Options are one of several fast-growing components of the DeFi ecosystem. This resource overviews some of the decentralised options platforms and protocols that are vying to become the go-to in the space.

This resource assumes prior knowledge of options contracts. To learn about options, read Crypto Options Guide I and II. For simplicity, this resource assumes a call option is a leveraged derivatives product and a put option is an insurance product for portfolio protection.

Hegic

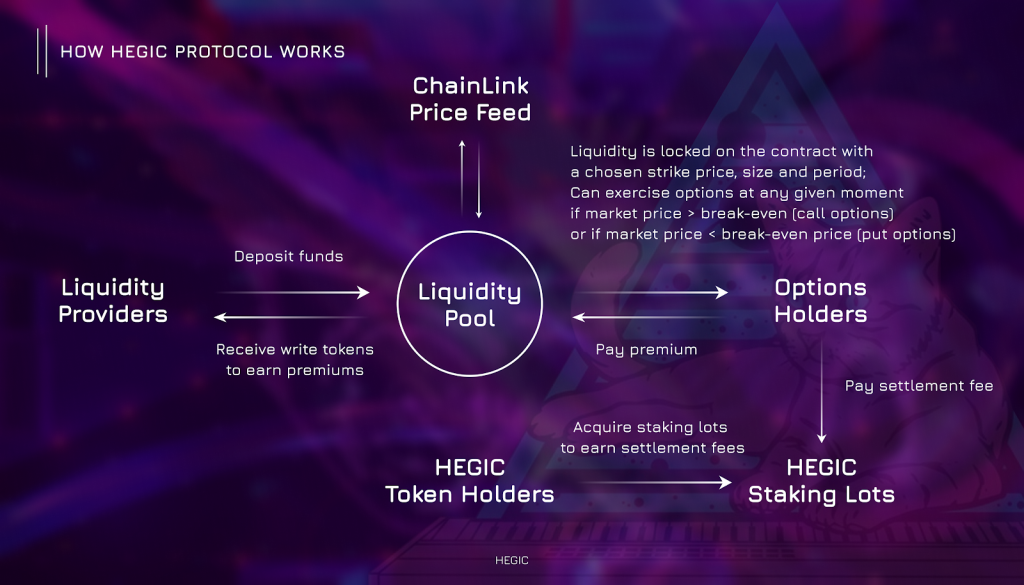

Hegic is an on-chain options trading protocol on Ethereum for buying and selling WBTC and ETH call and put options. The protocol’s native token is HEGIC. Whilst HEGIC is not needed to buy and sell puts and calls on the platform, it is the unit in which liquidity mining rewards are denominated and is used for governance.

Incentives: Hegic rewards users in the following 3 ways:

- Liquidity providers (‘LPs’) earn liquidity mining rewards over a 2-year period (80% of total rewards or 963,847,200 HEGIC) for providing liquidity to pools. Rewards are distributed proportionally to the total liquidity in pools.

- Option holders earn utilisation rewards over a 2-year period (20% of total rewards or 240,961,800 HEGIC) for holding options and using Hegic. Rewards are distributed proportionally to the total value and duration of purchased options.

- Hegic staking lots will indirectly be distributed rewards as well. The LP rewards earned by the IBCO contributions that are deposited into liquidity pools will be distributed to staking lot holders. As per the Hegic v888 beta launch announcement, $500K will be added to both the WBTC liquidity pool and the ETH liquidity pool every fortnight for 6 months as outlined in the v888 launch announcement.

Products

- Long call options for ETH

- Long put options for ETH

- Long call options for WBTC

- Long put options for WBTC

Advantages:

- Easy-to-use UI.

- Simplified pricing model.

- Options are exercisable when they are in the money (‘ITM’).

- Earn HEGIC for creating an options contract.

- Earn HEGIC for providing liquidity to option buyers (Note: You can not short the option, only a LP in the asset pool. More on potential risks of Hegic.)

Disadvantages:

- If your option is out of the money (‘OTM’), you will not be able to exercise it since there is a negative value in the option. This means you cannot recoup the time value (premium) left in the option if the underlying asset moves against you.

