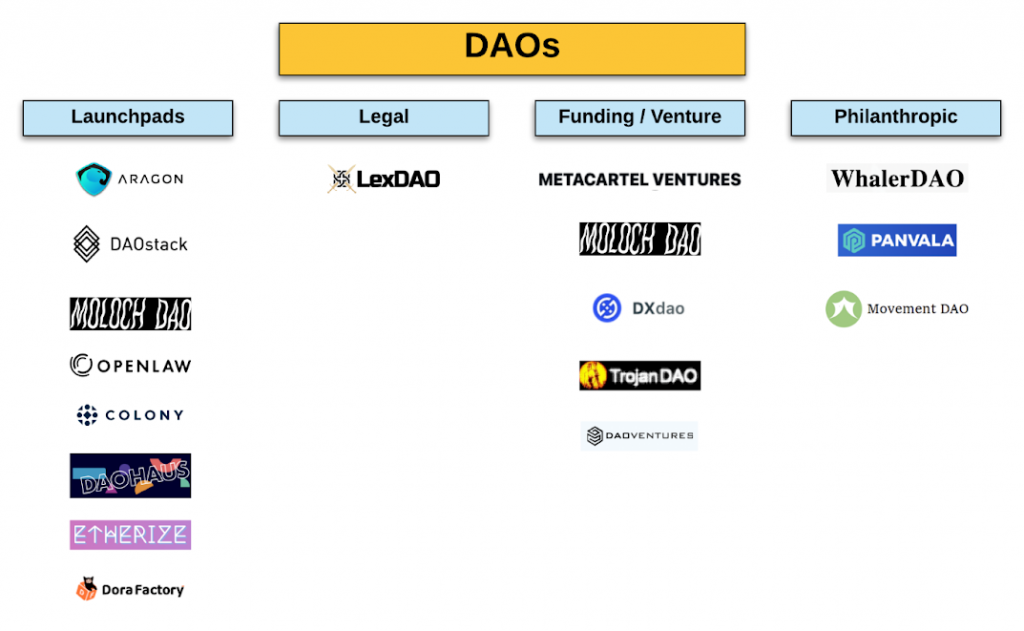

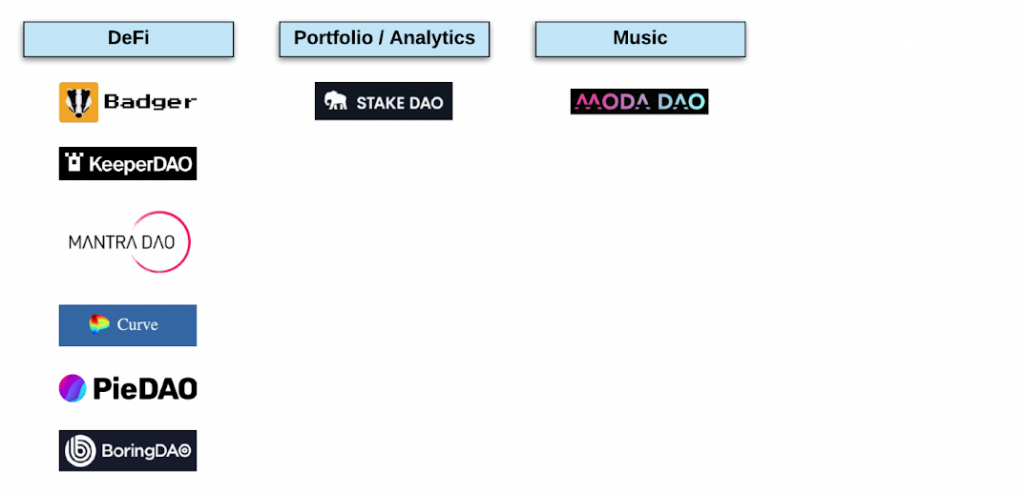

For now, DAO use cases are experimental and wide-ranging. The following types of communities lend themselves to DAO structures: closed investor communities; exclusive trader communities; interest groups; for-profit and non-profit organisations; open-source developer teams; DeFi protocol governance bodies; public chain developer communities; crypto artist groups; hobbyist groups; decentralised media and many more.

Below is a map of DAOs of various industries within Web3. Many prominent DeFi organisations operate with an autonomous organisation’s ethos and practicality even though they may not advertise themselves as DAOs or adhere to all DAO concepts.

Tracking the DAO Ecosystem

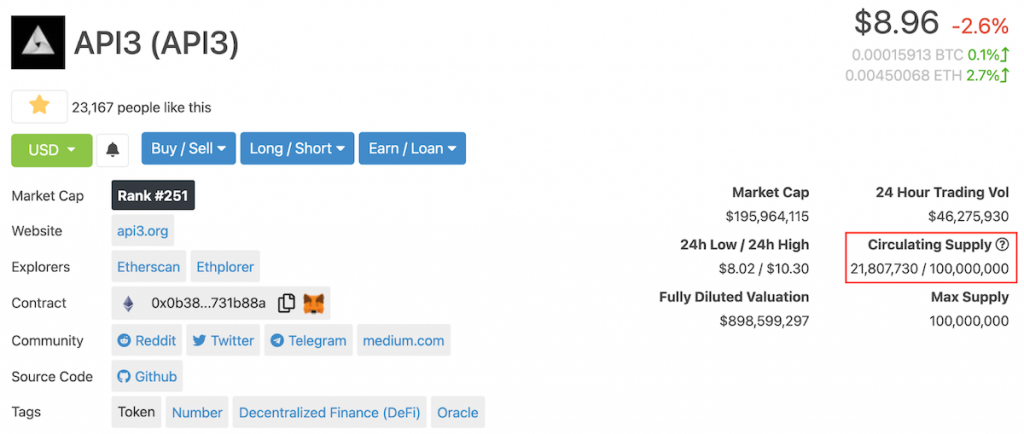

The ‘Top DAOs’ tab on DeepDAO’s dashboard displays analytics and user information for 102 current DAOs, and there are 4 platforms DAOs are built on; Aragon, Moloch, DAOStack and Colony. The ‘Top DAO Tokens’ tab shows the tokens used for the top DAOs.

