These monthly reports—available to Pro members only—cover altcoins that have recently caught our analysts’ attention. In these reports, we share our opinion on these altcoins’ progress and outlook. (For the purpose of this report, altcoins are defined as cryptocurrencies that are not BTC or ETH.)

Key Takeaways

- Polkadot continues to develop and expand its ecosystem, but its level of onchain activity leaves a lot to be desired. While stakeholders will be hoping the recently proposed ‘Polkadot 2.0’ can reignite user interest, it’ll be a long time until it is fully released.

- Arbitrum is making strides to reduce trust as much as possible, making it more appealing for users and developers. Separately, by year-end, expect the release of Stylus, an ambitious solution to allow web developers, not just Solidity developers, to build apps on any Arbitrum chain.

- Aave officially has a native stablecoin. The long-awaited GHO stablecoin went live in July and will likely be used in the growing sector of real-world assets (RWAs) as well as other areas.

- Ethereum Name Service is prioritising decreasing user fees by incrementally transitioning it away from Ethereum mainnet onto an L2.

- Maple has launched multiple offerings and raised additional capital in recent months, leaving it well-positioned to fill the lucrative gap in the crypto-lending market left behind by last year’s high-profile lender collapses.

Contents

Polkadot (DOT)

Analyst take: Despite Polkadot’s ongoing development and ecosystem growth, onchain activity remains lacklustre. The recently proposed ‘Polkadot 2.0’ promises to replace the parachain model, which has struggled for adoption. It will be a long time before this is fully released, though.

Mixed Performance So Far In 2023

Below are some year-to-date highlights for Polkadot.

- Launch of OpenGov: The new governance model allows DOT holders to leverage a more efficient and transparent decision-making process.

- Major upgrade of Polkadot’s cross-consensus messaging standard: XCM v3 enabled new features such as further asset exchanges and improved programmability.

- Avoided the SEC’s crosshairs (so far): The U.S. SEC has yet to allege that DOT is an unlawful security, despite doing so this year for the native tokens of some of Polkadot’s direct competitors. (For what it’s worth, the Web3 Foundation claimed last November that DOT had “morphed” into a non-security.)

- Relatively strong developer activity: Polkadot remains one of the blockchains with the highest development activity, ranking #1 for total developers on Santiment and #2 on Electric Capital’s Developer Report.

- Sustained levels of parachain demand: Some of the first parachains (e.g. Acala, Moonbeam) have renewed their leases, and some external projects (e.g. Mythical Games, Energy Web) have announced plans to migrate to Polkadot with the intent to operate a parachain.

Despite the positives, Polkadot remains with several issues with its parachain model.

- Volatile demand for parachains: The latest parachain slot was won with a relatively low bid of $55,000.

- High and variable costs: Rental costs spike in bull markets, with the first parachain secured for $1.3B. It’s a high barrier to entry, and the variable auction prices deter adoption from startups due to the difficulties it creates for planning and budgeting.

Even though Polkadot has relatively high developer activity and 45 parachains, its usage is rather underwhelming.

- Nearly 4 million ‘unique accounts’ across the Polkadot ecosystem. This is a rather small aggregate figure. Year-to-date growth of 600,000 accounts is somewhat encouraging, given the market conditions.

- Exceptionally low TVL of $137M: Value held in the Polkadot ecosystem lags most other L1s and represents less than 1% of total crypto TVL.

- Less than 1% of stablecoins live in the Polkadot ecosystem: A trivial amount of USDT and other stablecoins exist on Polkadot. Encouragingly, the upcoming launch of USDC on Polkadot should provide much-needed stablecoin support.

Polkadot 2.0: Going Beyond Parachains

At Polkadot’s yearly conference in June, co-founder and chief architect Gavin Wood shared his take on the project’s future, proposing to overhaul the restrictive parachain model with ‘Polkadot 2.0’. This new design would see Polkadot transition from selling limited parachain slots to selling more flexible space to operate.