- The maximum period of a contract is 28 days which is when time decay accelerates the most.

- No options chain pricing view.

- Multi-leg strategies are not available.

Opyn

Opyn is a decentralised options platform for hedging risk or earning a premium by trading DeFi options on ETH and ERC-20 tokens with data feeds from Compound and Chainlink. Unlike Hegic, which sources liquidity via its peer-to-pool model, Opyn relies on AMM-based liquidity from Uniswap.

Opyn options, known as oTokens, are ERC-20-compatible and tradable on any DEX. The name and symbol of an oToken is determined by the underlying, strike, collateral and expiry.

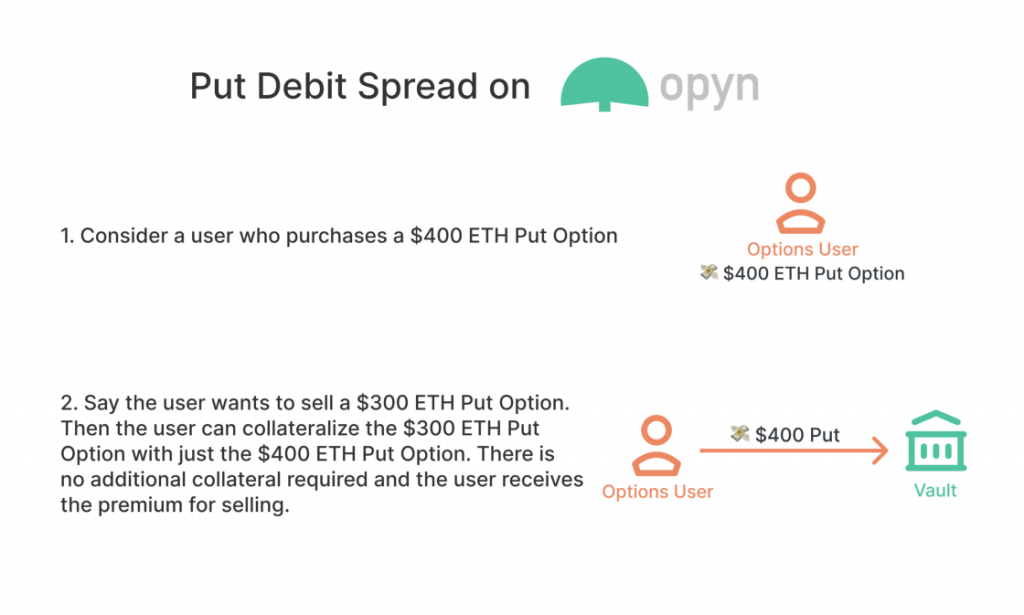

Ever since Opyn V2 launched in Dec. 2020, users have had greater flexibility when creating options contracts. In particular, it allowed users to create options spreads using one option (smart contract) as collateral to open another leg (e.g. call spread = 1 long leg + 1 short leg).

On the Opyn interface, oTokens trade on 0x. Each trade requires a 0x fee which is a function of gas price. As per Opyn’s docs, the team recommends confirming orders with the preset gas price.

Incentives

- Earn yield and governance tokens with collateral such as Aave’s aTokens and Compound’s cTokens.

- Lower margin requirements due to the greater capital efficiency that result from using options spreads to reduce collateral requirements.

Products

- Buy or sell put options (WETH–USDC)

- Buy or sell call options (WETH–USDC)

- Buy or sell put spreads (WETH–USDC)

- Buy or sell call spreads (WETH–USDC)

Advantages

- Traditional options chain view (UI).

- Able to create multi-leg strategies.

- European-style, cash-settled options that exercise automatically exercise at expiry.

- Options ITM will pay out in the collateral asset of the options series (e.g. USDC for puts and underlying for calls).

Disadvantages

- Options can’t be exercised prior to expiration.

- The only instrument to trade is WETH–USDC.

- Limited strikes and expiry dates.

- Gas prices for buy and sell transactions can’t be changed on Opyn’s UI.