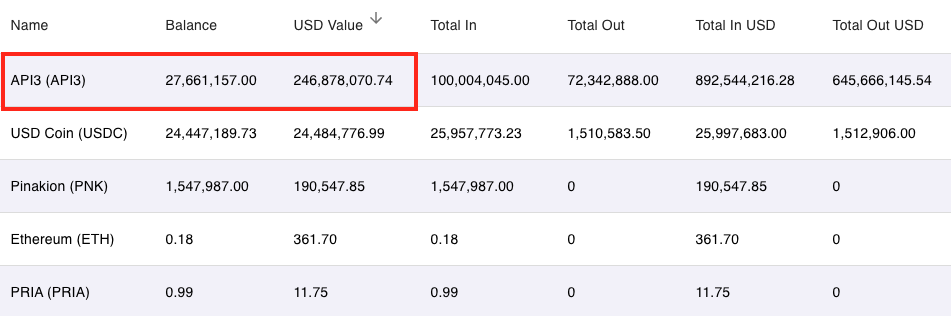

By assessing how much of the total token supply is currently allocated to the DAO, you can gauge the potential impact of a DAO. For example, the largest DAO, API3, has 27.66% ($246M) of the total token supply in its DAO, whilst Decentraland has 0.67% ($13.26M) in theirs.

In addition to tracking a DAO’s assets, protocol revenue-to-treasury flows can be monitored using tools such as Open-Orgs.info, which tracks the treasury accounts of several prominent DAOs. (In early March 2020, Nick covered the importance and value of some of the largest crypto organisation’s treasury accounts.)

Community

At the heart of all DAOs is a community of humans who share values and have a common mission. Their initial shared mission is often accompanied by an alternative view of reality and a firmly held belief of a different future.

Typically, as the organisation grows, so too do efforts to grow the ecosystem. These efforts often take the form of educational content; community support; memes; swag; NFTs; podcasts; in-person meetups; competitions and hackathons. For example, Index Coop ran a challenge for a designer to create a logo for its Metaverse Index, and BarnBridge runs an ongoing meme competition.

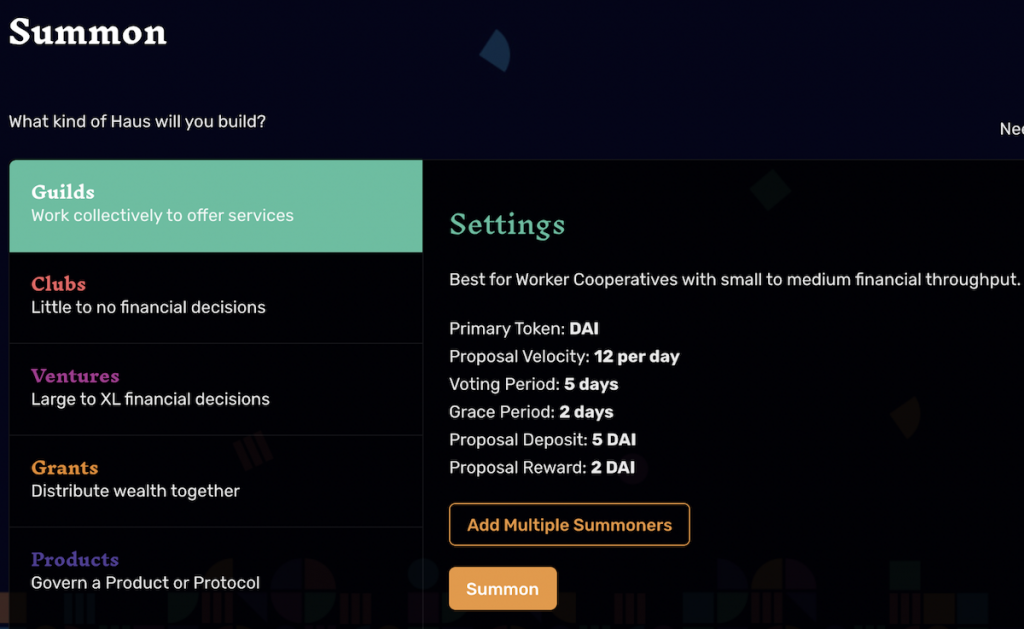

Summoning a DAO

Generally speaking, DAOs are easy and inexpensive to establish, with low barriers to entry. As of this writing, summoning a DAO on Ethereum is relatively costly. (A short-term alternative is summoning a DAO on the xDAI blockchain.) Daohaus has a user-friendly interface for those starting a DAO.

Resources

- DAO Rush Week

- Theory and Praxis of DAOs [Binance Research]

- DAO Creation Canvas [Google Doc]

- DAOfi: Tips & Guidelines On How to Launch a DAO Token [Google Slides]

- ‘Rock the Vote’ newsletter by Boardroom Insights

References

1 The Story of the DAO — Its History and Consequences

2 Exit To Community – University of Colorado Lab