These monthly reports—available to Pro members only—cover altcoins that have recently caught our analysts’ attention. In these reports, we share our opinion on these altcoins’ progress and outlook. (For the purpose of this report, altcoins are defined as cryptocurrencies that are not BTC or ETH.)

Key Takeaways

- Cosmos Hub is finally releasing a new security model that will, among other things, improve ATOM’s utility. Meanwhile, the way in which Ethereum L2s are developing is an increasing threat.

- Lido continues to perform despite increased discussion and awareness of the potential risks it poses to Ethereum.

- Optimism transaction fees have been slashed thanks to a recent upgrade. The first OP Stack chain launched in June. Coinbase’s Base and others will launch by year-end.

- Arweave is posting record transaction volumes despite facing challenges caused by a sharp decline in NFT activity.

- Illuvium raised $10M to extend its runway and recently launched two early releases. After multiple missed deadlines, private testing of the main games is nearly done.

Contents

Cosmos Hub (ATOM)

Analyst take: The first consumer chains are finally nearing launch. This will allow ATOM stakers to earn more revenue and, all else being equal, should increase demand for ATOM. Despite the positives, the rise of Ethereum L2s creating their own infrastructure may seriously threaten Cosmos Hub’s point of difference.

First Chains To Be Secured By ATOM

Cosmos Hub’s most significant value-accruing change, ‘Replicated Security’, went live in March. In short, this feature allows Cosmos Hub validators to leverage their staked ATOM to provide security to other Cosmos-linked chains. (As explained in February’s Altcoin Report, chains that use Replicated Security are called consumer chains. These differ from chains built with the Cosmos SDK (e.g. Osmosis (OSMO)), which are secured by their own validator set.)

Neutron (NTRN) will be the first consumer chain, with Stride (STRD), Duality and Noble all planning votes to be secured by Cosmos Hub validators’ staked ATOM.

Notably, Duality will not have a native token and will instead use ATOM for gas payments and governance. It matters because it sums up the value proposition for ATOM holders, with all fees—beyond those that go to liquidity providers—going to ATOM validators and delegators.

Increased Competition From Ethereum L2s

The first half of 2023 was notably marked by the popularity of Ethereum L2s and the development of their own infrastructure to allow dapps or other networks to build “on top” or around their respective ecosystems. Examples include Arbitrum’s Orbit, Optimism’s OP Stack and zkSync’s ZK Stack. Polygon is also incrementally unveiling its Polygon 2.0 roadmap.

These models compete with application-specific blockchains (appchains) on Cosmos Hub, which allow a dapp to create a custom blockchain. Further adding to the depth of competition for Cosmos Hub, a new Ethereum-based protocol, EigenLayer, more or less brings Replicated Security to the Ethereum ecosystem.

If developer teams can inherit elements of the security of Ethereum and other L2s while creating their own siloed, custom apps, why would they build on Cosmos Hub—which, in some cases, offers lower security guarantees? Ultimately, if more builders choose Ethereum L2 technology, demand for ATOM will fall.

Lido (LDO)

Analyst take: Lido’s dominance is largely unchanged this year, despite heightened discussion and awareness of the potential risks it poses to Ethereum’s security. Its Ethereum-based liquid-staking derivatives (LSDs)—stETH and wstETH—have become the backbone of the fast-growing LSDFi sector. With so many sources of competitive advantage, Lido and LDO are poised to play major parts in the next prolonged crypto bull market.