Polkadot 2.0—which presumably won’t fully launch until 2024 or 2025—is essentially an attempt to overcome the limitations of the parachain model by promising the benefits listed below.

- Optimise resource allocation: Not all parachains run at capacity. Moving away from parachains towards general space helps to use idle resources.

- Improve flexibility and reduce cost volatility: Moving to a more variable method of selling more general space rather than parachain slots.

Arbitrum (ARB)

Analyst take: August’s announcement of the BOLD protocol was the latest sign of progress being made to decentralise Arbitrum chains, lowering risks for users and developers. Another recent highlight for Arbitrum was Stylus, an ambitious project by Offchain Labs that will let regular web developers build smart contracts and deploy them on any Arbitrum chain. Offchain Labs released Stylus on testnet in August and expects to propose it to Arbitrum DAO by year-end.

New System That Lessens The Need to Trust Arbitrum

In early August, Offchain Labs announced BOLD, a system that effectively lets anyone validate Arbitrum chains.

Since launch, Arbitrum has had a permissioned set of roughly a dozen validators, meaning that anyone using Arbitrum has to trust that at least one of the validators will act honestly and validate that everyone’s transactions are going through correctly. This is an example of a trust assumption. The fewer trust assumptions that you have to make when using a blockchain, the better.

Once the BOLD protocol goes live—assuming Arbitrum DAO votes to adopt it—Arbitrum’s permissioned validator set will become permissionless, allowing anyone to safely challenge something they think is incorrect, ensuring the correct outcome prevails.

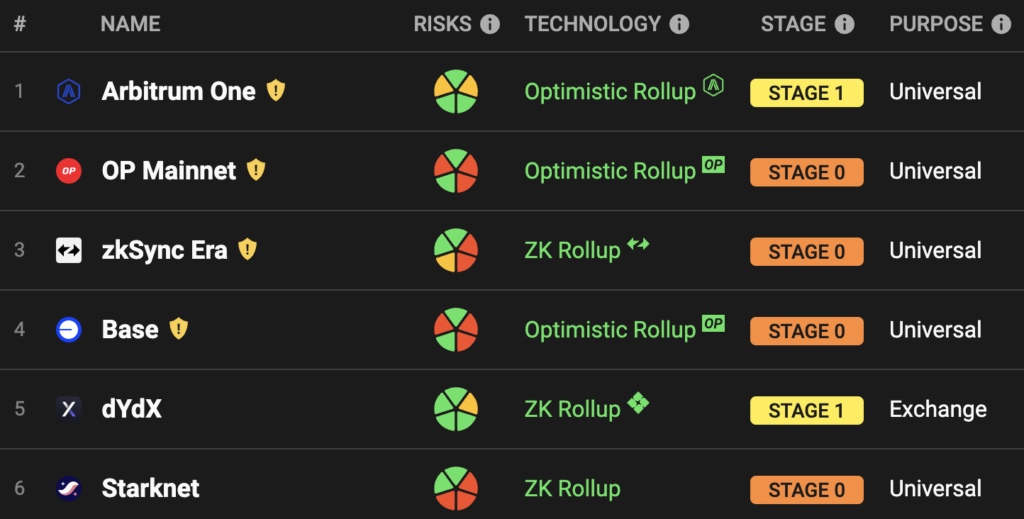

This will help Arbitrum chains become more decentralised, extending the lead it has over its closest competitors (e.g. OP Mainnet, zkSync, Starknet). According to L2BEAT’s industry-leading three-stage schema for measuring L2 decentralisation, Arbitrum One is already the only general-purpose rollup in Stage 1. The release of BOLD will get it closer to reaching the coveted Stage 2. (See Nick’s latest post for more on L2 decentralisation and why it matters.)

Stylus to Bring Popular Programming Languages to Arbitrum

On Aug. 31, Offchain Labs released its testnet for Stylus, software that will let developers build smart contracts in more widely used programming languages (e.g. Rust, C) rather than niche EVM languages (e.g. Solidity).

