This cycle’s bottom is in—in my opinion, at least. If past market cycles are anything to go by—and I think they are—now is the best time to research low-cap crypto-assets. Here are the 3 low caps I’m currently monitoring.

Disclaimer: I do not own any of these 3 tokens. That said, if I was to invest in low caps today, I’d be comfortable allocating a tiny percentage of my portfolio to each of these. (Reminder, Collective Shift team members’ material holdings are updated weekly.)

Key Takeaways

- Pendle (PENDLE) is a DeFi yield-trading protocol that is finally gaining traction, mostly thanks to the growing liquid-staking ecosystem.

- StakeWise (SWISE) is a staking app on Ethereum that is poised to ride the narrative of liquid staking.

- BrainDrops is an NFT platform for AI-generated art. I believe one of the collections on the platform, Brain Loop, is undervalued.

Contents

Pendle (PENDLE)

Why I like PENDLE: After nearly 2 years on Ethereum mainnet, Pendle is finally gaining traction. It is the market leader for tokenising and trading future yield; activities that will become more common as liquid staking grows. Smart-contract risk is particularly relevant to Pendle due to its various token contracts and supported protocols.

Pendle is a DeFi yield-trading protocol that lets you execute various yield-management strategies. It is built on Ethereum and governance is powered by vote-escrowed PENDLE (vePENDLE). It is also available on Avalanche and, as of last week, Arbitrum.

Having loosely followed Pendle since it launched in Jun. 2021, the protocol has captured more of my attention of late as it has gained traction predominantly because it has bolstered support for the fast-growing liquid-staking ecosystem.

Pendle supports several liquid-staking protocols and the core team wants it to become the go-to hub for liquid-staking tokens. The below example illustrates why liquid-staking holders are warming to Pendle.

- You, an ETH holder, stake through Lido and get stETH in return at a 1:1 ratio.

- You wrap your stETH to wstETH using Lido’s wrapper.

- You assess Pendle’s liquidity pools and choose to provide liquidity in the form of wstETH into one of Pendle’s pools (e.g. Aura wrstETH–WETH) and begin earning additional PENDLE, all whilst still accumulating stETH interest—which is automatically compounded.

- (Optional: Returns can be further boosted by locking up PENDLE in return for vePENDLE.)

With the rise of liquid staking, I think a strong few months await PENDLE and expect it to outperform BTC and ETH—assuming the crypto market doesn’t collapse.

Fundamentally, Pendle’s recent growth is encouraging. In particular, total ETH locked in the protocol is currently at an all-time high of 17,290 ETH.

Total ETH locked in Pendle since Jun. 16, 2021 (Source)

Total ETH locked in Pendle since Jun. 16, 2021 (Source)

StakeWise (SWISE)

Why I like SWISE: This is a narrative pick. As I covered recently, staking will be crypto’s major theme in 2023. Liquid staking will be one staking category that performs strongly. StakeWise isn’t without its challenges—fierce competition being the most notable—but I like SWISE from a risk-reward standpoint.

Launched in Mar. 2021, StakeWise is a staking app on Ethereum that lets you stake any amount of ETH to help secure the network and earn staking rewards. When you stake ETH with StakeWise, you receive sETH2 in return, which can be used with other apps on Ethereum. Staking rewards are paid out in a separate token, rETH2.

Two staking options are available with StakeWise:

- StakeWise Pool for staking any amount of ETH together with other stakers.

- StakeWise Solo for setting up a solo, non-custodial validator with blocks of 32 ETH.

The StakeWise DAO takes a 10% flat fee on rewards earned by StakeWise Pool. It also has an institutional offering in partnership with Blockdaemon.

As of this writing, 85,572 ETH is staked through StakeWise. (For comparison, 5.2M ETH is staked through Lido; 1.1M ETH is staked through Coinbase; 409,288 ETH is staked through Rocket Pool; and 98,966 ETH is staked through Frax.)

Last September, StakeWise V3 was announced. Among other things, V3 is introducing the concept of layered staking, which gives you the ability to (i) delegate ETH to your preferred node operator/s (i.e. the first layer), and (ii) gives you the option to mint osETH to represent your stake (i.e. the second layer). More on StakeWise V3 in the below video and this whitepaper. (Also, this Dune board by @jgf1 is my go-to for monitoring StakeWise activity.)