Lido Still Dominating After Short-Term Uncertainty

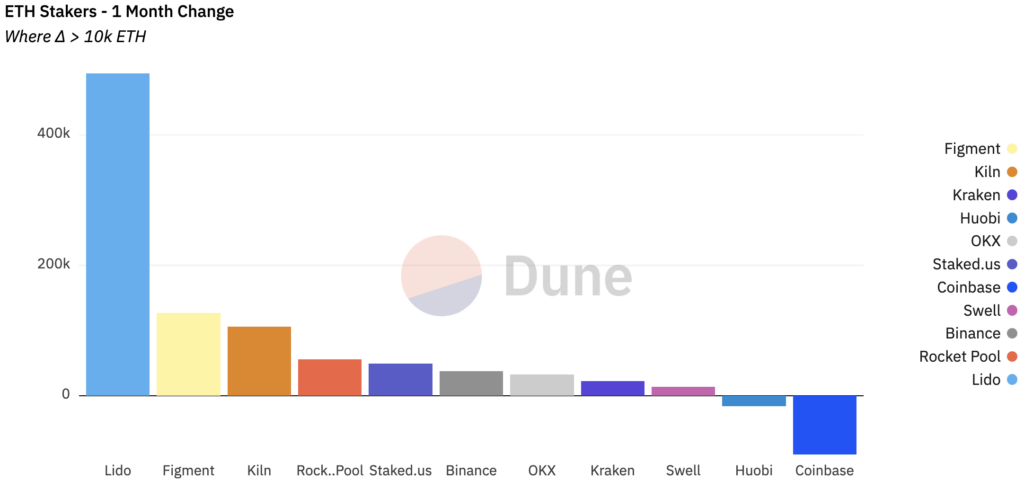

Lido has long been criticised for its sheer size. At times, it has been responsible for more than 33.33% of all staked ETH. This percentage is considered a critical threshold that can jeopardise a blockchain’s security. (The critical thresholds of 50% and 66.66% are even more threatening.)

Leading up to the enabling of staked ETH withdrawals in mid-April, short-term uncertainty surrounded Lido, with some predicting that it would suffer net outflows after the upgrade. The cause of the uncertainty was heightened awareness of the potential risk it poses to Ethereum’s core values of censorship resistance and credible neutrality.

It’s been nearly 3 months since the update. Debates about Lido are ongoing. However, one thing’s certain: fears of net outflows proved unwarranted.

Indeed, staked ETH on Lido has continued increasing. More importantly, the percentage of all staked ETH controlled by Lido has held between 30% and 32%, where it’s been basically all year.

For all the talk about Ethereum’s core values and the risks of Lido, the market is clearly unfazed. They continue to choose Lido because of its vast competitive advantages in areas such as integrations and liquidity.

DeFi Market Increasingly Using stETH As Collateral

Year to date, one of the most noteworthy market trends has been the increased use of LSDs in decentralised finance (DeFi), where holders are putting them down as collateral to take out loans and earn additional yield. (The enabling of ETH withdrawals accelerated this trend because it significantly reduced the risk of holding LSDs.)

This is why one of the key success metrics for liquid-staking protocols is the extent to which their corresponding LSDs are integrated with DeFi apps and protocols. The more integrations, the more options that LSD holders have to earn yield.

Given Lido’s dominance in the budding liquid-staking market, it’s no surprise that stETH and wstETH are far more deeply embedded in the DeFi sector than other LSDs. (wstETH is a wrapped version of stETH that more easily integrates with DeFi protocols. Simply put, you can do more stuff with wstETH. Sames goes for wrapped ETH (wETH).)

When you look at a chart of the historic supply of wETH, you can easily guess when DeFi boomed in the second half of 2020. In a 4-month period ending Oct. 2020, the supply of wETH tripled to as much as 7.9 billion. At one stage, the wETH contract address held 7% of the entire circulating supply of ETH.

Now, in mid-2023, a similar story looks to be unfolding with a wave of LSD-driven innovation reinvigorating the DeFi sector. We may be witnessing the early stages of a structural shift in DeFi, where yield-bearing staking derivatives are preferred as collateral relative to ETH.

While it’s too early to tell whether this will become the norm, the trend—known as LSDFi—isn’t slowing. In early April—crucially, before the enabling of ETH withdrawals—there was roughly $100M worth of LSDs locked in DeFi protocols. As of this writing, there is $688M. Which LSDs are making up this total? 87.9% of it is Lido’s stETH and wstETH.

For stETH and wstETH, the integrations are coming thick and fast. The recent one with Pyth Network (see below) was particularly noteworthy. The longer this continues, the better it will be for Lido—which already has the highest TVL of any protocol across all markets—and, by extension, the value of LDO.