Premia

Premia aims to provide a marketplace where previously there was nowhere else to trade options contracts on DeFi tokens. Built by anonymous developers from the Rope meme team, Premia is a decentralised options trading platform that leverages the NFT contract standard ERC-1155.

Where other centralised and decentralised options platforms use the Black–Scholes pricing model, Premia prices are based on a continuous double option (buy order and sell order matching), therefore accounting for the tail risk of DeFi tokens.

Premia uses SushiSwap to sell all fees into ETH and then into the PREMIER token off the bonding curve and rewards users with PREMIER. (This is identical to SushiSwap’s fee-sharing model.)

Incentives

Staking earns 80% off the all fees on the platform (fees are 1% of the option contact).

Anyone holding any supported tokens on the platform can stake those tokens into a vault strategy. Stakers then start earning PREMIA in addition to the fees and premiums earned by facilitating options trades on the platform. (More details here.)

Products

- Call and put options for 14 DeFi tokens.

- Meta Vaults (LPs facilitate the trade of the option buyer/seller by staking their asset into the option pool).

- Orderbook mining; similar to Loopring (coming soon)

- Earn yield in the token that is staked for the LP (coming soon)

Advantages

- Stay long in a token long and earn yield in the staked token over a platform rewards token.

- Coming: stake asset of their choice to provide liquidity to the AAM option pool.

- Coming: instant liquidity (when mass liquidity arrives through the staking program).

Disadvantages

- Premia’s most important problem to solve right now is mass liquidity. The more tokens added, the more diluted the option liquidity becomes. Therefore, it’s a trade-off between more options contracts or concentrated liquidity.

- Contract only allows white-listed pairs on the marketplace.

Other Exchanges & Protocols

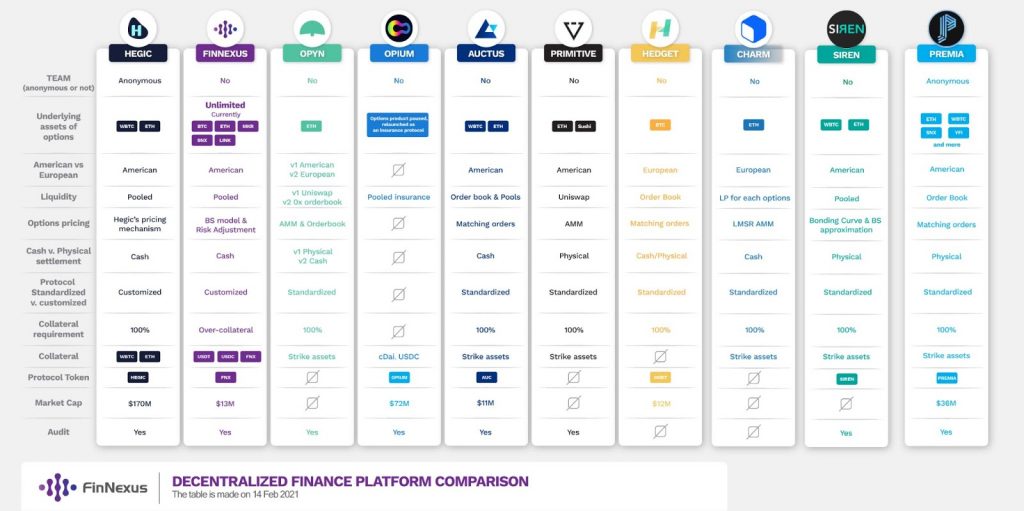

There are new protocols and exchanges providing variants of the options-style derivative, each of which has its own pros and cons—as shown below.

Summary

The derivatives market is being overhauled with decentralised protocols and blockchain technology. However, underscoring just how early this subsector is, most of these protocols currently concentrate on a certain feature of a derivative. There is not yet one protocol which caters to the requirements of professional options traders.

Until an all-in-one derivatives DEX platform exists, retail investors are forced to choose the one that best fits their individual needs—whether that’s short-term portfolio protection, another form of leverage trading, or providing liquidity for writing the contracts and gaining rewards.