This resource shares insights on how to think about structuring crypto portfolios, highlights common mistakes and includes examples of portfolio structures.

Information contained in this resource is not to be considered financial advice of any kind. You should obtain independent legal, financial, taxation and/or other professional advice regarding any financial decision. You acknowledge that any information provided is generic in nature and does not take into account your specific circumstances. Everyone’s portfolio will be different.

Key Takeaways

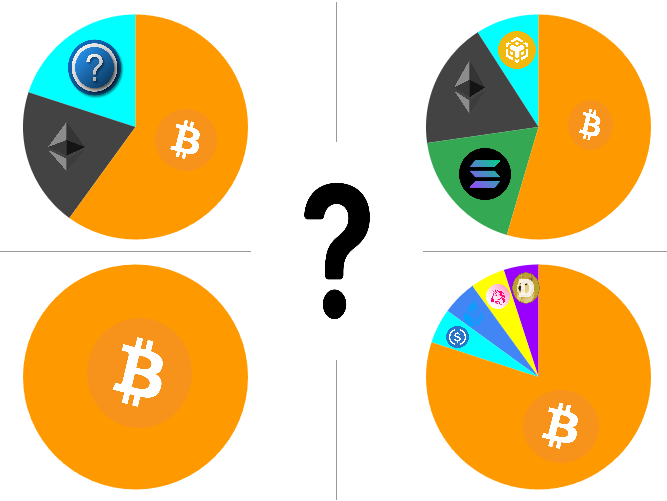

- Crypto portfolios vary significantly by composition and risk.

- They generally fall into one of these categories:

- Beginner (Lowest Risk): Only BTC or BTC and ETH

- Intermediate (Medium Risk): BTC, ETH and altcoins ranked in the top 100 by market cap.

- Advanced (Highest Risk): Everything in ‘Intermediate’ plus the highest risk crypto-assets (e.g. memecoins; crypto-assets ranked beyond the top 100; NFTs).

- Your version of the optimal portfolio composition will depend on your personal circumstances, goals, and risk tolerance.

Contents

Different Portfolios For Different People

Before we get into mock portfolios, the biggest thing to understand is everyone’s portfolios will differ. As the disclaimer says, please do not use this as any recommendations but merely as examples to help you understand factors to consider when it comes to portfolio construction.

People vary widely due to factors such as those listed below.

- Goals: What do you want to get out of cryptocurrency?

- Time horizon: How long are you willing to hold these cryptocurrencies?

- Risk appetite: How much risk are you willing to tolerate?

- HODL vs trading: Do you prefer to HODL or trade actively?

- Experience or skill: Do you understand how cryptocurrencies work and their associated risks?

The above questions will help shape whether more beginner portfolios (BTC and ETH) or more intermediate or advanced portfolios are for you, which take on more risk and require more knowledge. It all depends on your skill level, knowledge and risk. Everyone is different and will likely have a different goal and, thus, a different portfolio.

Common Mistakes

Over the years, through talking to hundreds of crypto users, we’ve heard many of the same issues or mistakes. These can be learning opportunities to guide your decision-making. Consider whether these apply to you. Below are some common ones.

1. Too Many Altcoins

Falling for the hype and the next shiny coin can be all too easy. And, before you know it, you’re holding 50–100 cryptocurrencies. Although this strategy may work for some, tracking each altcoin’s progress can become unmanageable. Culling some altcoins can make it easier for you to manage your portfolio.

2. Not Speaking With a Professional

Whenever your portfolio exceeds a certain number, it can be important to talk to a financial professional to ensure you’re managing your risk properly. This is even more pertinent to those who own a large number of altcoins, given the tax implications associated with owning them.

3. Not Enough BTC and ETH

While past performance is not always an indicator of future performance, Bitcoin remains the #1 cryptocurrency and the most battled-hardened, having survived many market cycles.

Arguably the most common mistake among new entrants to the market is ignoring BTC and ETH and going too hard on altcoins.

There is no rule about how much to hold in each, but a leading cryptocurrency index fund, the Bitwise 10 Crypto Index (BITW), has 80–90% in BTC and ETH.

| Name of Cryptocurrency (Ticker) | Weight |

|---|---|

| Bitcoin (BTC) | 73.1% |

| Ethereum (ETH) | 18.1% |

| Solana (SOL) | 4.0% |

| XRP (XRP) | 2.0% |

| Cardano (ADA) | 0.8% |

| Avalanche (AVAX) | 0.6% |

| Chainlink (LINK) | 0.4% |

| Polkadot (DOT) | 0.4% |

| Bitcoin Cash (BCH) | 0.4% |

| Uniswap (UNI) | 0.3% |

Separately, many vouch for the ’80/20′ rule when it comes to the composition of a crypto portfolio. Others also reference having no more than 2% in one altcoin to minimise losses. Use this as a guide only.

4. Not Considering the ETH or BTC Pair

A core reason for the above heavy weighting to BTC and ETH is because, over the long run, most cryptocurrencies underperform against BTC and ETH.

Mock Crypto Portofolios

Beginner (Lowest Risk)

Most new crypto investors start their journey by looking at altcoins, which is like diving into the deep end without ever learning to swim. Unsurprisingly, many become disenchanted with the entire asset class after having watched their portfolios shrink. For those reasons, many suggest taking time to learn about Bitcoin and to start with a BTC-only portfolio.