Optimism (OP)

Analyst take: Optimism is now significantly cheaper to use, thanks to a major upgrade in early June. More teams are building OP Stack chains, with the most anticipated (i.e. Coinbase’s Base) nearing launch. Ethereum’s next major upgrade will significantly benefit L2s such as Optimism and may go live by year-end. Amid lacklustre demand for altcoins, OP has one of the best chances to outperform through year-end.

Major Upgrade Delivers on Cheaper Transaction Fees

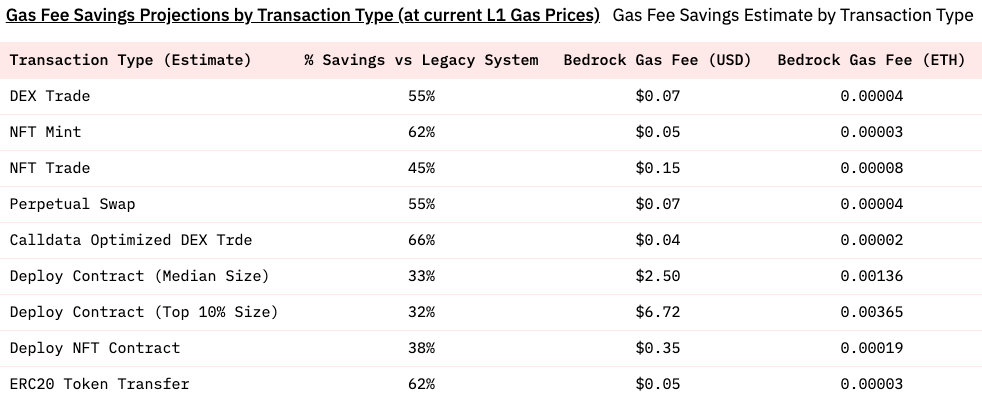

Earlier in June, Optimism’s long-awaited Bedrock upgrade went live. This upgrade had been highly anticipated because it promised to slash transaction fees. Encouragingly, Bedrock has delivered on this promise. Since Bedrock was released on Jun. 6, average gas fees have roughly halved.

Beyond lower fees, Bedrock has benefitted Optimism by considerably shortening deposit times to a few minutes and improving the performance of OP Mainnet nodes. (More on these and other benefits.)

Adoption of OP Stack

More teams continue to build with Optimism’s OP Stack, a set of modular components that can be assembled to build custom chains to fit any use case. Examples of OP Stack chains, most of which are yet to launch, are Base, Zora Network, Aevo, Kinto and Public Goods Network (PGN).

Launching an OP Stack chain has become considerably easier in recent months. This is partially due to the arrival of infrastructure providers such as Conduit and Caldera, which let users create production-ready OP Stack chains in a few clicks.

Then there are those who are contributing to the OP Stack ecosystem in other ways. For example, a16z crypto recently announced Magi, a second rollup client for the OP Stack ecosystem. (Previously, builders were forced to use a rollup client built by OP Labs.)

Expect more OP Stack chains to be announced soon. As they launch, more activity and greater economic value will presumably flow to the Optimism ecosystem. All else being equal, the OP governance token should become more valuable as the Optimism ecosystem becomes responsible for larger sums of economic value.

(While OP is purely a governance token today, its utility may increase eventually. For example, holders could stake their OP in order to participate in a shared-sequencer network, receiving a portion of sequencer revenue as compensation. Research into how to decentralise the sequencer’s role is ongoing. Today, L2s such as OP Mainnet and Arbitrum One use single sequencers.)

Arweave (AR)

Analyst take: Arweave is one of the simpler value propositions in web3, solving the need for permanent onchain data storage. While the brutal NFT bear market has lowered demand from certain Arweave users, the variety of teams building on the network is diverse. So much so, that monthly transactions on Arweave are higher than ever.

Impacted By The NFT Bear Market, But Building Continues

Arweave has been challenged by the NFT bear market. The number of new collection mints, projects launching, and NFT-related transaction activity have all plummeted. Worse still, in March, Meta cancelled its NFT support for Facebook and Instagram, where Arweave was the default NFT storage solution.

This affects Arweave because it benefits from NFT usage. All else being equal, lower NFT activity results in less data being stored on Arweave, hurting revenue and the value of the AR token.