As of this writing, V3 has no mainnet launch date. That said, with Ethereum’s ‘Shanghai’ upgrade slated for March, I’d hope V3 can be deployed to mainnet by the end of May—assuming the codebase is safe, of course!

BrainDrops

Note: The following isn’t a low-cap crypto-asset, but rather a platform upon which NFTs are launched. For the sake of portfolio management, I include mid-cap crypto-assets, low-cap crypto-assets and NFTs in the same high-risk category. This is why I’m covering it in this post.

BrainDrops is an NFT platform and community for AI-generated art. It is essentially trying to be to AI-generated art what Art Blocks is to generative art. (For those unaware, Art Blocks is one of the largest NFT companies. Several coveted collections have launched on Art Blocks such as Fidenza, Ringers, Gazers and Chromie Squiggle.)

This year, I believe BrainDrops collections are well-positioned to benefit from the recent AI boom ignited by the likes of ChatGPT and DALL-E 2. It’s no coincidence that BrainDrops has had its breakout moment in recent weeks, despite being operative during the NFT hype of late 2021 and early 2022.

This month, BrainDrops has gained notable traction after a new collection, Life In West America (LIWE) captured the imagination of many. Created by Roope Rainisto, the 500-piece NFT collection minted on Feb. 8 for 0.10 ETH.

Last week, LIWE’s floor price hit as high as 13 ETH after the world’s largest NFT investment DAO, Flamingo, confirmed its acquisition of several LIWE NFTs, including ‘Across the Ocean’, ‘Ready to Sign’, ‘Bon Appetit’, ‘Rainbow Warrior’, ‘Missionairies’ and ‘Slurpee’. Earlier this month, Flamingo also confirmed its acquisition of another NFT from a BrainDrops collection, miniPODs.

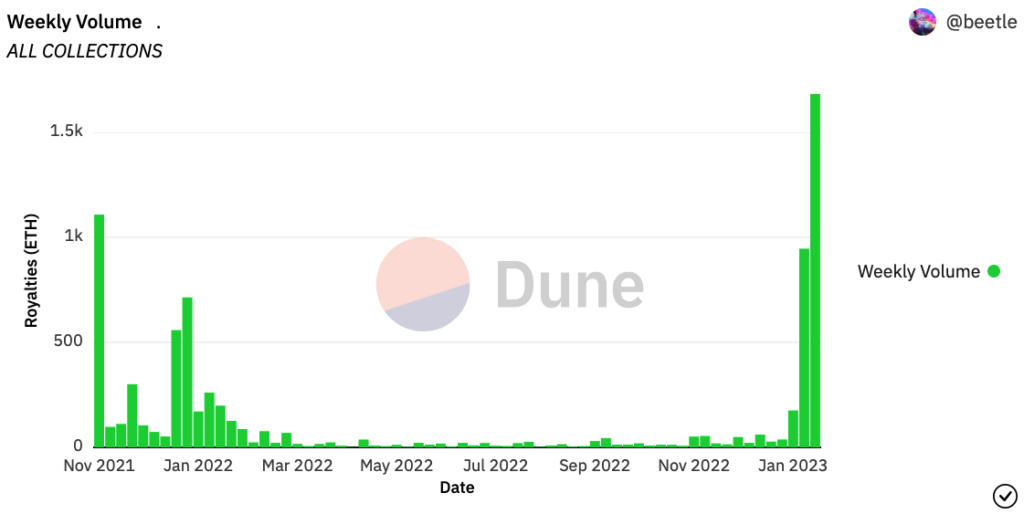

Royalties paid across all collections has soared recently, largely due to launch of LIWE (Source)

Royalties paid across all collections has soared recently, largely due to launch of LIWE (Source)

For every new collection on BrainDrops, day-one holders are eligible for pre-minting. Day-one holders are those who hold at least one of each of the first 3 collections released on BrainDrops: Brain Loops, podGANs and Genesis.Given this valuable perk, I believe Brain Loops is undervalued at the current floor price of 1.93 ETH.

For more on BrainDrops and the collections launched on it to date, read the below thread by @MoonCat2878. (Note, the author is heavily invested in BrainDrops collections. Still, the thread is valuable.)

Recap

As I said in my 2023 preview, I expect the overall crypto market to finish the year more or less flat. However, that doesn’t mean there won’t be several crypto-assets and NFTs that significantly outperform the market.

The above trio has the potential to be in this small group. That said, I don’t hold any at present and, if I did, I’d only be allocating a maximum of 0.5% of my portfolio to any one of these.