Stylus is significant for many reasons, the main one being that it will expand Arbitrum development “from about 20,000 Solidity developers to millions of developers using Rust and C, while retaining full interoperability and composability with traditional EVM contracts,” the team explained in its announcement.

Offchain Labs aims to propose Stylus to the Arbitrum DAO by year-end. If approved, it will be able to work with any Arbitrum chain.

In the below 30-minute presentation by Rachel Bousfield, who led the Stylus project at Offchain Labs, she breaks down why Stylus matters and how it works.

Aave (AAVE)

Analyst take: Along with all other DeFi protocols, Aave has battled particularly adverse market conditions in the last 2–3 years, as has the AAVE token, which is trading 91% below its all-time high from May 2021. A long-awaited milestone was achieved in July when the GHO stablecoin went live on Ethereum mainnet. While it has struggled to hold its USD peg since launch, the hope is for GHO to become integral to Aave’s liquidity markets.

GHO Stablecoin Launches, Struggles to Maintain Peg

The GHO stablecoin, Aave’s largest project of the past year, launched on Ethereum mainnet in mid-July. Fundamentally, GHO is another attempt at a decentralised and collateral-backed stablecoin pegged to the U.S. dollar. It is hoped that GHO will become an integral part of Aave’s liquidity markets.

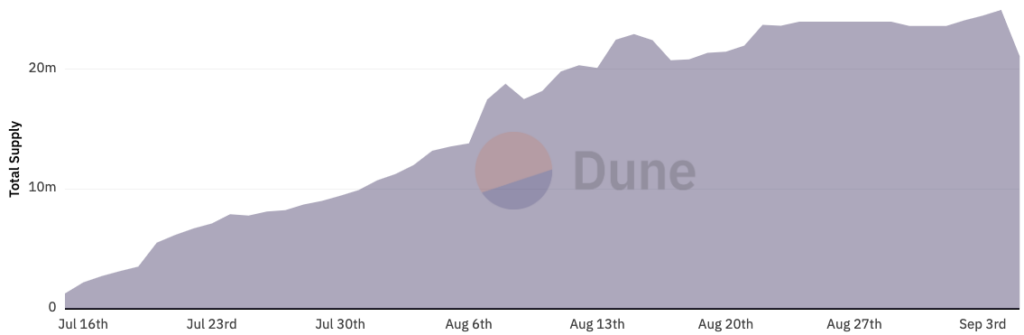

Since launch, GHO has struggled to maintain its peg. Supply grew strongly in the stablecoin’s first few weeks, as the below chart shows. “One of the primary reasons for this growth, especially in the current adverse market conditions, is the GHO borrow rate set below the market price of stablecoin borrows,” said Mark Zeller, founder of Aave Chan Initiative, in a recent proposal to increase the borrow rate of GHO in an effort to re-peg it.

Leaning Into Real-World Assets (RWAs)

Aave’s potential expansion into RWAs has long been a talking point within the community. It appears the project is finally ready to more meaningfully enter into RWAs, a budding sector of crypto that has grown considerably this year largely due to aggressive rate hikes by central banks around the world.

Once GHO is live for a while longer, expect proposals to start being submitted to Aave DAO from prospective facilitators. Unique to GHO’s design, facilitators can trustlessly mint and burn GHO tokens through various strategies. It’s only a matter of time before entities specialising in RWAs start submitting proposals to become facilitators. (Even in GHO’s launch announcement, RWA is referenced as a potential facilitator.)

Lastly, further signalling a fit between Aave and RWAs, Aave Companies—the technology company best known for leading the initial development of the Aave protocol—became a founding member of the Tokenized Asset Coalition (TAC) in early September, alongside the likes of Coinbase, Circle, and others. The TAC aims “to bring the next trillion dollars of assets onchain through real-world asset tokenisation, education and advocacy.”

Ethereum Name Service (ENS)

Analyst take: ENS Labs is focused on incrementally transferring the ENS protocol from Ethereum mainnet to an L2. If this can be achieved, interacting with the protocol (e.g. buying or renewing a .eth name) should become considerably cheaper, helping spur adoption and solidify ENS’ market-leading position.