Despite these challenges, startups continue to build on Arweave. For example, Othent is building Arweave wallets into web2 accounts and already has 16 service providers (e.g. Google, Twitter)—equating to more than 5 billion social accounts—and Bundlr is scaling Arweave with the largest crypto social network, Lens, with promising results.

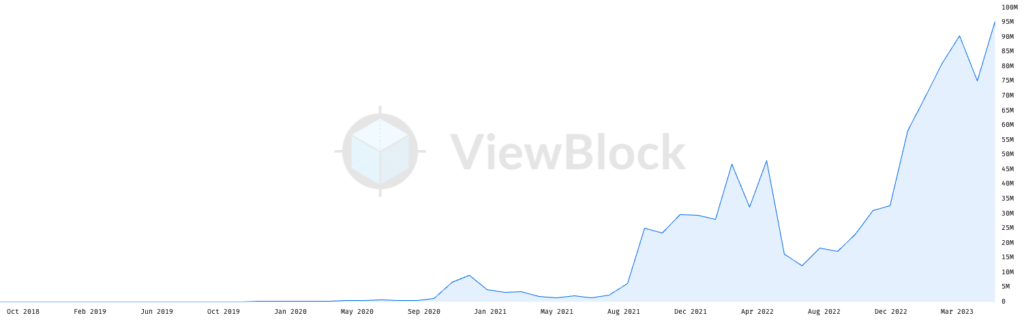

Mixed Onchain Performance

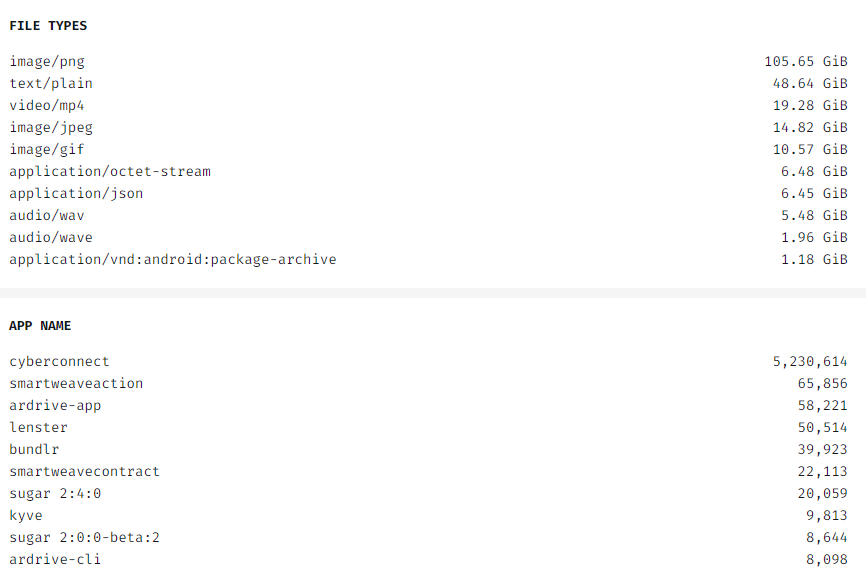

Arweave’s onchain data tells a mixed story. On one hand, decreased NFT activity has resulted in the lowest levels of data uploaded to Arweave since September 2021. Yet, on the other, monthly transactions are at all-time highs. According to a recent tweet by founder Sam Williams, “the average monthly growth rate has been ~23.5%, compounding, for 4 years straight.”

Why is Arweave growing so strongly while the NFT market is crashing?

The use cases of NFTs are far more expansive than many realise. NFT art (e.g. Fidenzas) and avatars (e.g. Bored Ape Yacht Club, CryptoPunks) get all the attention because of the price-speculation component. While these have crashed in the past year, fortunately for Arweave, other uses of NFTs have kept advancing. Some of these are listed below.

- Social and writing NFTs: Social NFTs (e.g. Lens) and writing NFTs (e.g. Mirror) orare consistent users. Lens alone settled 250,000 transactions between May 20 and June 18.

- Preserving online information: Projects such as Capsl8 have built ancientinternet.org to permanently archive Twitter accounts and tweets. Others, such as Alex., are preserving important historical artifacts (e.g. history books in the public domain, Russia–Ukraine conflicts, Zero-COVID).