The reality is that cryptocurrencies are among the riskiest assets you can invest in. Therefore, for most newcomers, it probably makes sense to start by owning the least riskiest member of this highly risky asset class, BTC.

| Name (Ticker) | Classification | Rank by Market Cap |

|---|---|---|

| Bitcoin (BTC) | Currency / Store of Value | #1 |

Beyond this, consider learning about smart-contract platforms. The most widely used smart-contract blockchain is, by a substantial margin, Ethereum. Its native cryptocurrency is ETH, the second-largest cryptocurrency by market cap.

| Name (Ticker) | Classification | Rank by Market Cap |

|---|---|---|

| Bitcoin (BTC) | Currency / Store of Value | #1 |

| Ethereum (ETH) | Smart-Contract Platform | #2 |

Intermediate (Medium Risk)

After learning about Bitcoin and Ethereum, some go on to explore riskier, alternative cryptocurrencies (i.e. altcoins). Generally speaking, the further you go down the list of crypto-assets by market cap, the greater the investment risk.

Intermediate portfolios will typically consist of BTC, ETH and various altcoins ranked in the top 100 by market cap. Some may decide to get exposure to sectors such as liquid staking, gaming, decentralised finance (DeFi), scaling and storage. (For more on categorisation, go to ‘How To Categorise Crypto Assets‘.)

Below are examples of intermediate portfolios.

| Name (Ticker) | Classification | Rank by Market Cap |

|---|---|---|

| Bitcoin (BTC) | Currency / Store of Value | #1 |

| Ethereum (ETH) | Smart-Contract Blockchain | #2 |

| Solana (SOL) | Smart-Contract Blockchain | #5 |

| Chainlink (LINK) | Infrastructure | #18 |

| Aave (AAVE) | DeFi | #43 |

| Arbitrum (ARB) | Scaling | #50 |

| Name (Ticker) | Classification | Rank by Market Cap |

|---|---|---|

| Bitcoin (BTC) | Currency / Store of Value | #1 |

| Ethereum (ETH) | Smart-Contract Blockchain | #2 |

| Uniswap (UNI) | DeFi | #23 |

| Sui (SUI) | Smart-Contract Blockchain | #33 |

| Optimism (OP) | Scaling | #51 |

| Jupiter (JUP) | DeFi | #77 |

Advanced (Highest Risk)

Some more experienced and risk-seeking market participants will typically venture beyond the top 100 cryptocurrencies by market cap in search of ones they believe have the potential to climb the rankings. Memecoins (e.g. DOGE, SHIB) and non-fungible tokens (NFTs) are also more likely to be found in these people’s portfolios.

Most advanced portfolios will have a 0.01–1.00% allocation for each cryptocurrency in this category—that is, cryptocurrencies that are ranked outside the top 100 by market cap and memecoins. (Like everything in this resource, a ‘correct’ percentage allocation does not exist.)

Other advanced portfolio owners will undertake activities to generate an additional return on their existing cryptocurrencies, taking on additional risk by doing so. Examples include depositing into DeFi lending pools (e.g. Aave), liquid-staking protocols (e.g. Lido) and staking contracts (e.g. SNX) as well as locking crypto-assets in exchange for vote-escrowed tokens (e.g. veCRV).

The tax implications of these activities are often overlooked. All crypto investors are strongly encouraged to speak with a qualified accountant before purchasing any crypto-asset or partaking in any advanced activities mentioned above.

Below are examples of advanced portfolios.

| Name (Ticker) | Classification | Rank by Market Cap |

|---|---|---|

| Bitcoin (BTC) | Currency / Store of Value | #1 |

| Ethereum (ETH) | Smart-Contract Blockchain | #2 |

| Solana (SOL) | Smart-Contract Blockchain | #5 |

| Lido Staked ETH (stETH) | Liquid Staking | #8 |

| Pepe (PEPE) | Meme | #31 |

| Arweave (AR) | Data | #66 |

| Ethereum Name Service (ENS) | Infrastructure | #121 |

| Ronin (RON) | Gaming | #127 |

| Maple (MPL) | DeFi | #318 |

| Name (Ticker) | Classification | Rank by Market Cap |

|---|---|---|

| Bitcoin (BTC) | Currency / Store of Value | #1 |

| Ethereum (ETH) | Smart-Contract Blockchain | #2 |

| Dogecoin (DOGE) | Meme | #9 |

| NEAR Protocol (NEAR) | Smart-Contract Blockchain | #25 |

| Optimism (OP) | Scaling | #51 |

| Aave (AAVE) | DeFi | #52 |

| Rocket Pool ETH (rETH) | Liquid Staking | #63 |

| Echelon Prime (PRIME) | Gaming | #158 |

| Maple (MPL) | DeFi | #318 |

Recap

As is the case for any asset class, crypto-asset portfolios come in all shapes and sizes. Opinions on the ‘ideal’ construction of a crypto portfolio vary immensely. Ultimately, there isn’t one because everyone’s circumstances, goals and risk tolerance are different.

One common way to categorise portfolio designs is by risk. Cryptocurrency is already a highly risky asset class, but within it there are varying degrees of risk. The three categories in this resource—Beginner, Intermediate and Advanced—provided examples of how crypto investors can have different portfolios that vary greatly by risk.