Making ENS Cheaper To Use

Over the years, interacting with the ENS protocol has been very costly for users, limiting the project’s growth. Recently, ENS Labs shared updates on 2 initiatives geared towards lowering these costs.

1. ENS on L2s. Parts of the ENS protocol will progressively be transferred to L2s, starting with a ‘minimum viable L2’ on Optimism. This builds on prior efforts to store certain subdomains records on other networks (e.g. cb.id (Base), lens.xyz (Polygon PoS), ecc.eth (OP Mainnet)). Support on Arbitrum, Starknet and Linea is being worked on. ETA: Gradual rollout into 2024.

2. Gasless DNS migration. Enabling DNS names (i.e. traditional web domain names) inside ENS with zero ENS reactions or gas used. ETA: Testnet in Q3 and mainnet by year-end.

Beyond making the ENS protocol cheaper to use, other notable roadmap items for ENS Labs include rolling out its first paid media and ad campaign and improving v3 of the manager app.

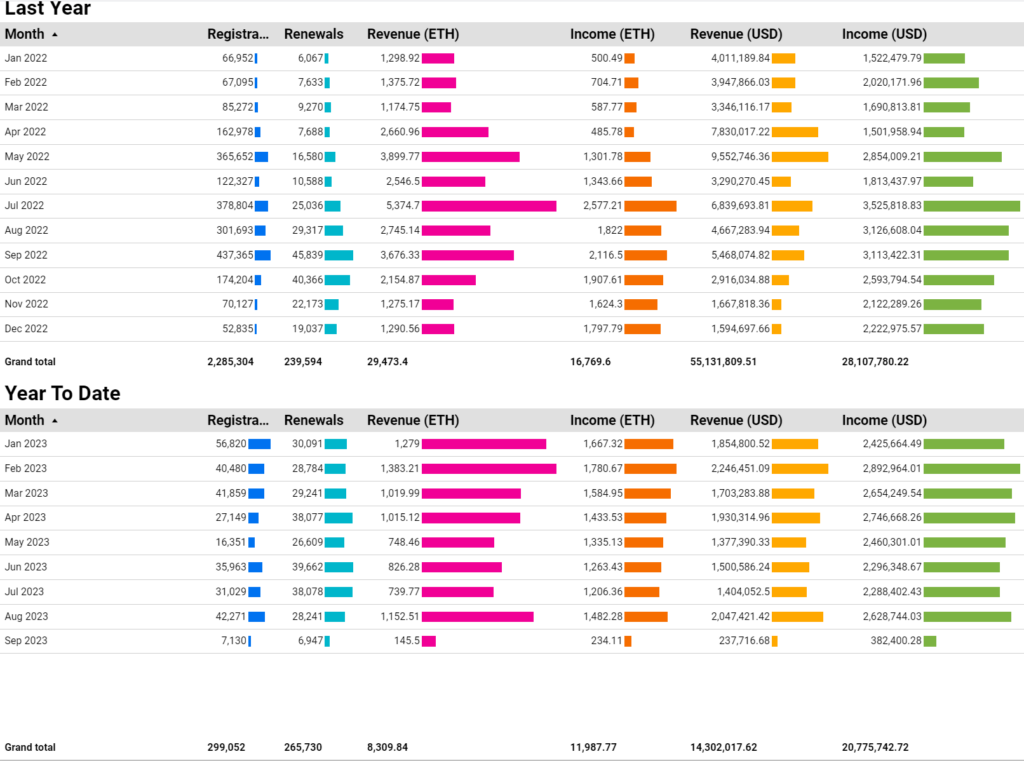

Large Treasury Can Withstand Slide In Metrics

As illustrated below, financial metrics are down across the board for ENS this year—just like nearly all other crypto projects.

Encouragingly, though, ENS DAO boasts one of the largest DAO treasuries in the world—some of which is actively managed to earn additional yield—helping ensure it can weather any prolonged market downturn.