- Web3 data networks: The likes of Streamr and CyberConnect are using Arweave as a storage layer.

- Video, audio and applications: Outside of images or text, there’s growing demand to use Arweave for video and audio storage.

Additionally, platforms such as ZORA and Manifold give creators the ability to store their NFTs’ metadata on Arweave. (Notably, Manifold—a creator launchpad that has been one of the very few startups to grow strongly in 2023—has exclusive support for Arweave in its Manifold Studio product.)

Illuvium (ILV)

Analyst take: Illuvium remains a highly anticipated crypto-native game yet to release. Positive steps have been made to extend its runway and launch two early game releases, with the main games entering the final stages of private testing. Despite the positives, Illuvium’s exceptionally high development load casts doubt over whether the team can deliver a feature-rich game in 2024.

Runway Extended Thanks to $10M Investment

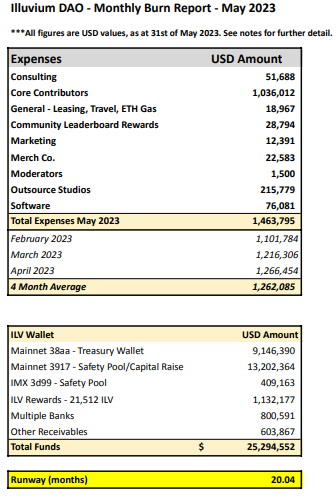

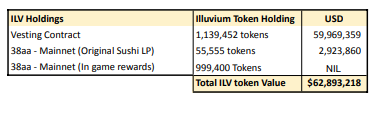

As covered in our bear case on the ILV asset page bear case, Illuvium’s operational expenses are relatively high. Its monthly burn rate has averaged above $1.25M since February. Encouragingly, financial pressures were somewhat alleviated recently after Framework Ventures purchased $10M worth of ILV from the treasury, extending Illuvium’s runway to 20 months. (The ILV is locked for two years, and Framework cannot stake it.)

Slowly Progressing on Ambitious Roadmap

Illuvium has been widely criticised for its well-capitalised team’s slow development times. Most games remain unreleased. That said, it did recently complete two milestones:

- Release of Illuvium Beyond and first public sale. Encouragingly, the three-day sale generated the equivalent of $4.75M. Additionally, Illuvium sold GameStop-branded collectibles in June, where over 10,000 of the 20,000 for a unit price of $50 worth of ETH.

- Launched Illuvium Zero Alpha Season 1 in May. While this was an exciting event in Illuvium’s history, it was later described as a “challenging release” by the game director in a post-mortem.

Given Illuvium’s overly ambitious product roadmap, more delays would not be surprising. Beyond building the games themselves, the roadmap includes token-staking improvements, account designs and the cinematic story.

Any 2024 release will likely be feature-limited. According to the team, “there’s still a long way to go for Overworld, even past the Public Beta. The world will be more interactive, fun to traverse, and exciting.”

| Product | Brief Description | Status |

|---|---|---|

| Illuvium Beyond | Trading card game | Wave 1 launched |

| Illuvium Zero | City-builder game powering the in-game economy | Limited launch for holders |

| Illuvium Overworld | Open world where players capture creatures | Private Beta 2 |

| Illuvium Arena | Player-vs-player battle arena | Private Beta 3 |

| IlluviDex | In-game DEX and marketplace | TBA |

| Game Launcher | One-stop shop to interact with the Illuvium world | Delayed, possibly Q4 |

Upcoming Milestones & Conferences

| Project | Event | Expected Date |

|---|---|---|

| Starknet | Alpha v0.12.0 | Jul. 12 |

| Ethereum (ETH) | EthCC 6 | Jul. 17–20 |

| Litecoin (LTC) | Halving of block subsidy | Aug. 2 |

| Chainlink (LINK) | SmartCon 2023 | Oct. 2–3 |

| Cosmos (ATOM) | Cosmoverse 2023 | Oct. 2–4 |

| Solana (SOL) | Breakpoint | Oct. 30–Nov. 3 |

Want more altcoin content? See May’s report covering LINK, ARB, AAVE, DYDX and ENS.