Maple (MPL)

Analyst take: Maple’s new products and capital injection leave it well poised to take advantage of the void left behind after the collapse of some of the industry’s largest lenders (e.g. BlockFi, Genesis, Celsius). In the short term, however, Maple will continue to battle fierce competition from traditional financial credit markets, where interest rates have increased considerably in the past year.

New Lending Product, U.S. Approval & Solana Return

In July, the team launched Maple Direct, a direct lending desk to underwrite and issue loans to web3 businesses with outside capital from institutional allocators across the globe.

Amid a hostile regulatory environment for DeFi in the U.S., Maple surprised many in early August when it announced that U.S.-domiciled accredited investors and entities could now use its onchain cash management pool. As covered in our coverage of Maple in April’s Altcoin Report, the pool was initially only available to companies and DAOs that were domiciled outside of the U.S.

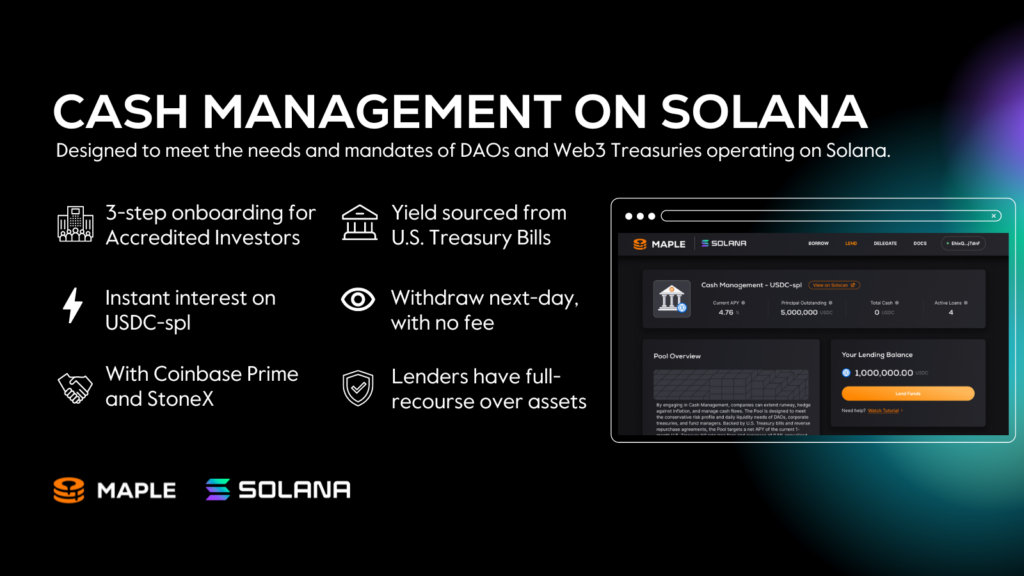

Later in August, Maple reinstated support for Solana some 8 months after removing its offerings from the blockchain in the wake of the FTX collapse. Support will Maple’s cash management solution, where allocators will be able to deposit USDC-SPL and earn net APY that is similar to the rate offered on a 1-month U.S. Treasury bill.

New Funding to Fuel Geographic Expansion

In what was a busy August for Maple, the team announced the raise of $5M in strategic funding. The round was co-led by BlockTower Capital and Tioga Capital. The capital will be used to expand deeper into Asia and Latin America, and to continue building out Maple Direct.

Upcoming Milestones & Conferences

| Project | Event | Expected Date |

|---|---|---|

| Frax (FRAX) | Frax v3 release | September |

| Polkadot (DOT) | Sub0 Europe 2023 | Sep. 19–20 |

| dYdX (DYDX) | dYdX v4 release | End of September |

| Chainlink (LINK) | SmartCon 2023 | Oct. 2–3 |

| Solana (SOL) | Breakpoint | Oct. 30–Nov. 3 |

Want more altcoin content? See August’s report covering SOL, MATIC, UNI, LINK and MKR.